The euro/dollar pair is the most popular and liquid in the foreign exchange market since the establishment of the euro zone – of course, a lot of technical solutions and trading robots are created specifically for its characteristics. So, this article will review an interesting EA for EUR/USD called Euro Blaster.

Before we consider the robot settings, let us answer the question of why the Common European Currency was chosen. First of all, the average daily volatility over the past year against the dollar was 0.58% or 80 pips – this is the average, a “golden mean”, which allows to earn and at the same time reduces the chance of false signals.

Secondly, due to low spreads for this pair, you can use the EA for EUR/USD with the same settings across different dealing centers. Thirdly, if the robot began to increase losses, it won’t be difficult for the experienced trader to help it cope with the situation by trading manually from the levels, because the European currency in this regard is relatively predictable.

How to customize the EA for EUR/USD

We can simply provide a list of working advisors and put an end to the discussion, but, in our opinion, it would be much more informative and helpful to understand a particular representative of the group. As was mentioned earlier, the Euro Blaster was chosen for the test, which, despite its five-year age, shows good results.

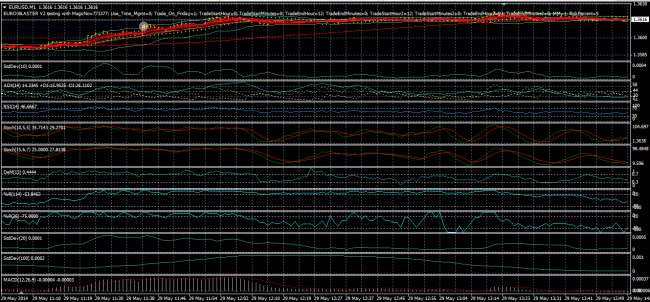

The robot is a scalper in its trading style, using a huge number of indicators in the algorithm, refuting a common misconception about their uselessness. A working chart is shown below, which barely fits all the windows:

As you can understand from the picture, it is not just difficult to trade according to such a system, but actually impossible. However, the EA combines several options of signals, without slowing down the work of the terminal. The developers didn’t provide an option to change the parameters of the indicators, and this is an absolutely right decision, because you shouldn’t forget that the algorithm is written and optimized for one pair, with volatility and other features already being taken into account. Among other settings, the following ones should be mentioned:

-

Time Management – enable/disable time management, when “Use_Time_Mgmt” parameter is enabled, the robot will only trade in the timeframes set by the user, an option to disable trade on Friday is also provided;

-

MM – enable money management, at the “false” value, the lot will be equal to the value specified in the “LotSize” line;

-

MaxOrder – the maximum number of simultaneously open orders;

-

Slippage – the number of attempts at opening the order, very useful at strong movements;

-

Trailingpips - if trailing started to work, then it will move the stop-loss to the order after a given number of pips.

Testing the EA for EUR/USD on history and summarizing

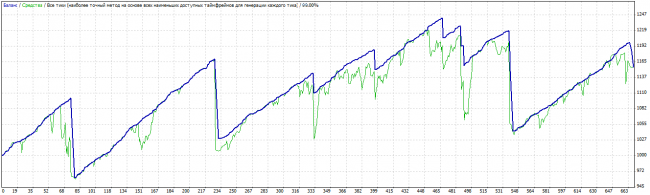

Given the fact that the robot under consideration is a scalper, the “minutes” were chosen as a working timeframe. The chart of funds and balance, as tested from January 2013 to May 2014, is presented below:

We should first of all note that the best results could not be achieved, because if a stop-loss is set below the profit, the robot fails to cope with the market noise and often cuts losses, so only the working lot was changed in the settings. Nevertheless, the final result is quite good, and these are the comments on the highlights:

-

net profit of 15.57% with 15.83% relative loss is fine, it does not siphon, profit exceeds the bank interest, drawdown is below 20%;

-

profit factor of 1.23 is low for a scalper, due to big stops – in particular, the average loss on the deal is $24.11, against an average profit of $1.3;

-

only 4.19% are losing trades, but in combination with big stops, these statistics are not objective.

The EA for EUR/USD reviewed in this article is a good option for partial automation, because after analyzing the results, it is evident that the algorithm generates sufficiently accurate signals and it is possible to work with, but the mechanism of losses elimination faces some problems, so it is necessary to take the unprofitable positions to a plus by manual trading from time to time.

Social button for Joomla