Any speculator and investor knows that a modern foreign exchange market is very unstable, because after the latest financial crisis many classic models became irrelevant: the number of stable trends fell, while the number of flats increased. Altogether this leads to a lot of unpredictable movements, and results in the problems with the stop-loss placement, even if the overall direction of the market is defined correctly.

To avoid such negative effects, more and more traders are using robots on grid strategies, one of them being an Expert Bee EA. Its main advantage is a simple and intuitive algorithm, which aims at ensuring the deposit sustainability to any manipulations of the major market magnates. This article will review the principle of this EA, its advantages and disadvantages.

Expert Bee EA and its logical constituent

In general, as we noted above, the algorithm doesn’t fundamentally differ from most other grid fellows, with limit orders being set at a certain distance from each other, take profit being set by the user and moving closer to the current price when countertrend orders are triggered. Thus, part of the deals in a series will be closed with a loss, but the total will be at a profit.

The Expert Bee EA, despite the developers’ plans to provide a stable and easy deposit growth, is using one risky move in its work: a sharp increase in the volume of deals after reaching a certain series of the grid. In such a way, several orders with uncovered loss are topped up with more positions against the trend, thus increasing the overall amount of work on the current series by dozens of times.

This robot also has advantages, the most important of them being “multi-currency”, i.e., it has no strict limitations on the use of the pairs. All you need to do is calculate the fluctuation range for the desired pair and become familiar with your broker's trading conditions – of course, it is best to use the tools with minimal spreads and commissions.

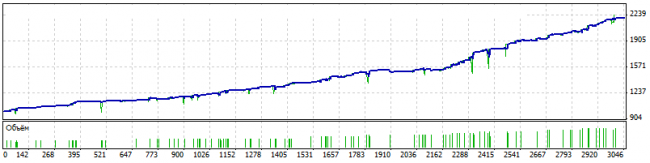

Taking into account the abovesaid, AUD/USD pair was chosen to test the algorithm, because on the one hand, it has prolonged trends (checking the strength of the averaging EA), while on the other hand, the price is often in a wide range during the day (increasing the likelihood of rapid orders execution). Test results since the beginning of 2012 on the default settings are presented in the figure below:

Summary: whether the Expert Bee EA is worth using

First of all, we should state the main advantages that make it more attractive compared to other robots:

-

work with pending orders, so there should be no conflict of interest with dealing centers or problems resulting from the lost connection;

-

serious approach of the authors, expressed in the EA support and upgrade;

-

another benefit can’t be missed: at the end of January 2014, the developers have created a real account monitoring with built-in Expert Bee EA in its latest version.

The disadvantages are the following: first of all, the algorithm uses limit orders, which normally involves working against the main trend. In our view, using the grid-type stop orders would be much more efficient in order to follow the direction of the market.

Secondly, the EA is increasing volumes when trying to exit the drawdown, which, under certain circumstances, can lead to bigger floating losses, observed even on the results of the history test. This technique is this robot’s feature, its trademark, but its efficiency compared to conventional grid is debatable.

Social button for Joomla