Many speculators are aware of the problem of the unforeseen stop-losses as a result of market noise, which often far exceeds the calculated standard deviation. These movements result in loss for a trader, while the price reverses and moves in the initial direction, so nothing is left other than either rely on the expectation of the system as a whole, or trade without stops at all, if a person can’t take the loss easy.

The latter option can be seen in various expert advisors from Ilan family, which are well-known for siphoning. This is why experienced traders prefer to use a hedging EA. The idea of such strategies and algorithms is to minimize risks by creating a portfolio of currencies or to use the opposite orders on one pair.

How to choose a hedging EA

The simplest and most reliable strategy is locking on one pair, in other words – working in two directions. This technique is built into virtually every modern robot using Martingale, and has a number of advantages:

-

first, it is simple to optimize, since only one pair is used, whereby it requires less calculation;

-

second, there is no confusion in a pip value;

-

third, there is no problem with testing in MT4.

A disadvantage also lies on the surface – the entire trading is reduced to a grid of orders, which nominally can be called hedging, but there’s no economic basis in the strategy, so a hedging EA built on the pairs correlation is a more interesting point.

First of all, we would like to note that such multicurrency EA can only be accurately assessed in the MetaTrader 4 in real time, because the algorithm doesn’t refer to other data than the major pair in the strategy tester. Thus, in the best case (if the algorithm was written by a professional), the operations will be carried out only on one pair, which would completely distort the result and the very purpose. The worst and the most likely outcome is that the tester will throw an error message in the log.

Given the above, we will focus on the fact that the optimization should be carried out by means of a tester in MetaTrader 5, which has slightly different programming language, or by studying monitoring and try an algorithm at a demo account. So, a monitoring will be reviewed below, since the fifth version of MetaTrader is less popular among the users.

The results shown by Hedge Gate EA in practice

Initially, the article wasn’t supposed to analyze a particular EA in detail, but after analyzing monitoring lauded by adverts, it became clear that worthy samples with long-standing reputation are just lacking, many accounts siphon, and the remaining discontinued test. This means that a beginner can put a “pig in a poke” on real account.

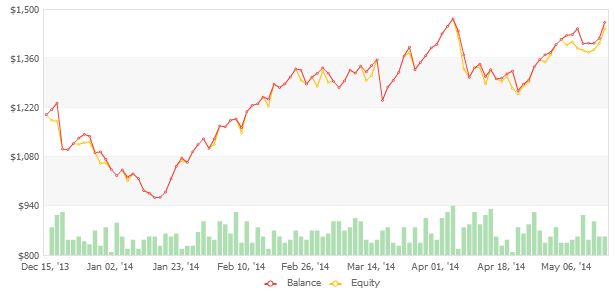

In order to answer the question on what results can be expected from such robots, it is reasonable to pay attention to the latest developments. In our opinion, Hedge Gate algorithm is worthy of attention, as it is a classic example of Forex hedging, and – most importantly – has an operating account put on monitoring. Its chart of funds is presented below:

Hedge Gate hedging EA uses all major pairs in operation, with entry point being “comprehensible” and formed by the Gann method. But it is based on insurance of basic position with correlating tools, so the outcomes are acceptable and the main ones are briefly commented on below:

-

maximum drawdown for five months is 21.82% vs. 22.69% of profit – it is a negative for a hedger, but if we take into account the fact that the drawdown was formed in the beginning of the work, it can be assumed that the developer was engaged in optimization in the trading process, which influenced the balance;

-

77% of profitable trades and their average duration of about 16 hours is a positive and indicates the lack of averaging, otherwise the deals would have remained opened for days. History of deals confirms this as well.

Please note that the results are representative for the whole group of similar robots – of course, variations and modifications are possible, but the estimated rate of return will be at approximately the same level, as it’s hard to squeeze more out of “hedgers”.

Social button for Joomla