The popularity of automated trading is gaining momentum at the moment in result of growing prosperity of the population in many countries, and as a consequence, increased interest of people in the financial markets. But many who are interested in trading experts have noticed that finding an efficient Forex advisor is not as easy as it might seem at first glance.

First of all, we’ll try to understand why we need advisors in the first place, if all the books and training courses recommend to start trading manually. Firstly, automation saves time, especially since many speculators combine their main profession with trading, and secondly, robots lack emotions and subjective judgments, which eliminates errors and violation of the rules of the trading strategy, and thirdly, the EA can be installed on a separate server for round-the-clock operation.

How to choose efficient Forex Advisor

To avoid disappointment in automated trading since the very beginning, it is wise to remember and observe a few simple rules for selecting and testing of robots. So, the rule No.1 is that you can’t trust the nice sellers’ reports. From our own experience we can say that in most cases the “states” don’t correspond to reality, and in the best case, the expert is tailored to the good part of the chart.

Rule No.2: if you can find a free robot, you should do so. A stereotype thrives on the market, especially among the beginners, stating that efficient solutions are always paid. In fact, the most profitable strategies are divided into two groups, the first being basic algorithms, which have long been automated and available to everyone, and the second being really sophisticated techniques that can’t be fully automated, and therefore no robots were invented for them.

Rule №3: efficient Forex advisor should not entail unnecessary problems, like requiring constant monitoring and options upgrade. If such a need arises, the loss of the deposit is just a matter of time. So the beginners are recommended to use algorithms whose parameters remain stable over the years. In simple words, it is better to start with trading in the “dailies” and move to efficient scalping robots in line with the professional development.

Efficient Forex advisor for daily charts

Hot on the heels we’ll take a look at one free algorithm created on one of the forums named Order_v_Day. Background of its appearance is not extraordinary – it all started with an attempt to automate the classic strategy designed to search for a trend reversal. As a result, simple rules have been formulated for the deals to buy (opposite for the deals to sell):

-

the last day candle must be bearish;

-

stop-loss is set behind the low of the last candle;

-

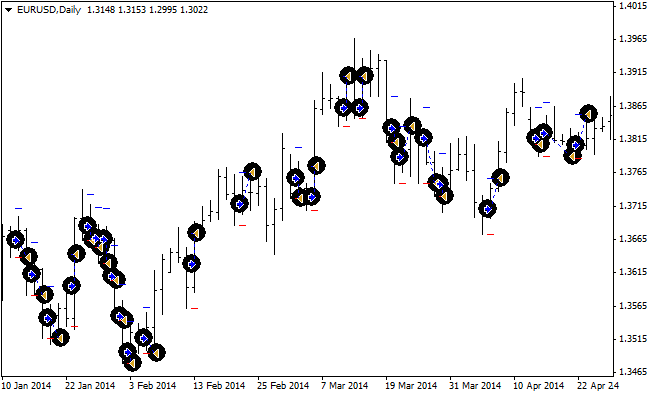

time acts as a filter – namely, the deals must not be made before the “opening” of London in European currencies, and the situation is similar with the currencies of the eastern hemisphere and the corresponding financial centers. Example of deals in euro is presented below:

Besides, a trailing stop was later provided, but experience has shown that in the current circumstances it does more harm than good, so it is advisable to turn it off. Thus, all settings for Order_v_Day are reduced to the following list:

-

Lots – working lot;

-

H – hour after which the order is allowed to be opened (terminal time);

-

TP – take-profit value;

-

Rass - filter by the candle shade;

-

TRAL – turn on/off the trailing stop (1/0);

-

Trailing Stop – trailing stop in points;

-

PROF – the profit value (again in points) after which the trawl is enabled.

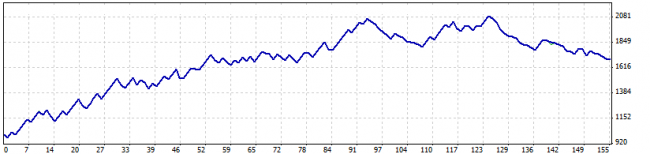

By the way, the daily timeframe has another advantage for robots testing – the imprecision and errors in the “gluing” of the chart are eliminated, so until the user has learned to achieve a minimum of 90% modeling quality, it is recommended not to go for short periods. Now let’s talk about the results: the test was performed on the EUR/USD pair with quotations from InstaForex:

Listing the parameters is not appropriate, since they can be seen in the report, so it is better to comment on the results. Roughly speaking, profit for one year and 3 quarters amounted to 69.1%, which is 39.5% year-to-year. This is a strong result, especially when you consider that the algorithm does not provide any averages or Martingale. Further attention should be paid to the risks.

Efficient Forex advisor must be configured in such a way that the risk per deal wouldn’t exceed 3%. Of course, you can often find more stringent rules of money management, but we should not forget that in this case only one deal can be made per day, so there is some freedom in the risk management. In the above example, the average risk is 2.8%, which is calculated by dividing the average losing deal by the initial deposit.

Note that the risk value for Order_v_Day robot is determined only following the results of the test, as a stop-loss is variable and depends on the market situation. Actually, seven quarters are sufficient enough to draw some conclusions about the volatility and nature of the movement on the euro.

Summing up the results and solidifying knowledge

Now let’s get back to the rules that were listed at the beginning of this article. The expert under review is a classic efficient Forex advisor, because it satisfies all key criteria – in particular, the dynamics of the balance has the shape of the curve. This is absolutely normal, since the market phases rotate, and stop-loss cuts losses from time to time. If the Martingale was used, the balance (not the funds) would have increased in a straight line or exponential, while the account always runs the risk of siphoning off.

In addition, Order_v_Day is free, because it was created by an enthusiast and can be easily found using search engines online. And the last rule was previously mentioned – the expert under review is working on the daily charts and therefore doesn’t require significant investment of time to monitor the results by definition.

Of special note are the potential problems with automated trading. For example, Order_v_Day failed to launch on the first try. The matter is that it was created back in 2010, when the older versions of the MT4 terminal were in use, so a new “build” had such an incident. The solution was trivial – the file with the advisor had to be “compiled” manually. You can find the guide on how to do this on our website in the articles devoted to the creation of robots.

Why does such trouble mean much? Because many beginners don’t hesitate to throw away good and free experts after the first error, though elimination of the problem is a matter of minutes. Moreover, there is always the possibility to appeal to programmers with a request to find the error, since the open source of the free robots allows it.

Social button for Joomla