Is it possible to profit from Forex with EA? Sooner or later, any trader asks himself this question, and it does not matter at what stage and level of professionalism they are, whether it is a beginner or an expert who has created their own trading system – when choosing the first robot, everyone is in the same position.

With all the evidence of a positive response, this issue raises a lot of debate and confusion, so we will recall some theory and “destroy” common myths. First of all, you need to take the following fact for granted: whatever the supporters of manual trading are saying, the most money is earned from using robots, because operations in all the banks, corporations and foundations are fully automated.

Of course, programs of the private and “home” traders significantly differ from the solutions of the financial giants, because even if we don’t take into account a completely different principle of interaction with the market (the bank actually creates it), the speed of data transfer and transactions for the independent trader will be much lower. However, the automation on the “live market” slightly increases the chances of a positive outcome of trading, especially when trading within the day, where you need an immediate reaction.

The live market means interbank and futures markets, i.e. where you can see all the deals. If you plan to install the robot in the dealing center (hereafter DC), which hides much of the information, such as its quotes supplier, whether the deal are introduced at the market, and so on, you need to take additional risk factors into account.

How to profit from Forex with EA by trading via a dealing center

All of these can be divided into two groups. In the first case, policy and management are designed to ensure maximum comfort for the trader, so there are no additional restrictions in the offer. In such a case, any robot can be used.

Difficulties arise with the rest of the DC, but they can be avoided if you carefully read the client agreement. The most common clauses that make the whole group of experts useless are usually the following:

- the need to keep an open position for the minimum time – throws scalpers and pipsers into the garbage;

- provisions on profit correction and cancellation of deals on the news bursts and gaps – completely neutralizes news robots and create problems to griders, because it would be easy to profit from Forex with EA, but the profit won’t be allowed to be withdrawn from the account;

- time and type of order execution – brings fewer problems than the above-mentioned points, but can considerably harm the scalpers.

- other ambiguous paragraphs.

Thus, after reviewing the offer, some companies will be completely unsuitable for most of the modern robots. If you delve into the theoretical considerations, the long-term strategies may be appropriate in all circumstances, even the most "tricky" ones, but the question arises of whether it is worth to complicate the process when it is easier for you to initially open an account with a company which does not care much about the actions of the trader.

Specific expert advisors will not be considered in today’s publication, because the subject of the research is very vast, and a few lines on each expert won’t be enough. Instead, we’ll list the features of the main groups of robots in the context of the potential for earnings and the inherent risks.

"Ilan" - liquidator of the deposits

So, the most popular algorithm among the newcomers is the original "Ilan" and its modifications. The advantages of this robot is that it is easy to set up, has a basic code that does not load on the processor and does not import additional data from other sources, and the most important advantage is the ability to use an expert in all of DC – there were no cases where the companies would struggle with Ilan.

And there's a good reason for it, which also is the main drawback of this class of robots. The matter is that the use of the Martingale principle allows both to profit from Forex with EA and to easily lose all your money. Please note that the probability of the latter option is close to 99%, because the Martingale is a tactic of multiplying each new rate twice, which came from the casino.

In addition, noteworthy is the fact that the probability of loss of money in the market is even higher than in the gambling establishment, because you can only bet on two possible outcomes – to win a certain amount or lose what is at stake. But most of these algorithms do not restrict trading risk per deal and add the new orders to the existing loss-making ones. As a result, a huge counter trend position leads to the risk multiplication and wipes off the account.

Nowadays, many robots are distributed under the assumed names, but you can recognize "Ilan" with the help of the strategy tester in the MetaTrader terminal. If you can’t run the algorithm in the tester and the seller requires a deposit, an indirect sign of the abuse of the Martingale would be an exponential curve on the balance monitoring chart, and the real picture on money is always hidden.

It is easy to profit from Forex with EA if trade intraday

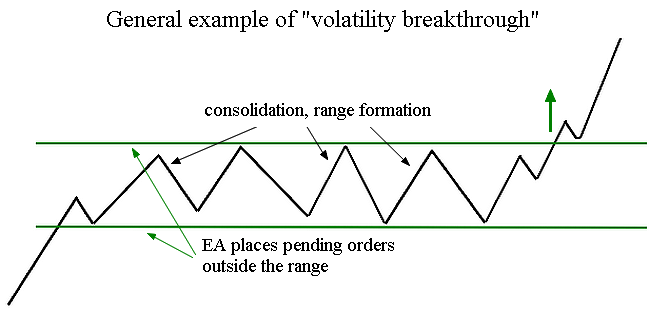

Many expert advisors are invented for intraday trading style, some of which relate to the aforementioned group and are therefore unprofitable by definition, but others deserve special attention – in particular, good solutions can be found for the “volatility breakthrough”.

There are plenty of names and options for the realization of such robots, but the central idea is reduced to trading pending orders on the breakthrough of the established trading range. Typically, the deals are made at the junction of the sessions – at the opening of European and American sites, and strengths balance weaknesses of the algorithms – for example, the presence of the stop-loss protects from erroneous transactions on the random news bursts. You can find a detailed description and tests of some of the “breakthrough” robots under the “Trading Advisors” section of our website.

Alternative is pipsers, which also ignite serious debate without any objective reasons. It is just that many speculators get used to trading in companies with huge spreads and commissions, but today you don’t even need to open an account in the futures market to reduce the costs, because there are DC with acceptable terms and conditions close to the market – in addition, new types of accounts and rebate services emerge that will be a good help under the lack of alternatives.

Summing up, we would like to note that it is possible to profit from Forex with EA, but to do so you must drop the knowingly loss-making algorithms built on Martingale and focus more on testing strategies, especially intraday, because when trading mid-term, the robots don’t bring that same effect in full for which they are created (saving time is not as noticeable).

Social button for Joomla