No EA is able to trade for a long time without human intervention. The market lives by its own laws and sooner or later the algorithm it is built on will cease to trade profitably. To avoid this, the EA should be constantly monitored and tested, and its parameters should be optimized on the basis of the results received.

Testing of the EA is performed using the built-in strategy tester and won’t cause any difficulty even to the beginners. However, many people make common mistakes when testing expert advisers, which affect the final result. The mistakes are:

- testing at a short time interval;

- no quotes are loaded before testing;

- quotes are loaded in the timeframe corresponding to the EA working timeframe.

Typically, an archive of quotes in the terminal is only present since the installation or last upgrade, so the data must be loaded manually. At this stage, you should remember that you need to perform the download for m1 timeframe, as the bigger timeframes are built on its base.

If the EA is designed to work on h1 timeframe and the same interval is chosen for loading quotes, the test won’t consider all the price fluctuations within the hour. Even for the EA trading on D1, this error will greatly distort the test results.

EA testing: algorithm of actions

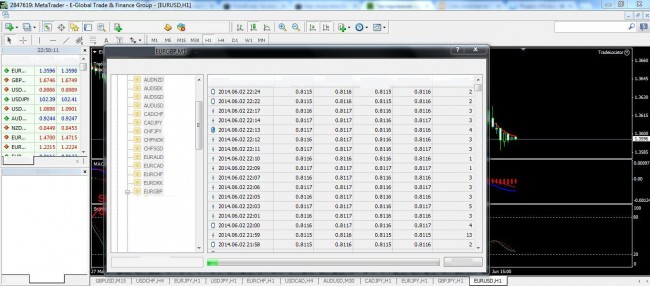

To load an archive of quotes, you should go to Service menu and choose Archive of Quotes tab (or press F2). Then choose the required currency pair and the time interval m1. After you click “Download” button, data will start downloading.

You can import the archive of quotes downloaded from another broker. To do this, click “Import” button and select the path to the text file with data in the dialog box. At the moment, the most accurate data is considered those received from Dukascopy.

After that you can start testing expert advisors right away. Strategy tester is opened with the key combination ctrl+r or by selecting the appropriate button in the tab “View”. Then the window with the settings of the strategy tester will appear in the bottom of the terminal.

You need to choose the required currency pair, the EA, the model (it is recommended to use simulation based on all ticks), the period of time for testing, the timeframe (recommended for the EA) and the spread value. The button “EA Properties” will allow to change the robot parameters, and by clicking the button “Modify EA” you can make changes to the EA code. “Start” button will start the test.

EA testing: processing the result, general recommendations

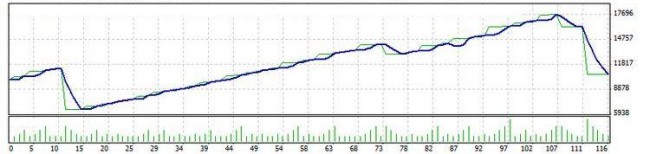

Once testing is completed, you can see the results in the tabs “Chart” and “Report”. The report itself can be saved as a separate file with .htm extension – to do so, select the option “save report” in the context menu.

Any trader can perform EA testing, but it is no less important to know how to analyze the results. The attention must be paid to such parameters as the quality of the simulation (shows the reliability of the result), the expectation, and the maximum and relative drawdown. In the example shown, the quality of the simulation is 25%, because the EA is designed to work on m1 timeframe.

As a rule, the quality of simulation doesn’t exceed 90%, which is an acceptable result for expert advisors working on timeframes starting from h1. For scalping advisors, the price fluctuations within minutes are very important, so it’s better to use tick data instead minute bars for testing. In this case, the quality of simulation increases to 98-99%.

It is also not recommended to test the advisors during the weekend. The matter is that some brokers widen the market spreads before closing, which affects testing results.

Social button for Joomla