There’s very little information about this trading robot online; the sellers argue that the Income expert advisor is a real godsend for lazy traders, promising mountains and marvels within a month of trading. Concern is the lack of a more or less coherent statistics, as well as the reluctance of the authors to describe the algorithm of the robot at least in general terms.

The author of the expert advisor tells a basic story: he first became interested in trading, then put together a team of like-minded people, spent a couple of years studying the market and the result was "a unique tool to earn money". The typical part of the story is not a single word about the algorithm of the EA and the instruments used.

Generally, the only certain fact about this EA is that the authors reached the optimal results on m15 timeframe and the EUR/USD currency pair. It is also emphasized that the algorithm allows it to adapt to the behavior of the volatile currency market. Well, the author offers you to become the owner of "pig in a poke" for $200.

Income expert advisor: is it worth the risk?

You can judge the performance of any expert advisor by several parameters; you should assess:

- profitability;

- expected payoff;

- drawdown;

- it is desirable to know the principle of making deals, at least in general terms.

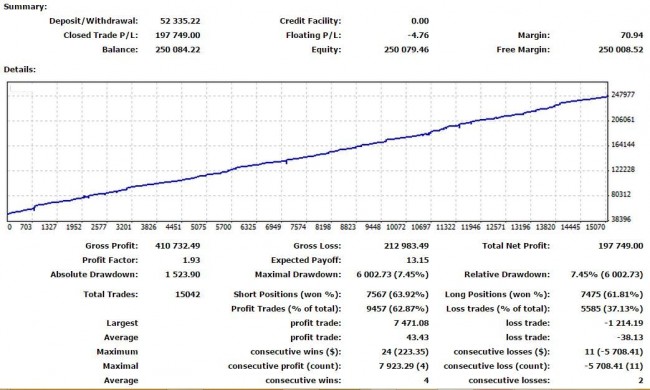

Only a list of transactions for the period from January to September 2014 is provided to confirm the effectiveness of trading. During this period, the bot increased the initial deposit 4 times. At the same time, the maximum drawdown does not exceed 8%, and almost two thirds of transactions are profitable.

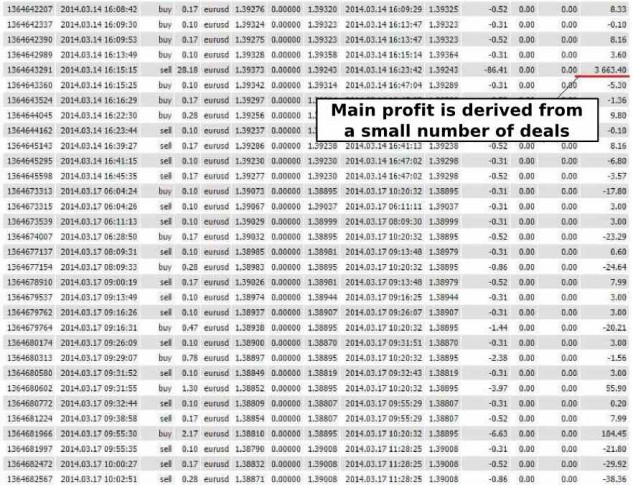

It can also be seen from the test results that the bulk of the profit is achieved by only a few very good deals (not more than 10% of the total). Most of the open positions are closed with a minimal loss, and the life of the transaction does not exceed 60-80 minutes, after which the transaction is forced to close.

Profit per one deal is small – no more than 20-25 points, often even within 10 points. The interesting fact is that the EA enters the market with a very large lot in profitable transactions, while the lot is dozens times smaller in losing trades. Another interesting fact is that the EA can almost simultaneously open positions in different directions (a difference is just a few seconds), as locking is not often used by expert advisors.

Forex Income trading system

A Forex Income trading system is mentioned online: perhaps, the Income expert advisor uses this very algorithm of deals. The author of the strategy is Peter Schwartz, and the rules of the trading system include the use of a simplest trend indicator (MA) and analysis of the arrangement of candles with respect to it.

The work using this algorithm is carried out in the following order:

- direction of the moving average is analyzed: you shouldn’t trade at a small tilt or if the price has recently crossed it several times;

- the position of the price chart relative to MA is monitored: at an uptrend, the price should be above the MA, at a downtrend – the opposite;

- entry into the market is carried out with pending orders and only after the formation of the signal candle.

A candle is considered signal for the deals to buy if it rewrote the low of the previous candle, touched the MA and closed above it. In this case, a pending order is set 5 points above the high of that candle, and SL is set a few points below the low. The rules are opposite for the deals to sell. If a pending order wasn’t triggered within the following 3-4 candles, it is removed.

Examples of transactions

Trading is in fact carried out on the rebound from the resistance level (moving average). This method is applicable to any currency pair and any timeframe, the main difference lies only in the MA period. In the classic Income strategy, trading is conducted on D1, so the MA with a period of 21 is used there.

In this example, the chart has consistently decreased over the previous 4 weeks, while it never crossed the MA upward. This gives reason to hope for the formation of a sustainable downtrend, and the price growth is seen as corrective.

After the price approached the MA from the bottom, a signal candle formed, below the low of which a Sell pending order is set. The transaction closed by TP in the next 48 hours. However, such a system may give false signals without additional filters. In the same example, the price approached the MA from the bottom again, but then managed to break it upward.

The Income expert adviser trades at smaller time intervals, but the same principle applies to m15. As for the frequency of entries into the market, the expert advisor can monitor the market situation on smaller time intervals as well (up to m1), hence a large number of transactions.

Summing-up

The EA leaves mixed feelings. On the one hand, low drawdown, a high percentage of winning trades, 4 times increased deposit in less than a year – all make it very attractive. At the same time, almost complete lack of information about it in the public domain is disturbing, although this robot is known for a few years now.

The fact that the author claims he managed to increase the initial (real) deposit 76 times (from $1,000 to $76,592) in just 1 month does not add confidence. Here we are dealing either with an incredible coincidence, or with a conventional fit of backtest results. Actually, a small amount of time when the EA trades just perfectly can be found for any robot.

In addition, the EA is not available for trial, it is also important. Not everyone can afford paying $200 just to get acquainted with an interesting expert adviser. In general, the Income expert advisor is not recommended for trading on real accounts due to lack of information and overly optimistic promises of the author – this is very much reminiscent of a trap for unsuspecting novice traders.

Social button for Joomla