Progressor EA was written back in 2011, and since then only its modifications and new versions emerged. This fact is a good opportunity to thoroughly investigate this robot, as the creators may have corrected errors present in most of such advisors written before the global financial crisis.

Signals that the robot uses to enter the deals are built on standard MACD indicator and therefore inherit all of its shortcomings, the most important being lagging of the current trend, which makes it impossible to use short stop-losses in operation. This and other points should be considered when setting up the algorithm and key nuances are reviewed in this article.

Settings used by the Progressor EA

The authors don’t single out the univocal blocks of related parameters, but for easier perception of data it is reasonable to single out some arrays. First of them is organizational issues, including:

- Max_Spread – the highest allowed spread value, important for accounts with floating spread;

- Working_Time – setting of working hours;

- Trade in fri – enable / disable trading on Friday.

The second is settings of the working lot and the Martingale:

- First_lot – the original lot in a series of deals;

- Distance – the distance between orders in the series in pips (if the signal on the first order proved false, the EA starts to apply averaging against the trend, so please be careful);

- Level – the maximum number of orders in the series;

- Martin_mode and Multiplier – to respectively enable / disable the use of Martingale and the multiplier to calculate the amount of the deal;

- Increament – if "Martin" is disabled, the Progressor EA will add the specified lot amount to each new order: such approach is less aggressive.

The last array is functions of the profit and stop ratio management. In this case, it is intuitive, and you can turn on the multiplier by which the profit value will be adjusted at each new order in a series of orders.

Testing the Progressor EA and making conclusions

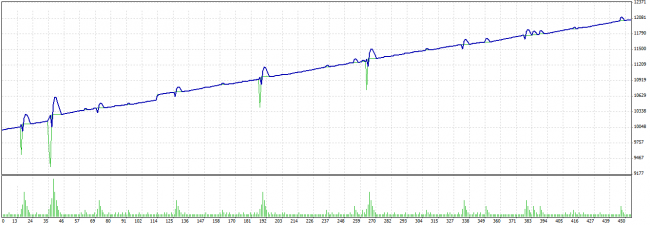

To answer the question about the efficiency of the algorithm, you don’t have to go through all the possible options for the aggressiveness degree: all you need is review a conservative configuration, because if the robot siphons under the most benign settings, then it will last even less under the aggressive ones, bit if it makes it, you can experiment. The figure below shows the test result for 2013 on the EUR/USD pair:

Cent account was expected to be used, so the initial deposit in the tester is set to 10000 units. Among the results you should pay attention to the following figures:

- Net annual profit is 20.53% at the 12.33% relative drawdown – this is an acceptable result, compared with the majority of such advisors;

- There are 453 deals in total – it’s hard to interpret unambiguously, as on the one hand, the more deals, the better, as otherwise it makes no sense to use robots, since it’s easier to trade manually, but on the other hand, the signal quality is poor, as most of these deals are averaging orders.

In conclusion, we will traditionally briefly list the strengths of the Progressor EA:

- plain and simple settings;

- ability to work both with the Martingale and without it (i.e. with the usual stop-loss);

- after a certain series of orders, the factor for new orders can be either increased or decreased, which most analogues lack;

- trading time is set by the user, which allows filtering the flat periods (usually at night), which are very dangerous for the MACD.

No significant weaknesses in the algorithm have been revealed during the test, as it is improper to compare this EA with other similar advisors that don’t use the Martingale, but it looks quite good in its niche. The only thing to note is the lack of ability to change the parameters of the signal indicator in the settings on your own.

Social button for Joomla