Scalpel EA was originally intended for intraday trading. It should be noted that to date the original version of this advisor is almost unheard of, although a number of brokers offer it in the standard terminal package.

First of all, you should pay attention to one thing: this robot was written in 2009, and you know that the market has changed in a short time after that – the number of stable intraday movements declined, and more flats showed up. The logic dictates that the EA should bring even more profits in such case, but the matter is that this robot was written with fatal mistakes, which we will discuss below and try to eliminate their consequences.

How Scalpel EA works under default settings

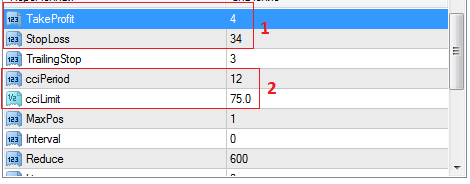

Pay attention to the recommended settings for four-digit (see figure below). The first thing to alert you immediately is the profit/stop ratio (1). It is not suitable for any kind of strategy. Therefore, you will have to set this option by your own. Secondly (2), look at the settings of CCI indicator and its signal line – this is where the blunder hides.

I use the Commodity Channel Index in my strategy, and I know its features. This is why I can say with confidence – Scalpel EA won’t work correctly intraday, since it opens a deal not at the rebound from the boundary (cciLimit parameter), but rather at the breakdown.

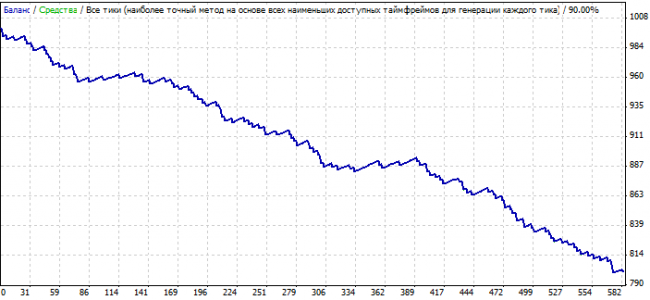

Obviously, the developer used the logic of volatility breakdown – generally, such methods are profitable, but he chose a bad tool for identifying those movements. In fact, such a technique is the most common mistake made by the beginners and unexamined algorithms: buying at the top, selling at the bottom. Let’s run a tester in 2013 for five-minute charts of the EUR/USD and look at the result:

The test showed that Scalpel advisor, if configured on the recommendations of the author, was just a cash siphon. A short trailing stop had a significant impact on the result, as it is applicable only when hunting for intraday news pulses rather than in the general case, due to the large amount of noise.

Is it possible to optimize Scalpel EA?

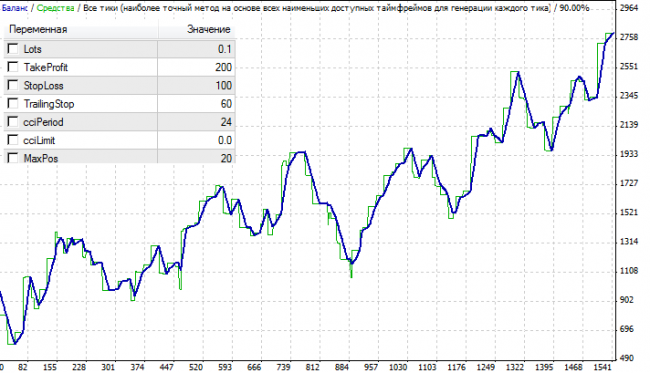

If we abandon the use of the robot intraday only, then it isn’t difficult to configure it for a profit. To solve this problem we need to correct the following mistakes:

- revise the profit/stop ratio;

- use a longer period of the CCI calculation and choose a zero mark as a signal line in order to enter the market with the expectation of catching a new medium-term trend;

- adjust the trailing stop wisely, taking into account the volatility of the pair.

In the optimization process, we have focused on the opportunity to catch a powerful movement, so defining parameters were stop-loss, trailing stop and the maximum number of orders that Scalper EA could open in its operation. The results of the test are presented in the figure below:

In general, the result of setting up and testing is satisfactory. In summary, we can list the main strengths of the Scalpel EA:

- the ability to use in the medium-term trade;

- easy to set up, works with any pair, and you can select the setting for any deposit;

- it works more efficiently on small timeframes, resulting in reduction of the time of CCI signals delay and saving pips.

Its weaknesses include the following:

- its name doesn’t match the content, which may mislead a user;

- it has no additional filter for trend identification, which results in a wide range on equity during the test – in other words, there can be long periods of losses.

Special attention should be paid to another conclusion, which will be useful for beginners – never scrap an advisor which turned out to be a siphon on the default settings: instead, try to apply it differently to the author, change decision logic, and experiment with the settings.

Social button for Joomla