Algorithm we’ll review today was created and introduced to the public back in 2006, and the strategy it is based on appeared even earlier: it represents one of the variants of volatility breakdowns. For a few years, the robot has been demonstrating excellent results – until the global financial crisis, which changed the very nature of many currency pairs. As a result, most of the strategies based on a range breakdown were no longer working properly, and the Scalper Day was no exception.

Scalper Day EA and its operation logic

As noted above, the robot decides to make a deal after the range breakdown. A distinctive feature of this EA, in comparison with related algorithms, is calculation of two ranges instead of just one: for eight and twelve hours. The first range reflects the flat formed during Asian session, while the second one also takes into account the movement in the early hours of the European session.

Therefore, in theory, and only in the conditions of high volatility, the EA can open a maximum of four deals per day:

- sell and buy at an eight-hour range breakdown;

- sell and buy at a twelve-hour range breakdown.

In practice, this situation is extremely rare, and normally there are just two signals per day: one for each range. You should pay special attention to several important parameters in the settings window. Days2Check is the number of days taken in the calculation of the average daily range, which, in turn, is divided into ChannelK. The result of the calculation is the value in points, which, if overcome after channels’ boundaries breakdown, will indicate the breakdown validity.

The Scalper Day EA analyzes the market conditions over time, and also modifies the base profit and stop-loss values for each group of signals, which is also a result of the different sessional volatility.

Can Scalper Day EA make money? Testing and optimization

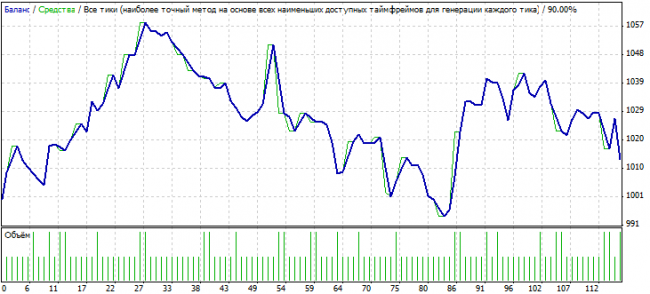

The algorithm will be tested on GBP/USD pair, as it is one of the most active and technic pairs, which "wakes up" with the London opening and fluctuates heavily until the American markets closing. The figure below shows the result of its work on the parameters recommended by the authors.

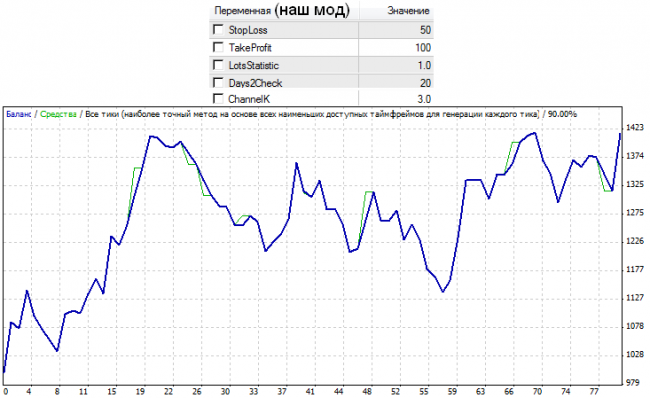

Profit is far from what the developers promised, but the most important thing is that the EA didn’t siphon the deposit, which means that there are some prospects to adjust it and get better results. We’ll update obsolete values which lead to serious errors in operation – first of all, we’ll increase the number of days to calculate the range boundaries. Then we’ll optimize the stop/profit ratio and choose an acceptable risk. The result for 2013 is the following:

The account dynamics shows that from May to September the Scalper Day EA was trading at a loss. This period was really hard for the market, mainly because of the geopolitical background. This circumstance gave rise to many false key ranges breakdowns and resulted in the stop-losses triggering more often than with a pronounced trend.

Summarize of the Scalper Day EA advantages and disadvantages

To summarize the work done, the following positive aspects of the Scalper Day EA can be emphasized:

- built-in algorithm to calculate the average price range for the period, while other similar robots only look at the current day;

- no averages and Martingale, the lot is adjusted only by the user;

- all deals are closed before a new trading session, the losses are fixed in a timely manner.

The main negative aspects, in our opinion, are:

- lack of built-in trailing stop;

- sensitivity to economic instability, resulting in long periods of losses.