As you know, scalping strategies brings good profit but take up a lot of time and effort, so many traders began to automate these algorithms, which resulted in a separate class of trading robots.

Speculators and programmers simply call them scalping advisors. In fact, the idea of creating individual automated strategies intended for fast transactions emerged quite a long time ago – almost immediately after the transactions for buying/selling securities became implemented by means of Internet communications.

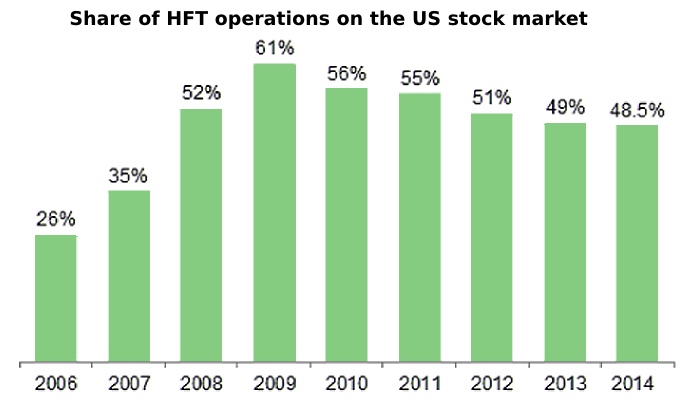

Of course, the traders in the stock market were the pioneers in this field, some of them at first were even able to get huge profits, but it lasted a relatively short time, as the high-frequency algorithms of the large banks have literally "squeezed out" the weak competitors.

Moreover, HFT algorithms are not limited to only the advantage in computing power and connection speeds – they usually get data from the exchange on incoming requests from other traders before other traders do. Such valuable information is, of course, bought from the exchange for big money.

As a result of this simple but not quite honest transaction (congressmen in the United States regularly raise the issue of the need for a ban on HFT technology), large amounts of capital outrun the usual scalpers by several points. Surely, some readers who are fond of speculating in the stock market may have noticed that before publishing the unexpected news for a public company, high volumes are already seen on the corresponding stock – this is a sure sign of HFT activity.

Forex scalping advisors are the best option for the beginner

Despite the fact that it’s very difficult to track the performance of HFT, because of the lag from several seconds to half a minute, it is still possible to scalp the markets at the moment, although it is becoming more difficult every year, and much, by the way, depends on the tool. For example, you can earn even on the EUR/USD pair (which, in the opinion of professionals, has the highest number of "traps"), making quick deals with a duration of 5 to 15 minutes. It is even easier to work with all other pairs in this regard.

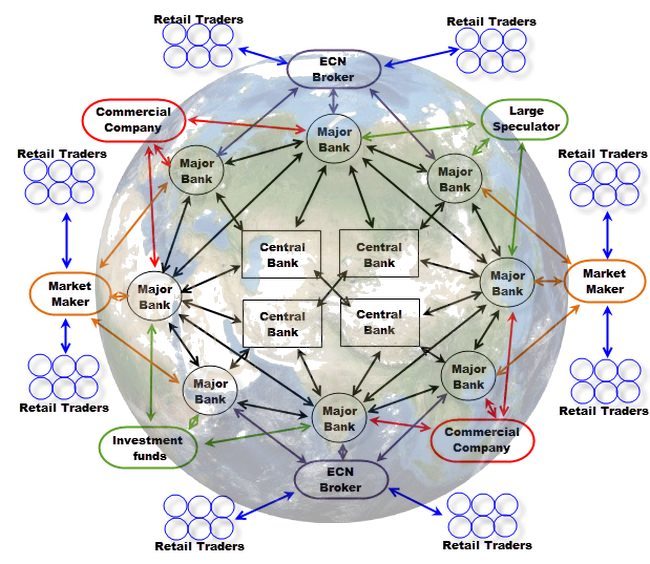

This feature of the foreign exchange market is due to the fact that it is decentralized, because even if the broker takes quotes strictly from one market maker, a major deal between the corporations may occur at any time that can affect all "sites" that exchange a particular currency. The following figure shows an exemplary structure of FOREX:

Roughly speaking, if all the big players start using HFT algorithms, the "sharks" will just eat each other, as you can’t buy all the information from worldwide, and the international conglomerate to regulate the entire Forex market is yet to be created, so scalping advisors can and should be used on Forex.

By the way, the term "advisor" came from the currency market – from the developers of MetaTrader to be precise, as all other terminals and exchange platforms traditionally use the word "robot" to describe the automated strategies.

Profitable scalping advisors do exist

In fairness, we should note that it is not easy to find a freely available reliable advisor. Most of the algorithms from the forums are either optimized strictly for certain market conditions or are made with errors, or are simply outdated, so finding more or less working scalping expert is a real event.

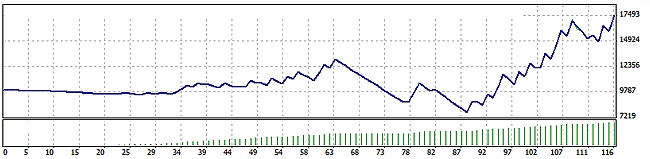

Against this background, the robot called Agent_Fx_v07_XZ_ss looks very nice, so we’ll consider it as an example. There’s information online that it is designed for 1-hour timeframe, but the tests have shown that the expert, like all the scalping EAs, works perfectly on the five-minute charts – moreover, profits on M5 was much higher than on H1. Results of testing from February 2014 to January 2015 speak for themselves:

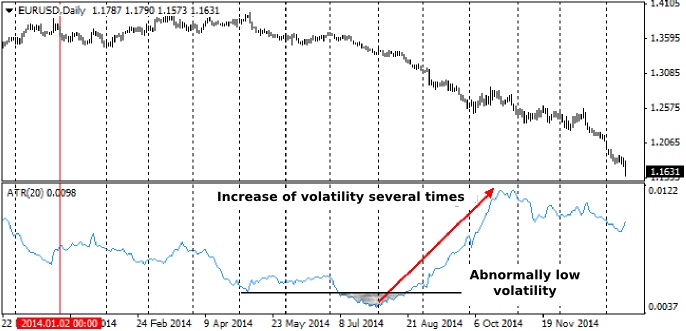

As you know, both flat and powerful trend could be seen on this section, while the volatility that becomes a stumbling block of many advisors with fixed stop-losses has also changed from "abnormally low" to "high":

In addition, the algorithm is built on a standard Commodity Channel Index, the calculation of the period of which can be changed by the user at their discretion. All other settings are also available for optimization and are divided into three classic blocks:

1. The parameters of the initial stop-loss and take-profit;

2. Block of the settings of the trailing stop and the value of its increment;

3. A final set of variables is intended to enable capital management, where minlot is the minimum possible working lot, maxlot is the maximum lot, after which the robot will cease to increase the volume of the position, and lotstep is the increment of the lot.

Actually, all options are intuitive and self-explanatory, but here are some important issues that need a comment: in particular, Agent_Fx_v07_XZ_ss will increase a lot in the new deal by the lotstep value only if the last order was closed with a profit.

Unfortunately, the developers did not provide a similar rule in the opposite direction, because after the losing trade the advisor does not reduce a lot, but in any case, it's not a catastrophe, because the test deposit has not only survived but also grew by 75.5% over the difficult 2014.

Also, be aware that reliable scalping advisors do not rely on a large number of profitable trades, but rather on minimizing the losses from each individual operation. In the case of Agent_Fx_v07_XZ_ss, this rule is met, since the average profit is higher than the average loss by 2.88 times, and the very profitability (profit factor) was brought up to 1.4, which is a strong indicator for a free expert.

Conclusions and recommendations

To summarize, we should note that scalping strategies in the currency market are now less vulnerable to deliberate manipulations, for example, than similar algorithms in the stock market. Also, don’t confuse scalping with intraday trading, which is popular on all platforms.

By the way, scalping advisors in most cases "requalify" into intradayers and even middle-termers, because thanks to the trailing stop, they can move open orders over to the next day and then hold them for several days.

Here comes a simple conclusion: a lucrative scalping robot will be able to bring profit on long trends as well, but the algorithm that was initially configured for larger timeframes will siphon off the account to zero on M1 and M5. Therefore, we recommend middle-termers to take a closer look at the scalping robots instead of criticizing the intraday.

Social button for Joomla