Automated trading does not lose popularity, but the search for a stable trading robot is a rather difficult task. While you can automate almost any trading system, it is much more difficult to achieve stability of the results.

There are so many advisors and new bots are created every day, both paid and freely available. However, the high cost of the expert advisor does not guarantee a steady income, and vice versa, sometimes you can come across real gems among free bots.

When choosing an expert advisor, attention should be paid to such parameters as:

- number of currency pairs;

- timeframe: the higher the time period, the more durable the robot;

- working principle: if the algorithm of transactions is unknown, it is better to avoid such EA;

- naturally, the code should not contain errors.

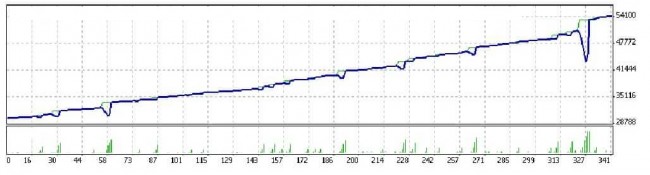

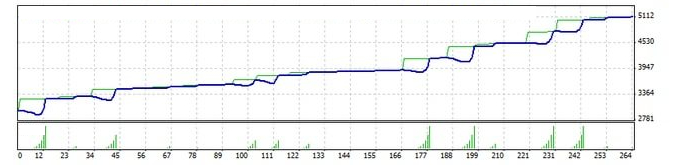

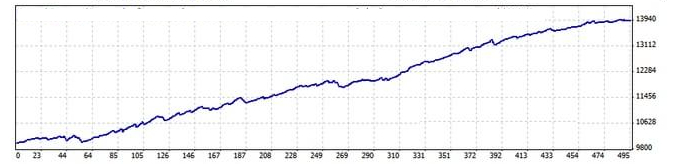

You can judge the stability of a particular EA solely on the basis of test results (preferably over a long time span). If the robot is really reliable, no large drawdowns of the deposit will happen during the entire test, and the rate of mathematical expectation of profit will be high.

Stable Forex expert advisor and Martingale

Many traders believe that the Martingale and the very notion of reliability and stability are not really compatible. Well, this statement is rational. Expert advisors based on the principle of Martingale will sooner or later zero the deposit, that’s out of question. The whole calculation is based on the fact that up to this point the trader will have time to "recapture" the initial deposit and earn. But such a EA may start siphoning off at any moment.

Numerous options that somewhat change the classic Martingale should also be mentioned. For example, griders are quite popular – expert advisors that spread a whole grid of orders (the lot increases each time), and many were looking for happiness with Ilan-like robots at the time.

An example of the effective use of the Martingale is the Silent Ilan EA. Entering the market is carried out on the basis of Ozymandias indicator readings, and to exit the loss, the lot increases at the opening of each next order. It is better to use this robot on the crosses, for example, EUR/AUD.

Stable Forex expert advisor using the Martingale is possible – the 10 Points EA with the addition of Martingale can be noted as an example. The market is entered at the breakthrough of the day extreme, and the profit is equal to only 10 points. The stability has been achieved through smart arrangement of the grid orders.

About the impact of the working timeframe on stability

It is known that a decrease in the working timeframe leads to decrease in the likelihood of a long work of the EA. Pipsing robots are simply not worthy of attention, as they require optimization too often. When tested in the Strategy Tester, the robots from this category increase the initial deposit by 10 or more times a month, but none of them was able to repeat the success in trading with real money.

Most of the expert advisors are designed to trade within the m15 – h1 timeframes and this is not by accident. The fact is that the main task of automated trading is not only to get rid of emotions in the process of making deals, but also a lack of time for manual trading. At time intervals above h1, there are not so many robots for this reason, transactions are few and they can be opened manually.

Stable Forex expert advisor may be suitable for trading on multiple timeframes, while showing a good result. For example, an Equilibrium EA is used for trading on both m15 and h1. In addition, it trades in a calmer way – it doesn’t use lots increase at losses and doesn’t enter the locks. Test results speak for themselves, the EA is stable for 7-year period.

Stability of different types of expert advisors

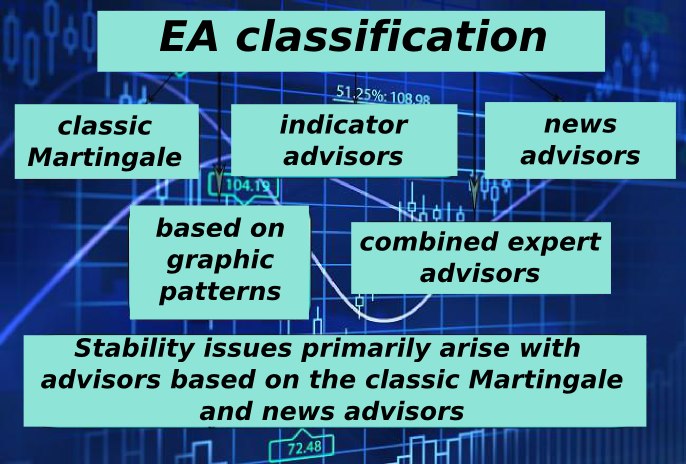

All expert advisors can be classified into several types (based on the principle that underlies the algorithm):

- indicator – the market is entered on the basis of the indicators’ set of readings;

- news – before the release of important news, the robot simply sets the pending orders on either side of the horizontal channel (indicators can be used as an auxiliary tool);

- griders – actively use the Martingale;

- expert advisors trading graphic model (Wolfe Waves, other patterns);

- combined –the algorithm uses, for example, the Martingale and a set of indicators.

Even the most stable Forex expert advisor can’t replace a human – for example, it will not be able to adequately respond to the unexpected announcement. Therefore, it is desirable for the algorithm to provide protection from price spikes, which is especially important for Martingale robots.

Stability of the news expert advisors is not guaranteed either, as the price not always "fires" after the important news. Reliability of other expert advisors is not guaranteed either, it all depends on the algorithm and the efficiency of the idea in general.

Summing-up

The term “stable Forex expert advisor” should be understood as not a robot, which increases the deposit in times in a few days, but a tool that guarantees profit for a long period of time. Also of great importance is the survival rate of the expert advisor, and the less often the optimization is required, the better for the trader.

In addition, you need to pay attention to the percentage of winning deals and the value of drawdown. The stability of the expert advisor can be judged even by the form of the curve of the deposit, which is displayed in the test results. The ideal is smooth growth without zigzag sections and horizontal "plateau" when EA trades to zero.

The most stable expert advisors can be found in the category of indicator and combined robots, but stability is rarely met among Martingale instruments. In any case, the conclusion of the stability of any expert advisor can be made only on the basis of test results.

Social button for Joomla