Can a program appraise the market and make decisions on its own? This is a question anyone engaged in trading asks themselves. Unfortunately, artificial intelligence hasn't been created yet, but an already known algorithm can be fully automated, quite successfully. This is what trading robots exist for.

Based on my experience and circle of contacts, I can assert that the beginners and experienced traders are looking for advisers using the methods and formulas they have already used or at least studied in theory. The most glaring example is a set of algorithms with a common root in the name of Stochastic expert adviser, taking decisions in their operations based on the values of flexible settings of the homonymic indicator. Let’s take a look at each group of such advisers.

Work from the boundaries of the trading range and Stochastic EA

The mechanism of such robots is based on the nature of stochastic fluctuations. It is assumed that when the price reaches the boundaries of the trading range, the market will reserve or dive into correction, and the robot opens a deal at this very moment.

The signal is crossing of the line built on the basis of the parameter %K and the boundary of extreme values. In this case, both fast and slow building method may be applied – the only difference is that the first one is not smoothed during building, while the second one is the result of fast smoothing.

Any elaborated algorithm has all these parameters in its settings. If there is no possibility to customize the EA (no option in the settings window, and no code), then you should avoid using it, because it will bring nothing but losses and is just hastily made.

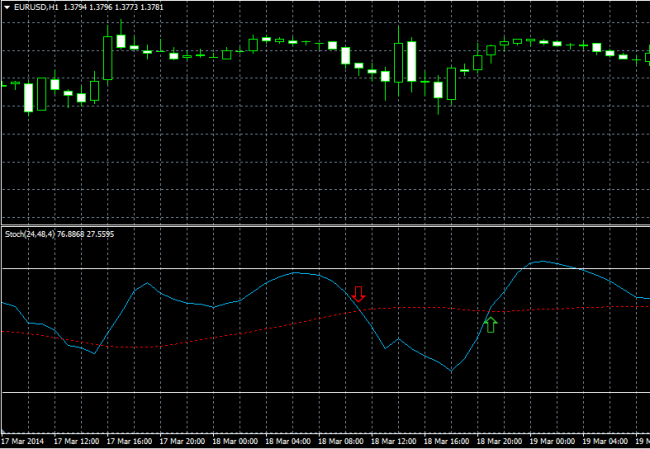

Below we’ll see how the parameters of our key formula will affect the result of the EA operation. To do so, we build two necessary indicators on the hourly euro chart with the period of calculation of 24 hours.

The differences are obvious at first glance, so we can recommend the following methods of operation and configuration:

- fast Stochastic should be used for tools that often see “shot” impulses in order to catch the pullbacks;

- slow Stochastic is applicable to the quieter tools, where the price is often forced in the same direction for a long time.

Stochastic EA also has disadvantages that appear in the trading from the boundaries:

- formula values can "stall" and give false signals, causing a number of robots make several consecutive deals at the boundary unless the maximum number of orders is specified in the settings;

- after the pulldown from the boundary, the formula values don’t always go up even to the middle of its range and start aiming in the same direction again.

The only way to solve these problems is to use fixed stop-loss and take-profit. Never use a Stochastic EA which doesn’t allow to adjust these settings – believe me, I’ve seen them, and they automatically closed deals after the signal line touched the middle of the range or the opposite boundary. This is a fatal mistake, it’s better to come to terms with the stops. The more interesting variant of the robot is the one applying blocking: here you can experiment.

Stochastic EA based on indicator lines crossing

Another common group of robots are those making deals at the point when the signal lines of the indicator under examination cross. The mechanism is simple: the order to buy is opened when the fast line crosses the slow one upwards, and for the order to sell the conditions are reversed. Below you can see an example of the deal opening:

Cons of such work are obvious: a large number of false signals and acute lag, especially on large timeframes. The problem is solved by resetting of the mandatory stops and by additional filters for trend identification. If the robot is simple, you can adjust its operation – for example, by allowing only sell or buy, depending on the direction of the market, which is determined by other methods. But this approach eliminates 24-hour operation or using EA on a separate server. With this in mind, the programmers have created more complex robots that identify trend on their own, usually with the same indicator, but with a larger period of calculation.

There is another kind of EAs which are a combination of the aforementioned. In this case, the deals are opened beyond the limiting boundaries of the trading range and only after crossing the signal indicator lines. This is one of the most reliable options, which can be used both in scalping and in position trading. All of the above rules are true for the settings.

In conclusion, let us recall that the main advantage when building any strategy is analysis of statistics and risk management. In the case of automated trading, the strategy tester allows to perform the first task quickly, and the second solution depends on your capital. If you acknowledge these rules, the Stochastic EA will help you and save your time.

Social button for Joomla