People have always been partial to the yellow metal, and with the development of Internet trading situation has not changed. From a technical point of view, automated trading with precious metals does not differ from speculation in currency pairs.

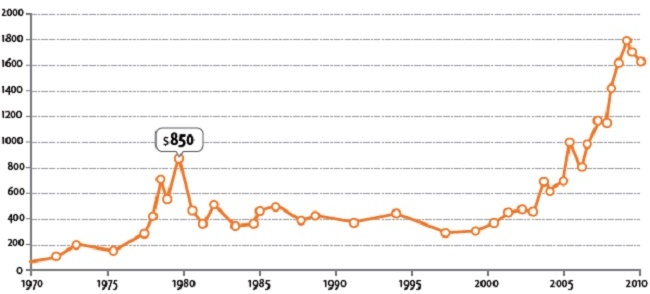

However, not every expert advisor for gold can be used; you may often come across the usual "sit-outs", the whole principle of operation of which is based on the fact that gold can’t always get cheaper. By the way, the misconception that the yellow metal is always growing in price is quite common.

However, the history knew the protracted downturns of interest to precious metals. For example, from 1996 to 1999, the price of gold fell from $400 to $252.8/troy ounce. And drop occurred with little or no kickbacks, so it was impossible to just sit out losses.

However, the price of gold is a good indicator of the events taking place in the world. At a time when the armed conflicts regularly flare up on the planet, and the situation in general is far from stable, there has been a sharp increase in interest to gold. Price is very sensitive to macroeconomic statistics, and the expert advisors try to earn on this.

Expert advisor for gold on the example of Gold Trader

Gold Trader EA was originally designed specifically for trading gold, but in the last version the author also added an opportunity to trade with silver. Bot has rather high requirements to the size of the deposit. So, it is recommended to have at least $500 (preferably $1,000) for the 0.01 lot on the account. As for the leverage, it is recommended not to exceed 1:200.

We can note 4 operating modes of a robot:

- In the standard version, there is a balance between profitability and safety;

- aggressive option – the size of the working lot increases, and respectively, requirements for the deposit also increase;

- economy mode – in this case, deals to sell are not concluded;

- extra economy – minimum lot is reduced by 50%.

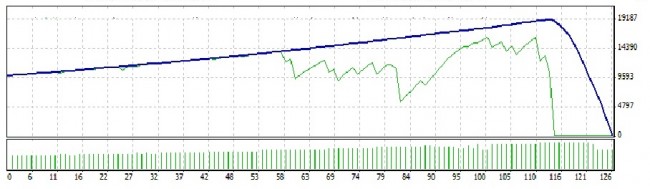

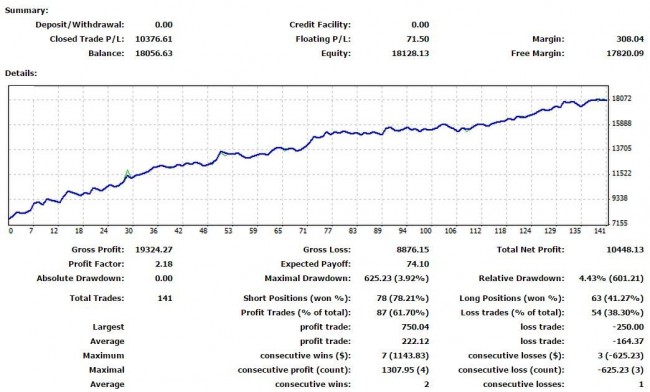

Testing was conducted exclusively on gold for more than a year. Test results do not allow to attribute the EA to reliable tools for earnings. It only works by one principle – buys gold and waits until it grows in value. Possible drawdowns can quickly reset the deposit.

We can say that the EA is too one-sided when estimating the movement of the price chart. Everything is fine while the price increases, but once the interest to the yellow metal falls, serious drawdowns are immediately noticeable on the chart. In other words, the bot just sits out losses, and siphon-off looks natural.

Golden beetle: an expert in gold trading

This expert advisor for gold can be identified as one of the most promising. We can point out the fact that it has updates regularly published, and the EA has not yet appeared in the public domain. This usually happens with working bots.

As for the trading algorithm, the author emphasizes that the best result is achieved during high volatility. That is, trading is conducted on a breakthrough of support/resistance levels. Hence, the main disadvantage of the EA is that during the relative calm, trading is conducted with almost zero efficiency.

The results of trading on real accounts look good – over less than a year, a start-up capital more than doubled. In this case, no large drawdowns were observed over all this time, the maximum drawdown did not exceed 5%. The EA is not available for free, so we have to believe every word of the author.

Gold EA: in the pursuit of profit

In this case, the expert advisor for gold is not trying to just sit out losses. The author does not hope for good luck, so the bot opens both short and long positions. The author notes that profit for the average transaction is always greater than the loss, so in any case, the trader will not be a loser.

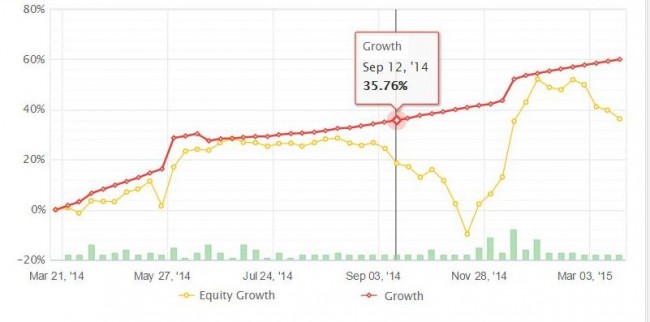

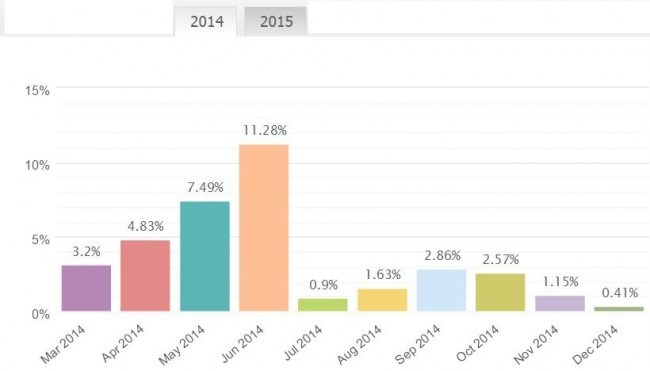

Like most working expert advisors, this robot is not in the public domain, so we will have to focus mainly on the results of monitoring on a real account. As of the end of March 2015, the bot shows profit of about 60% per year. At first glance, it is not that much, but for such a high-volatile tool as gold, it is a good result.

Noteworthy is the fact that for all time monitoring, no month was closed with a loss. And it is clear that the main growth of the start-up capital came in the early months of the last year – this is when gold has risen in price by almost $200. This expert advisor for gold stands out by working well during the flat.

Summing-up

Profitable trading with gold in the automatic mode is possible. By and large, this is no different from the use of expert advisors on common currency pairs. The main thing is not to use expert advisors, in which preference is given to buys. Of course, one might get the impression that in the long term, the yellow metal only grows in price, but no deposit is able to sit out a couple of years of losses.

Also, it may be advisable to avoid multicurrency trading robots. Theoretically, they can work with both currency pairs and precious metals, but the practice proves otherwise. This is due to hypersensitivity of gold to fundamentals.

As for the question of which expert advisor for gold exactly to choose, it may be advisable to stay with the robots trading on timeframe up to h1. There are bots in the public domain designed even for a day timeframe, but in this case SLs are too large.

Social button for Joomla