The proponents of automated trading wonder from time to time: which Forex EA is better, and whether there is a robot that can trade consistently for a long time. The answer largely depends on what criteria evaluate its performance.

Each trader can decide what is more important for them – the speed of deposit growth or the time during which the robot is able to trade on its own without optimization. Beginners often look for options to build up the deposit, hoping to hit the jackpot and get rich in a few days. Traders with experience approach the choice of the EA more prudently and give priority to reliability, while sacrificing profitability.

Also, a lot depends on the algorithm of the EA. Of course, the ideal option is automation of the working trading system, but there are also decent options among ready-made EAs that are freely available.

Which EA is better: dependence of the success from the algorithm

It is clear that the best results are achieved only when the working trading system is automated. Depending on the operation algorithm, we can distinguish the following types of EAs:

- indicator EAs;

- griders (Martingale is actively used);

- news;

- using graphical patterns;

- EAs working on the breakdown of support/resistance levels.

There is other classification of the expert advisors – depending on the working timeframe – it also has a direct impact on the efficiency of trading. Thus, the pipsers trade on m1 timeframe and can hardly be considered as an effective tool, but robots trading on h1 are already worth considering.

What is the danger of pipsing bots?

Wondering which Forex EA is better, you can forget about the pipsing bots right away. Typically, such EAs are used to attract the trader by incredible results and persuade them to purchase such a tool. Backtesting results look great, the deposit is growing by leaps and bounds, but it is difficult to achieve such a result in reality.

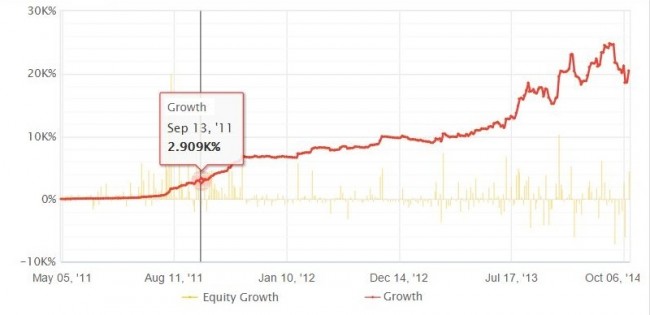

Once popular TDP EA (Trillion Dollar Pips) looks great on a demo account. Over the entire testing period, the deposit was constantly growing, and profit already exceeded 20,000%, but trading with real money ends with siphon-off. Actually, the alarming thing is that the sellers stubbornly refuse to provide monitoring of the real account, and are limited only by virtual money.

The main reason for this is the algorithm of the EA. The matter is that the lifetime of a single transaction is very short (sometimes just a few seconds), and there a lot of deals that are opened in bulk. Phenomena such as slippage and requotes are missing on a demo account, so the result is magnificent.

Indicator expert advisors

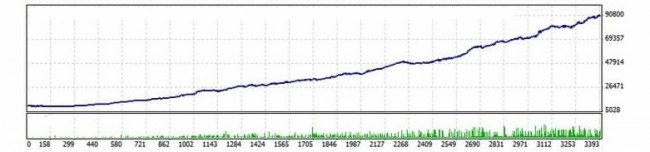

This group of expert advisors often includes interesting options, the working timeframe is usually in the range of m5 - h4. For example, Wall Breaker scalping EA showed good results in long-term testing.

It is designed for trading on timeframes from m1 to h4, but the best result is achieved with the standard settings on m15 time interval. The main difference from pipsing in this case is that the target is up to several tens of points, and the transaction may live for several hours, i.e. the slippage is not critical.

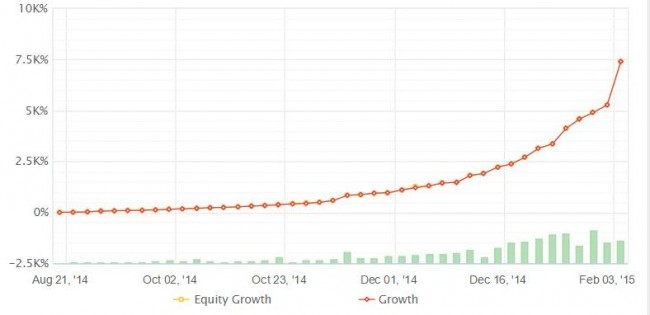

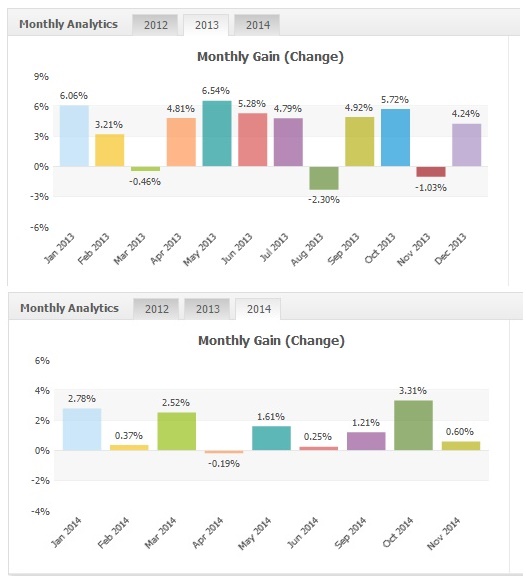

Wondering which Forex EA is better, it is worth paying attention to the Monetizator EA – it performs well in situations where a new trend emerges on the market. In this case, the bot waits for the end of the first corrective wave and enters the market. Its redeeming feature is that in the continuous trading over 2013-2014, it had only 4 months closed with a slight loss. And this is despite the fact that the default settings without further optimization were used.

Griders and news expert advisors

Robots of this category differ by not relying on price movement in one direction. They're just trying to make a profit regardless of the direction of price movement. For example, news expert advisors are waiting for flat before the publication of important macroeconomic statistics and set pending orders outside of the horizontal channel in both directions.

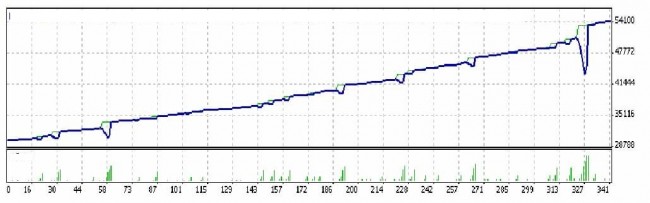

Among the robots using a trading method, a NewsCatcher Pro can be singled out. The fact that the test result on real money is provided instead of abstract test on a demo account speaks in its favor. Of course, the author is disingenuous when guarantees a 4-fold increase in deposit in the short term, but judging by monitoring, the robot can really trade profitably.

As for the griders, they all operate by the same principle – the whole grid of orders is placed in one direction. Typically, these bots use Martingale, and the distance between the orders is chosen in such a way that quite small price movement in the right direction was required for a break-even. Those locking the orders can also be met among the griders.

As for which EA is better in this category, we can single out the "10 points" EA with the addition of Martingale. Unfortunately, it is unavailable for free, but the results of many years of testing and traders reviews speak in favor of its efficiency.

A simple algorithm also speaks in its favor. Psychology is used rather than the indicator market analysis. The deal is opened at the breakdown of the extremes of the previous day, and the target is less than 10 points – according to the author, it is the distance that the price will pass by inertia. Martingale is added to increase the efficiency of trading.

Summing-up

It is physically impossible to list all worthy expert advisors in one article. In order to answer the question of which Forex EA is better, you first need to define the performance criteria. Best trading robot must:

- trade stably for long periods of time without optimization;

- it is undesirable to make several hundred transactions daily (this can attract the attention of DC);

- it is desirable that the principle of its operation was simple and straightforward;

- bots must be excluded from the list of possible candidates if their authors guarantee millions in a short period of time;

- a paid EA should not always be considered effective.

The expert advisors mentioned in the article meet these criteria. And using the given parameters of analysis, the trader can choose a truly effective tool for stable earnings among the many proposals.