This trading robot can be considered a classic grider. It enters the market on the basis of signals of the set of indicators, and in case of price movement in the opposite direction, the EA opens a grid of orders with a certain step and thus comes out of difficult situations.

Of course, this approach requires strict compliance with the MM, and trading with a small deposit is not recommended. But the algorithm lacks aggressive Martingale and it is good. Like any grider, the Zerg expert advisor is extremely sensitive to the strong trend movements, the deposit may not withstand deep drawdown.

This partly explains the choice of the currency pair. Most of the expert advisors are generally focused on popular EUR/USD, GBP/USD, USD/JPY, crosses are much less popular. The expert advisor is designed not by chance for AUD/NZD, the economies of Australia and New Zealand are closely interrelated, so strong trend movements are less common than in other currency pairs.

Moreover, the algorithm of the basic version of the expert advisor uses the rigid adherence to the currency pair. The EA will simply refuse to trade on any chart except the AUD/NZD. The author recommends the use of m15 timeframe in trading, and you can actually trade on higher timeframes, but it reduces the profitability of the trading robot.

How to configure the Zerg EA

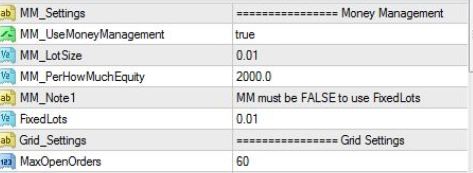

A trader can influence the parameters only indirectly related to trading. All settings can be divided into 2 parts – the part that controls money management and settings of grid orders:

MM_Settings – the part of settings responsible for managing capital; MM_UseMoneyManagement – responsible for the use of dynamic lot. To enable flexible MM, the parameter must be set to true, the false value disables money management;

- MM_LotSize – lot size;

- MM_PerHowMuchEquity – amount of funds that is taken into account when calculating the size of the lot (only works with the active MM);

- FixedLots – a fixed value of the lot is set (with disabled MM);

- Grid_Settings – settings of the grid of orders;

- MaxOpenOrders – sets the maximum number of open orders;

- GridOrderGapPips – sets the distance between the individual orders;

- StopLoss – used to limit losses;

- MagicNumber –used by the advisor to distinguish the orders opened manually from the orders opened by the adviser;

- Slippage – the max drawdown in points is set.

The list of options shows that the trader is unable to modify the algorithm to assess the situation on the market, which greatly reduces the possibility of optimizing the MTS. In general, the Zerg EA does not stand out from the rest of griders in terms of the settings.

Testing the EA on "native" AUD/NZD cross

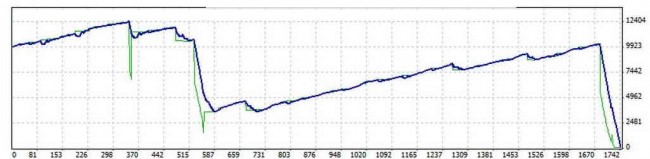

Since the EA was initially optimized for trading only on one currency pair, the trader can expect high survival and good profitability from it. First of all, the trading robot was tested with the default settings and enabled MM on the NZD/AUD pair from early 2010 to the end of October 2014.

Results can be deemed disappointing: the Zerg EA did not fail to earn, but even siphoned off the deposit within this time. By the end of December 2010, the starting capital was zero. At that, the balance change chart showed that it was due to 2 powerful trend movements that led to large losses in a short time.

During most of the time, the EA slowly built up the deposit, but the default settings do little to protect it from a long trend movement. Test results indicated that the EA algorithm needed some improvements, primarily to protect from the trend movements.

Originally, the step between the orders is only 5 points, and the maximum number of orders is limited to 60. But the step change between orders (up to 15) and limiting the maximum number of orders (down to 40) had no significant effect on the result. Of maybe the deposit was siphoned off 5 months later.

Testing the EA on other currency pairs

Basic version of the expert advisor cannot be used on other pairs because of tight binding to the AUD/NZD. But the EA is available free for a long time, so the versions without restrictions on the currency pair are also available. In this case, the algorithm of such modifications is unchanged.

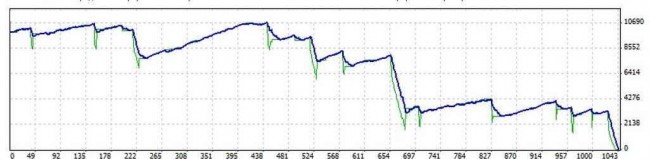

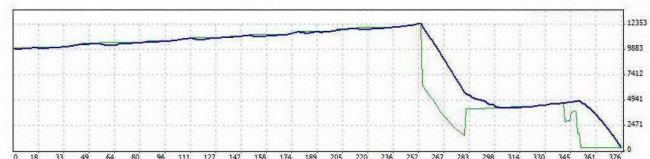

The Zerg expert advisor was tested on a fairly popular EUR/USD pair on the recommended m15 timeframe. But the results were no better on this pair than on AUD/NZD. Regardless of step change between orders, limiting the maximum number of orders or timeframe changes (from m5 to h1), the result was the same – starting capital was zero.

The expert advisor was only able to hold out until the end of the testing period on h1 timeframe. However, we can’t tell about the profit, as trading since the early2014 to the end of October resulted in a loss of $2,003.06.

At the same time, just like in the case with AUD/NZD, most of the time the EA slowly built up the deposit, and the major losses were due to the strong trend movements – it can be called a typical problem of all griders.

Summing-up

The test results suggest that the Zerg expert advisor is not suitable for use in real trading, at least not without serious modification. The algorithm of the trading robot suffers a major illness of all griders – it siphons off the deposit at pulse price movement.

Perhaps we should provide for automatic shutdown of the advisor in high volatility. During important news release, the price often takes several dozen points in a matter of minutes, while the expert advisor opens a number of unprofitable orders.

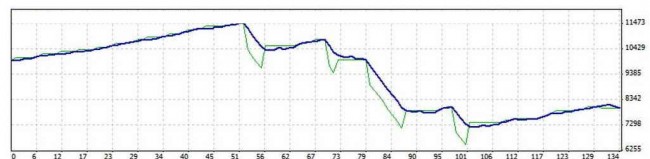

At the same time, the expert advisor definitely has potential – during quiet market, the growth curve of the deposit tells about a relatively stable trading. In this situation, the only solution may be a periodic withdrawal of money earned.

Judging by the traders’ reviews, this EA was really trading well in the past, especially before 2010. Now it has time intervals at which the trading is sufficiently stable and profitable, but then the rapid siphon-off follows, i.e. there is no protection against bursts of volatility. Maybe that's why it appeared in the public domain, which does not usually occur with profitable trading robots.

Social button for Joomla