When a trader makes transactions in the foreign exchange market, it's usually valid for a certain predetermined plan, which, in turn, is part of a trading strategy. The presence of a specific set of rules for trade is a necessary condition for profit in the market. Statistics show that the most successful traders have in their arsenal of one or more trading strategies.

Strategies can be based on different indicators, both fundamental and technical. For example, the formation of the system of orders before the release of important macroeconomic statistics - this is a simple trading strategy that operates excessive emotional reactions of market participants. There are also sophisticated approaches to predict price movements. This may be a trade system based on a set of indicators, filters, as well as inter-market correlation relationships.

In this topic, consider the complex strategies we will not. For the novice trader is best to start with simple and clear methods. The increasing complexity if it will be necessary, of course will come with time. By the way, even many very experienced traders with years of experience in the end come to a simple and reliable systems. In this article we consider the example of the strategy, which is based on technical indicators. We will need a couple of tools for analysis and entry exit conditions of the transaction and the current tactics of adequate management of capital. Still, a simple trading strategy ready.

Indicators and regulations input/output should provide a positive expectation. The magnitude of this is not important. Of course, the above expectation, the better. But it's not so essential. Since most of the work for the growth of account provides money management system.

Brief description of the strategy.

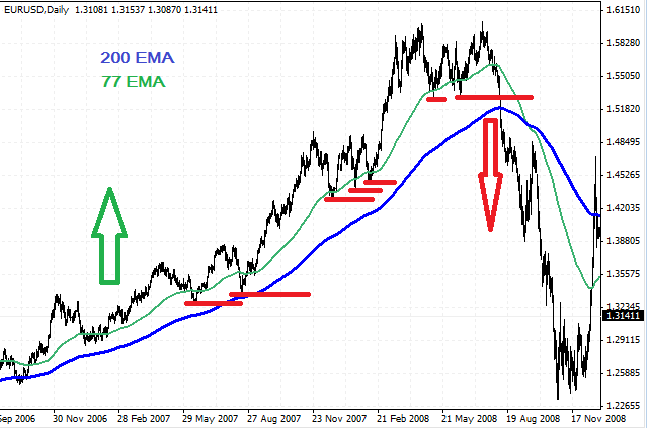

In our example, let us consider trendsledyaschuyu system based on two moving averages, built by the exponential method. Given the fact that in addition to the above indicators are no longer tools are used, it's safe to say that this trading algorithm - it's a simple trading strategy. Let us turn to the heart of the system and briefly describe how it works.

In a period of time, the system assumes transactions in one direction only. That is, it can be a game or only Long or Short only. To determine the current market phase uses two averages - it's 77 EMA and 200 EMA. If they have the same direction, then it's a sign of the presence of trends and transactions are made only in the direction of the current trend. Protective stop orders are placed under local extremes (the red line in the figure), and catching up as we move prices in a favorable direction. If the average bound, or have a different direction, it's not made any deals. Exit the transaction takes place on the protective stop anyway.

It's really very simple trading strategy. And, of course, it has significant drawbacks. High volatility will adversely affect the quality of the signals. This may be the cause of significant drawdown of capital in periods when there is no trend. But, nevertheless, these systems are able to generate profits in the long run. As for the method of money management is quite popular and well-established herself is a fixed-proportional system of Ryan Jones.

A simple trading strategy that is described in this article - this is just one example of how we can build on the basic indicators in decision-making in the market. Of course, any strategy, simple or complex, requires careful analysis, testing on historical data, etc. But it must always be remembered that if the system is working well in the past, then there is absolutely no guarantee that it will give the same results in the future. Source: Dewinforex

Social button for Joomla