Any trader knows that Forex market (unlike stock market) has its limits, which are relatively predictable. For instance, if we consider a euro/dollar pair, many would agree that euro rate is unlikely ever to exceed $ 5. If company’s stock can grow infinitely, the exchange rates always have averaged values. Extreme TMA trading system is based on this rule. A trader can use this system with any currency, and the recommended time interval is 15 minutes.

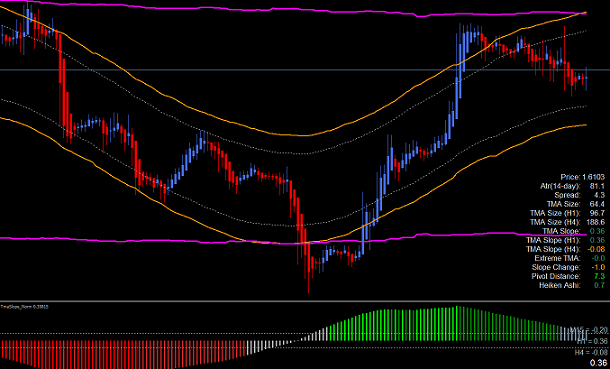

Extreme TMA System has two indicators and a specific graphic design at its disposal. The price channel formed by moving averages is the first thing to catch the eye. This indicator shows the last price dynamics. History, as we know, is repeated, so a trader already has an idea about the possible future price movement. It should be noted that the indicator is dynamic and is constantly redrawn, because the price never stands still. In addition, the indicator’s lines can be used as support and resistance levels.

The next element of the Extreme TMA System is TMA Slope indicator, which provides the trader with information about how the average line changes in the context of previous movements. In fact, the indicator shows the current direction of the market. This indicator can also be used to determine the divergence. The principle is well-known: if the price rises, and the indicator declines, then the currency pair should be sold. In general, you should rely on the indicator, while price at divergence is not in line with market realities. You should buy if the price falls, and the indicator grows. In TMA System, TMA Slope indicator also gives signals to close the position, but we will talk about this later.

Now let’s take a look at the signal to open positions on Extreme TMA System strategy. First we look at the TMA Slope indicator, which will help us to determine the trend. The indicator value ranging from 0.25 to -0.25 indicates sideway movement, so here we start trading from the channel boundaries. When the value is greater than 0.25, it points at the priority of buying, and if the indicator value is below -0.25, then we look for opportunities to sell.

So, let us assume that we understand the direction of the market. Now we wait until the price goes beyond the Extreme TMA range, and if we see the top-level breakdown, we sell. If we see the lower- level breakdown, we buy. The assumption is that the price will remain within the channel, so the principle of action is similar to level-based trading.

Don’t forget about monitoring the TMA Slope. Orders to buy are opened only if the value of the indicator is above zero, and vice versa – we sell only if it is below zero. The signal strength depends on the histogram angle.

It is also important to mention the stop-loss levels. Extreme TMA System strategy can be used with or without using stops. If you don’t use a stop, then you should enter the deal only if all the conditions are met and only after testing the strength of support or resistance level.

If you want to control the risk, then just keep the protective order at a distance of 25-40 points from the opening level of the deal or next to the immediate technical level.

In conclusion, we’d like to note such an important part of making the deal as the position closing. Closing conditions are fairly simple: you should quit the deal when the price reaches the opposite TMA boundary. When Slope indicator crosses zero mark, it is also a signal for the immediate closing of the deal. If you think that movement potential is not yet exhausted, you can put a trailing stop, but half of the volume of the deal still should be closed in the black. Source: Dewinforex

Social button for Joomla