Fishing strategy is a classic example of the partially automated systems, which have recently been getting more common. The reason for such popularity is on the surface – on the one hand, the pace of modern life does not allow to continuously sit in front of the monitor, on the other hand, the market began to change rapidly so that robots sometimes can’t consistently work even for a half of year without the intervention of the trader.

The system found its common form in mid-2013 after extensive tests by many traders and collaboration of programmers and enthusiasts, so it has never been sold and is completely open development for everyone.

The logic of the strategy is built on the usual breakthrough of slanting lines, constructed according to the latest price extremes – roughly speaking, the trades open at the breakthrough of the tangent, which is most often formed in the regular triangle or wedge, but sometimes can be outlined at only one side of the current price.

It is unclear why this name was chosen – probably due to the fact that the technique brings the most profit on the daily charts, i.e. most of the time the trader (or expert advisor) waits for the formation of the desired pattern, and then "hooks" for the deal and squeezes out the maximum profit.

Indicators the Fishing strategy runs on

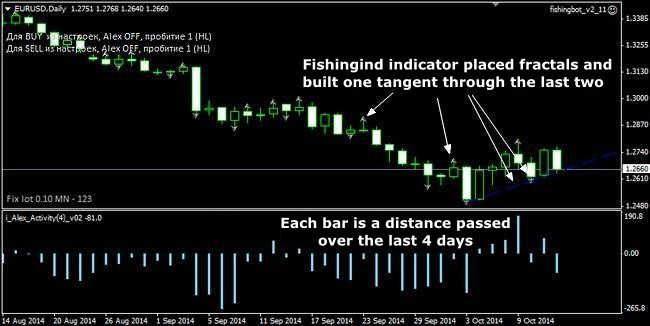

To identify the signals, the algorithm uses only two indicators. The first is called fishingind and is designed to search for primary signals, i.e. seeks for breakthrough of the tangent lines, which in turn are based on fractals. As for the settings, the focus should be on the following variables (the rest is recommended to leave the default):

- Otstup – indent in pips from the actual price for the construction of fractals and signal lines;

- Kolshow – period to be taken into account when marking fractals. As a rule, it is not critical, but may be useful in case of long trend in which fractals are rarely formed.

The second indicator is Alex_Activity_v02_light, which calculates the net balance in pips of price changes over the last few bars, defined by parameter BARS_Period. At the same time, we should pay attention to the word “balance”, as the indicator is intended to analyze the effect of momentum, rather than volatility (where the pips are taken into account modulo, i.e., without the sign). In the figure below we can see an example of the working window:

However, you should not discount the volatility. As you can see, the Fishing strategy uses Alex_Activity extreme levels as a filter, so for each currency pair, you must pick up their own parameters, as each of them has its own features. For example, there will be more flats and short pulses on AUD/NZD than on AUD/USD and NZD/USD. Of course, in the future you will have to regularly monitor market changes and edit parameters – for example, once a month.

Rules for transactions that Fishing strategy involves

Before analyzing the parameters of the expert advisor that complements the system, let’s consider the classic example of a signal. By the way, from the first minutes of the test, the problem emerged: it turned out that fishingind does not preserve the history of its layouts and displays only the actual signal, so you have to put advisor on a demo account to get statistics, after allowing it to work simultaneously on several pairs (the more array and the sample, the better). In real-time, the signal generation is as follows:

In the above case, the pound sterling has at the moment fulfilled all the conditions, and if the situation does not change until the closing of the daily candle, the robot will open the order to sell after the opening of the next day. Please note that this rule is also integrated in the fishingbot EA, which comes bundled with the system for the automation of some operations, so the errors are excluded at the robot-trading, but the beginning fans of manual trading will have to overcome the desire to make a deal as soon as possible.

To accompany the positions, the Fishing strategy provides several options. First of them is a breakthrough of positions into several parts, with a stop-loss on the total position being set behind the previous extreme, then one of the orders is closed immediately after the impulse movement of the price in the direction of profit to the Alex_Activity extreme value, while the stop of the remaining position is moved to the breakeven.

This option is popular both in manual trading and when using the fishingbot EA, which, by the way, has some kinds of “trawl” build-in by the authors – in particular, at the time of writing the following ways were available (in the future new versions may be out):

- Usual method (number of pips);

- By extremes (fractals);

- By the help of the ATR indicator;

- By moving averages, for which you can set any of the settings on the basis of your own reasons.

The second option: profit deals are closed at the intersection of several moving averages of different periods. And since we are talking about the standard indicators, another way of fixing can be noted here – by the CCI indicator. All of these modules are also included in the fishingbot expert advisor.

The last method is a fixed ratio of profit and stop, again calculated using the Alex_Activity indicator. For example, the stop-loss can be equal to 1*extreme (exlevel) value of Alex_Activity, and profit, respectively, as 2*exlevel of Alex_Activity.

A few notes about the expert advisor and the attached scripts

It should be noted that the authors of the strategy under review have done a really serious work, so no special description of the advisor settings are required, since each variable is described in detail directly in the code of the algorithm, all you need is to open the .mq4 file in the MetaEditor editor. Nevertheless, we will list the main ones, because the beginners do not know which buttons to push, and someone just have no time to figure this out:

- Typelot - calculation of the lot. If set to "1", the fixed lot is used, specified below, if "2", then money management enters the "game" (the order value is determined based on the funds in the account);

- Lot and risk - respectively, the minimum fixed lot and the maximum risk at the money management enabled;

- MeansType - Very important parameter, which specifies the type of funds accounted in the calculation of risk. If the value is "1", the formula uses the amount of the deposit, if you specify "2" – the free margin, and if "3", then max [deposit; margin] is taken into account. For most of the strategies, it is reasonable to set it to "3";

- TP and SL - take and stop in pips respectively, which must be optimized for each pair.

And the last thing I would like to pay attention to is scripts that do not affect the formation of the system signals and are for more flexible management of the expert advisor. Below is a brief description for each of them:

- Bot nobuy - prohibits to open orders to buy, even if the Fishing strategy “gave” a signal;

- Bot nosell - prohibits to open orders to sell;

- Bot frozen - a total ban on trading;

- Bot knockknock - cancels all previously imposed bans.