As you know, the currency market significantly differs from the others because it is predominantly an OTC market. This is why if you try to apply the strategy of, say, the stock market to the currency market, there will be a lot of confusion and substitution of notions. One of these methods is Forex Arbitrage strategy, which can be met in different variations online and in the books, but not all the information is true and applicable in practice. But first things first.

The first thing a beginner faces when looking for profitable strategies is an aggressive advertising of arbitration advisors and programs. In most cases these are literally fraudulent schemes that are aimed at exploiting the imperfections of software and hardware of the dealing centers (hereinafter DC).

Forex Arbitrage strategy and conflict of interest with DC

Let’s go back to theory in order to understand how the classic authorized Forex Arbitrage strategy is built. Basic operation in this case is the simultaneous buying of the undervalued instrument at one trading floor, and selling of the overvalued related asset at another one.

Accordingly, for a particular currency market it can be done in the form of buying the EUR/USD pair in a certain DC which takes quotes from interbank, while simultaneously selling euro futures at CME, but under one condition: if the price divergence occurred. Thus, the operation always involves risk, albeit a minimal one.

Almost all applications on the market are not built on the instrument price divergence, but rather use a loophole in the quotes delay in one DC in relation to another, even if they have the same liquidity and prices supplier. Of course, DCs take measures and address such manipulations, so a tricky customer doesn’t normally trade for a long time. Enough about unfair work – let’s consider other options.

Which Forex Arbitrage strategy won’t create problems and allow to earn

One of the most popular strategies is using the “triangles” of pairs. Theoretically, it comes down to the assumption that sometimes the basic rate in the pair is at odds with the exchange rate calculated through the cross. For example, we sequentially buy EUR/USD – sell EUR/JPG – buy USD/JPG, with the lot volume being accordingly recalculated.

In this example, it turns out that we initially bought euros for dollars, then sold euros for yens and closed the triangle by buying dollars for yens. Thus, the risk is minimized, and a kind of locking takes place. In fact, it is just a theory, because the effect from the operation can’t compensate spreads and swaps, so it is not recommended to work under such a scheme.

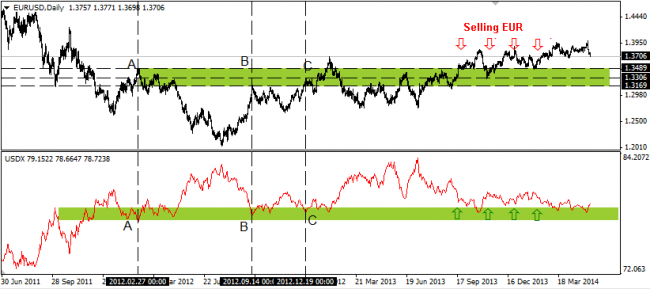

Forex Arbitrage strategy becomes much more efficient when using the divergence between the currency index and exchange rate of a certain pair included in its calculation. Let’s consider this logic at the example of the dollar index and the EUR/USD pair. To do so, you need to build required charts in one window. The result is presented below:

First of all, a green area of support was built on the dollar index and then transferred to the euro chart with the control points A, B and C. Thus, after September 2013 (in fact, after the FRS meeting), the EUR/USD pair broke through the resistance area, while the dollar index largely managed to refrain from falling. Consequently, from this point on, it was reasonable to simultaneously sell euros and the dollar index contract, expecting the price to converge, and the rate of the European currency decline to exceed the growth rate of the dollar.

Of course, it was possible to confine selling EUR/USD with a stop loss, but the idea of arbitration is to hedge via another correlating instrument if the entry proved untimely. Paired trading is also an arbitrage strategy, but such operations are a special case of the above example. Source: Dewinforex

Social button for Joomla