Divergence is quite a strong signal that precedes a reversal or at least a slowdown of the trend. Forex Master Method provides using a series of filters and the divergence as a key signal to open positions.

Creator of the trading strategy, Russ Horn, uses its own classification of divergences by introducing hidden and extended divergences besides the classical (countertrend) one. Tradelocator EA will carry out search for divergences.

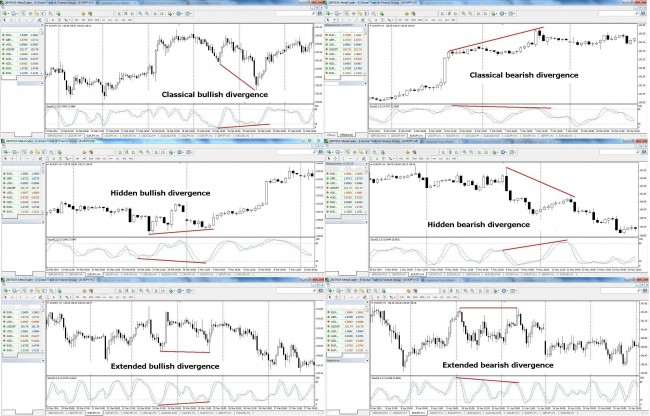

At the regular bullish divergence, the price chart draws two or more consecutive minimum, while the indicator observes increasing minimum. At the bearish divergence, the picture is reversed. At the hidden bullish divergence, the two increasing minimum on the chart correspond to 2 decreasing minimum on the indicator.

The extended bullish divergence is identified when 2 maximum are formed on the price chart, located at the same level and corresponding to the two successively increasing minimum on the indicator. Horn argues that this signal has a good potential.

Forex Master Method features

The strategy involves using the MACD and Stochastic indicators. MACD parameters are recommended to leave as default; the settings for the Stochastic Oscillator are the following: slowdown is 8, the period %D is 3% and the period %K is 8. Oversold/overbought areas are limited with 20/80 levels.

In order to reduce the setup time, you can copy a predesigned template of the Forex Master Method to the “templates” folder, files MACD 2Line.ex4 and TradeLocator.ex4 – to the “indicators” folder. For better readability, the divergences are shown in different colors, the parameters of the TradeLocator EA specify colors for each type.

Human plays the main role in the strategy, the EA just helps not to miss any divergence, while indicators play a supporting role. To make deals, the TradeLocator EA searches for divergences not only on the MACD, but also on the Stochastic Oscillator.

Entry into the market is based on the divergence that is identified by the EA on at least one of the indicators. If it is found on 2 indicators at once, the strength of the received signal increases.

Method of trading with Forex Master Method

Forex Master Method is a multicurrency strategy, and it can be used on any timeframe. However, the author doesn’t recommend trading at intervals of less than H1 – this would allow to reduce the impact of random price fluctuations on the efficiency of trading. When the timeframe grows, the strength of the received signal grows as well.

Opening of a deal is based on the divergence identified by the TradeLocator EA. A confirmation of a signal by one of the indicators is also required (for example, by the Stochastic indicator crossing a signal line). If the signal is confirmed by both indicators, the volume of the deal can be increased.

SL level should be placed over the last local extreme of the price chart. For H1 timeframe, Russ Horn recommends to place SL at a distance of 8-20 pips from the previous local extreme (including spread), for H4 – at 20-40 pips, for D1 – at 30 to 75 pips, for W1 – at 100 to 200 pips and for MN – at 150 to 350 pips. The magnitude of this distance should depend on the volatility of the currency pair.

You can focus on the nearest level of support/resistance when setting TP. The profit is recommended to be fixed in parts, and a trailing stop is also a good idea. In the case of receiving signals in various directions at various time intervals, the bigger timeframe should be preferred. In this case, it is better not to enter the market at all, just monitor the situation. Source: Dewinforex

Social button for Joomla