Today's publication will be somewhat different from previous ones, as Golden Boy strategy was designed specifically for intraday gold trading and uses simplest indicators on Renko charts, which is not often.

Before proceeding to the description of the algorithm, which would take just a few lines, we shall understand what are Renko charts, because some of the readers had never heard of them, and some just didn’t use them in trading. So, this way of presenting prices was developed by the Japanese, which is not surprising, but after 1990 it gained popularity in the west.

The principal difference between the ordinary and Renko charts is that the first is built in price-time coordinate system, while the second totally eliminates the time factor. You can often meet arguments on the forums over the usefulness of this approach, the users’ points of view are diametrically opposed, but conflicts are destiny of amateurs, as any method has strengths and weaknesses, in particular, Renko chart will be useful in the following cases:

- When using technical indicators, as it smoothes random fluctuations and allows to reduce the delay of signals – this is just what we will need today;

- At the analysis of classical patterns of technical analysis (flags, pennants, etc.).

This method also has disadvantages – for example, "bricks" don’t allow the use of candlestick patterns in trading and most of the Price Action provisions; you will also need to put an end to the "tick" volumes and popular volatility indicators such as ATR.

Golden Boy strategy and building of Renko chart

The developers of the terminals differently reacted to the "bricks" – for example, this method of price performance is available by default in modern exchange platforms, but absent in the most popular trading platform among Forex traders, MetaTrader 4. However, the resourceful programmers have created a special expert advisor that easily builds Renko charts, and it's called RenkoLiveChart.

At the time of writing, the latest version of the expert was v3.4 mod, which works correctly in MT4 builds of 600 and above, but to date, the new additions could have been released, so it is reasonable to use the latest modification, in any case – the robot is free and available to everyone.

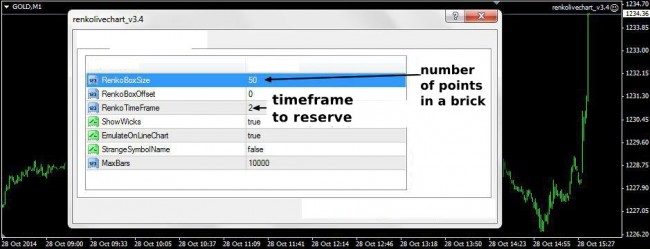

As was already mentioned, the Golden Boy strategy involves trading in gold, so we should open the minute chart (this is a fundamental point) of gold and drag RenkoLiveChart from the navigator to the active field. The window of standard settings is opened, the parameters of which are defined as follows:

While situation with the points is clear, we shall clarify the «timeframe». In fact, this setting has no relation to the time period and acts only as an identifier of the autonomous Renko chart. Then we press «ok» and wait until the upper left corner of the main window shows the following:

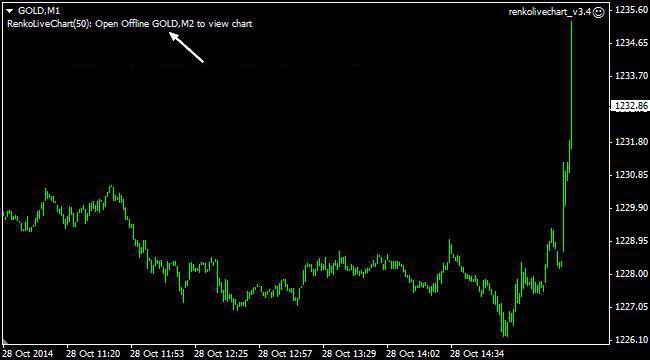

Now open the menu File – Open Offline – Gold, M2. Of course, the ticker symbol may vary at different dealing centers (hereafter DC) – for example, XAUUSD can be used to show quotes from the spot, and if cfd is used on commodity futures, the symbol will be «GC» indicating the respective month. For more accurate information, please refer to the table of the trading tools at your DC. So, after a few simple operations, we get the following chart:

Golden Boy strategy’s terms of trading

The picture above shows the necessary indicators for operation, the first of which is a regular MACD. Basically, we consider it inappropriate to describe it, because its description can be found both on our website and in the online help of the MT4 terminal, we will only note that this version shows not just the distance between the moving averages, but additionally displays the signal lines.

The second indicator called Slope Direction Line (abbreviated to SDL) differs from the standard moving average only by the ability to change color when changing direction (the trend). The Golden Boy strategy just borrows the algorithm, i.e. it was written earlier and is freely available. SDL is built for 80 bars by linear weighted (in the settings method = 3).

Trading on the Pacific and Asian sessions is not recommended, as powerful pulsed motion on metals at this time are extremely rare, and expanding floating spread only exacerbates the situation, so it is optimal to work after the opening of London and before the closing of US sites. The deals to buy require two conditions:

- Fast MACD signal line (blue) has crossed the slow (red) upwards;

- SDL changed the color to blue.

Stop-loss on the deal is set behind the nearest local low, and the profit can be fixed in one of two options – either at reaching a fixed take profit of 200 points (i.e. when the price of an ounce of gold has changed by $2), or at opposite intersection of MACD signal lines. The figure below shows an example of the deal:

For the deal to sell, the rules will be diametrically opposite, i.e. you must wait until the red MACD line crosses the blue one downwards, which is confirmed by a SDL change in color to "tomato", the stop-loss is placed behind the nearest high.

Golden Boy strategy and some of the nuances the author did not mention

With serious experience in trading on Renko charts, we can allow to make a few important observations. First, gold is a tool of high volatility, so the market often doesn’t allow to buy or sell under the signal. What does this mean? The picture will be "nice" on the history, but in the real-time the price can take a few bricks (each of which is equal to 50 points) in just a fraction of a second.

This happens at the time of the release of important news and at the opening of trading sites, so you need to make it a rule: if the price after the signal "flew" the magnitude of the expected profit, it is reasonable to ignore the signal.

Secondly, the "requotes" that are taking place in many of DCs would greatly tarnish your life. The only thing that we can advise is to set the maximum possible deviation in points from 20 to 25 in the terminal settings. This approach will allow time to take almost all the signals even at a "nervous" market. Many would agree that it is better to sacrifice half of the "brick" than miss a deal at all.

And the last nuance is rather specific. It is noticed that in some of DCs, the filters of quotations on gold are set sufficiently hard, which results in the price on the chart moving smoothly and virtually with no noise. On the one hand, it is in these companies that the Golden Boy strategy will bring the most profit, but on the other hand, there is a question about the financial sustainability of these "offices", because in this case the deals are clearly not brought to the counterparties. Source: Dewinforex

Social button for Joomla