Each novice trader is seeking to find the best Forex strategies that will provide a stable income with zero risk, but as you know, the “Grail” does not exist on the market, so you need to learn once and for all that the best strategy may be referred to those that will ensure the survival of the deposit on the distance. Below we will review the basic criteria to consider when choosing the method of work, as well as a classic example of a working system.

So, the most important criterion, which is significant when creating your own or buying a third-party model, is a positive expectation for a certain period. Best Forex strategies can generate income every month, but in a single transaction the result can be both positive and negative, so sifting the algorithms which signals sometimes trigger stop-losses can get you into a vicious circle.

In addition, the strategy choice should not be biased – for example, some speculators argue that the indicator systems are useless and the market can only be understood with the help of a fundamental or volumetric analysis. In fact, this is a misconception, because absolute truth is missing in trader’s profession, and if someone did not understand how to use indicators, it does not mean that you should take on trust and then reject nine out of ten algorithms.

Additional features of the best Forex strategies

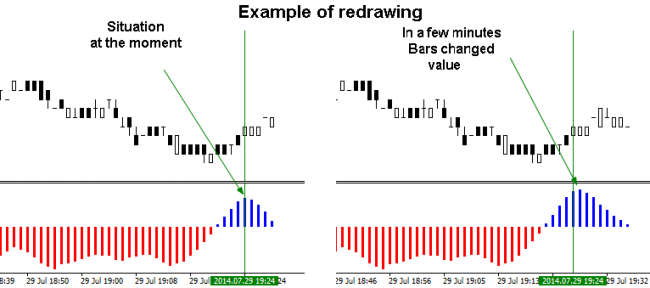

After compiling the list of candidate systems, it is necessary to conduct testing and detailed analysis of the results. At this stage it is important to make sure that the indicators do not redraw in real time and in history – if such a phenomenon occurs, the system can be immediately discarded.

The reason for such approach is very simple: if there is no opportunity to objectively evaluate the work on the history, you won’t be able to formulate unambiguous rules to open and track orders, and the most important is that the trader will not know the risk, because the optimized stop-loss is half the entire system.

Best Forex strategy should have signals unambiguous in treatment – this is the second criterion, which follows from the first. Reservations like “ignore the signal if important news is released” lead into confusion, as everyone understands the degree of importance of the event in their own way. That is why the manual must contain the usual and unambiguous characteristics: the limits of acceptable volatility and trading hours.

Third, if the indicators are used, the formula must be open (indicator files in mq4 format) and comprehensible. If you use too complex calculations, it is a sure sign of the attempt to “adjust” the algorithm to the current market conditions. By the way, even regression calculations are inherently basic.

Best Forex strategies are simple algorithms

To better understand this expression, let’s consider a system based on the ATR, Moving Average, Standard Deviation and RSI. The first element will play the role of the filter determining the current volatility. Moving average is a reliable identifier of the general trend, and the standard deviation and the relative strength index will be merged into a combination that will be the main signal. Below you can see the working window:

It’s impossible to mark absolutely all of the signals, because a graphic example is inferior to the videos in its meaningfulness, but the point is clear – sell in the direction of the trend (moving pointing down) at the moment when the power index of the standard deviation reaches extreme values.

ATR is used for its intended purpose and measures the volatility of the market. In the corresponding box, a horizontal level of 0.0004 is marked – this is the limit value of the average volatility, after which the former signals lose relevance. In this case, it is necessary to use a different modification of the signals with a larger period of calculation. As can be seen, such an approach can distinguish between the “nervous” market and the “quiet” one without resorting to the subjective interpretation of the news.

Due to the fact that the considered system uses only standard indicators, there are no problems with optimization – all you need to do is collect statistics on history for several versions with different parameters, compare their expectations, and ultimately choose the most profitable or stable modification. Source: Dewinforex

Social button for Joomla