Inception strategy is one of the many varieties of "London bombings", as it implies trading using pending orders after the opening of London, but it differs from peers by being based on EUR/USD and AUD/USD pairs.

The algorithm of this system is very simple and is based on years of statistical observations of the behavior of speculators. The fact is that after the opening of London, the Europe's largest site, which is not inferior in importance to New York and Tokyo, the European traders and banks get involved in active trading.

As a result, during the first half hour of the working day, the market receives a large number of orders to buy and sell, and the sum total of them causes the impulse or, speaking professional terms, the volatility growth. As you might guess, savvy traders saw this effect and created a simple method to extract profit from chaos.

Before proceeding to further description, I would like to mention another important point – you should not draw parallels between the name of the system and the popular Hollywood movie, because you can meet similar descriptions by the fans online. In fact, everything is simple: the authors chose this “name” due to the fact that transactions are opened at the beginning of the day, that's all.

Logic of the Inception strategy

As mentioned above, during the first 30 minutes after the start of the London session, the market receives a lot of orders, so on the one hand, the price often makes a false movement at the time, while on the other, strong intraday levels take shapes.

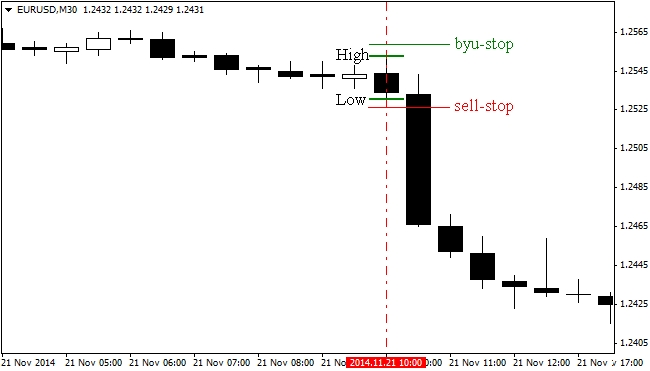

Of course, the "strength" in this case is a relative term, but the authors start from the assumption that those High and Low that the market outlined during the period of high liquidity will be difficult to break further, and therefore the fact of their breakdown will signal the willingness of the market to go further in the chosen direction. The figure below shows the example:

Inception strategy is intended for use for trading on exactly such impulses. So, after marking of the extremes of the first half-hour candle, we take at least five points in each direction from them and set two pending orders: buy-stop and sell-stop. Schematically, the procedure is as follows:

Stop-loss for each order is always set by the price of the opposite order, i.e. the stop for the buy-stop will be located at the opening of sell-stop, and respectively, for the sell-stop the opposite is true. The system does not provide a fixed take-profit – instead, profit is taken at the same time – when the "corporate" traders go to lunch, which is after about 2.5 hours.

Inception strategy in examples

Before taking any action, we recommend you to clarify the difference in the terminal time of the dealing center or broker with UTC, as errors in determining the range will lead to fatal consequences. If you are too lazy to study this question, you can focus on the opening of trading on the FTSE index. Further, all of the examples will be presented on the InstaForex quotes (the difference in time of this writing is 2 hours).

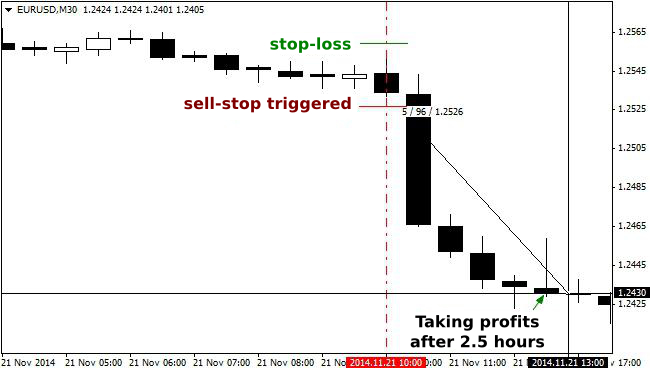

So, let’s continue to review the above situation. After the sell-stop pending order has triggered, the price rapidly "flew" in the direction we need. Since the signal according to the rules is relevant for 2.5 hours, we patiently wait for the expiration of the time interval, then take profits, which in this case could amount to 96 points – very good for the euro.

By the way, in addition to a major position being formed in the first half hour of the session, the further movement on the market is often supported by the news received from the Eurozone. This fact, coupled with the use of pending orders in both sides, allows to reduce the chance of losing trades to a minimum. But speculation is speculation, so losses are unavoidable – for example, below is a typical situation where the Inception strategy ended in a fiasco:

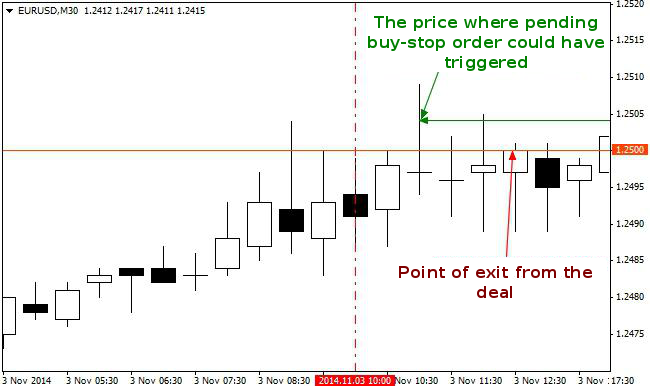

You can’t avoid such a scenario, so you have to take it into account as an essential element of the strategy. On the other hand, a trader has completely free hands in the optimization of profits – in particular, they can reasonably use different methods for trailing of positions that will minimize the negative effects of the following situations:

It can be seen that the loss of profit in just one day exceeded the average daily income of the system. Moreover, the main deal was closed at the opening price, i.e. even spread has not been "covered", so we recommend to choose a broker with low spreads for trading under this system.

Inception strategy and its features

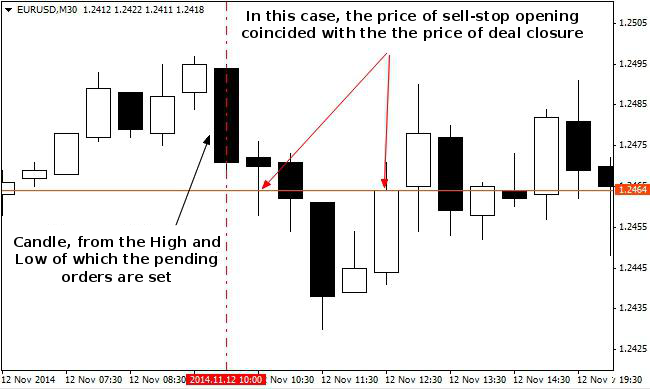

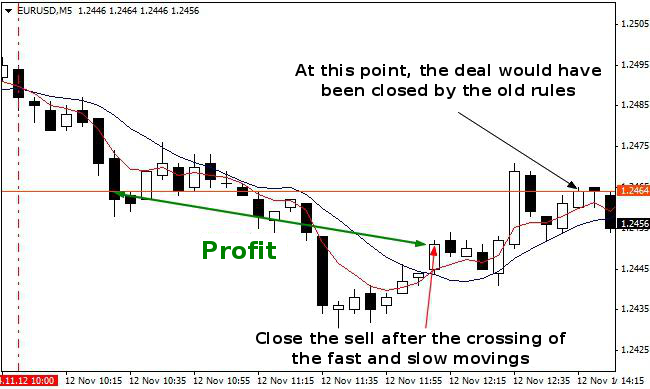

Despite the fact that the authors mention the complete absence of indicators in the algorithm as the main advantage, the example presented above reveals some shortcomings: for example, why not use the intersection of the common moving average for the timely closure of the deal? Yes, they lag, but if you use a smaller timeframe for trailing, the total profit can be much larger. For example, the figure below shows the following situation observed on 5m:

In this case, you could save 12 points, and the notorious "lag" of the movings is in favor of the trader, as since such a slow tool changed direction, it is at least unwise to talk about the further movement in the direction of the original signal.

By the way, since we are talking about the direction, we can recommend a channel of non-linear regression as an auxiliary tool, which if properly configured can generate anticipatory signals of a possible trend reversal, with the regression being equally effective on all timeframes.

In conclusion, we traditionally focus attention on the strengths and weaknesses of the system under consideration – in particular, its main advantages are, firstly, simplicity, which is the minimum number of restrictions and regulations, and secondly, the fact that the strategy can be profitable even in the original version.

The third advantage deserves special attention: the Inception strategy is virtually not time-consuming, because it takes less than 5 minutes to set the stop order, and fixing of the profit is expected at a certain time. Thus, the speculator spends only a few hours on trading, and the remaining time can be devoted to either their business or main job.

There are also some flaws, the most important of which has already been discussed in detail – it is the vulnerability of the algorithm during the flat. A minor flaw is over-optimization of the strategy, i.e. it is not universal, and was not even optimized by the authors for the pound sterling, which by definition is more dependent on trading in London. Source: Dewinforex

Social button for Joomla