There is a common wisdom that all traders will sooner or later come to the conclusion that the optimal timeframe for online trading is one day and more. However, it is difficult to say is it true or not, because basically the difference between timeframes is determined rather by the size of the deposit and the free time which trader has. There is, of course, the presence of the so-called "noise" movements at the less than one day intervals, but fractal analysis settles this problem as well by applying mathematical calculation for all hardly predictable price movements. Nevertheless, Forex trading systems in the interval less than a day make not a daily profit for many traders only, but also the perfect combination of energy spent and the income which was made.

There is a common wisdom that all traders will sooner or later come to the conclusion that the optimal timeframe for online trading is one day and more. However, it is difficult to say is it true or not, because basically the difference between timeframes is determined rather by the size of the deposit and the free time which trader has. There is, of course, the presence of the so-called "noise" movements at the less than one day intervals, but fractal analysis settles this problem as well by applying mathematical calculation for all hardly predictable price movements. Nevertheless, Forex trading systems in the interval less than a day make not a daily profit for many traders only, but also the perfect combination of energy spent and the income which was made.

I would like to show you an example of a simple trading strategy which uses two indicators only. This is a simple one hour Forex strategy.

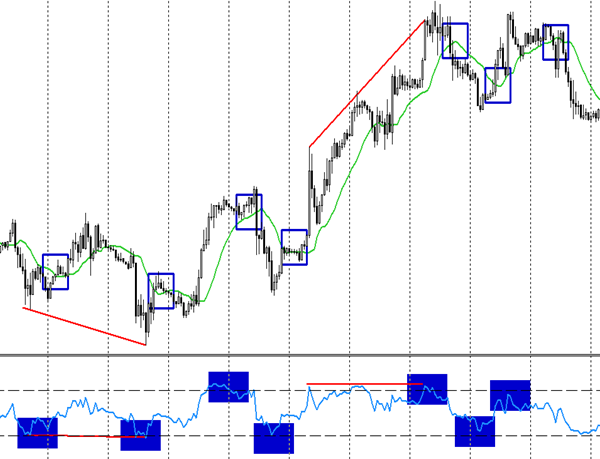

The graph shows the principle of work with the EUR / USD pair on the hourly time interval. Two indicators are used here. The first one is the Relative Strength Index with a parameter 13, and the second one is a simple moving with a parameter 13 and the shift by three candles. The principle is simple. The most important here is not wait the moment when the RSI shows overbought or oversold levels. Only after this indicator signal you can expect moving signal. This signal indicates a situation when a simple moving average meets the price graph from the bottom with the upward movement and from the top in a downward motion of the price graph. Stop-losses can be placed according to the wish of the trader, but within the last minimum or maximum. This one hour Forex strategy is distinctive because of the fact that, in parallel with standard signals, it often shows divergence - convergence signals.

You can add another indicator to this chart, it is better to say another moving. If you add MA with parameters 21 and shift 5 to this chart you will get the opportunity for long orders. Furthermore, this one hour forex strategy gives us another signal that is an intersection of two moving averages, and it provides us with an opportunity to weed out the wrong signal for the closing order. So, the order is closed not when the price graph meets the MA13, but when the price graph crosses the MA21.

However, we should note the nuance of this trading strategy that is a large number of false alarms. To do this, you just need to adjust the parameters of the basic indicator of the trading strategy. The picture shows the Relative Strength Index with the parameter 13. If you set, let’s say, the parameter 21, then the number of indicators’ signals will be reduced significantly, but at the same time the false signals will be reduced as well. In general, the trader decides which parameters to use.

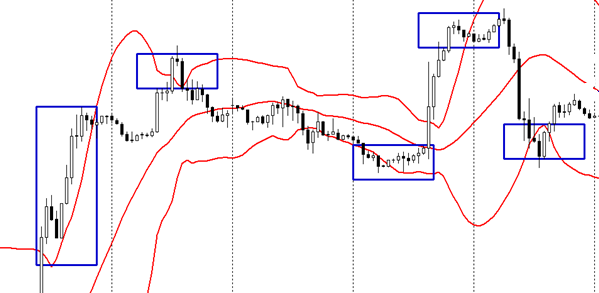

Another one hour forex strategy is described further. It is based on a single indicator, which is called Bollinger Bands, or Bollinger Band line. This indicator allows you to work in a sideways motion, and in long positions as well. However, due to its interpretation and changes in the parameters, the Bollinger Bands indicator remains the difficult one for many traders. But here we will explain its signals in a simple way.

So, the parameters are: a period 20, shift 3.

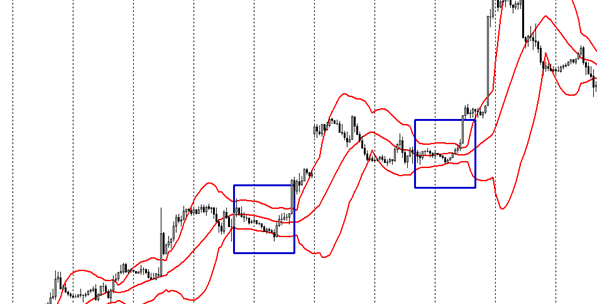

The rebound from the top and from the bottom line of Bollinger Band is a signal for the orders opening. Thus, the trade is conducted within the channel of price movement. The middle line is used as a simple moving and defines the main trend direction. Furthermore, two significant signal should be noted. The first one is when the price does beyond the upper or lower Bollinger Bands. This situation indicates that the movement will continue. The second signal is a strong narrowing of the canal. The example is shown on the picture below.

In this case, you should pay attention to the situation when the middle line meets the price graph, because it is a strong signal for opening of the order. Thus, using the one hour interval on the Bollinger Bands line you can achieve the high accuracy of the price trend forecast.

To draw a conclusion, we can say that the one hour Forex strategy can be made on the basis of almost any indicator, and the combination of any of them can be applied. The most important rule here is a strict adherence to the established strategy, regardless of its components. Source: Dewinforex

Social button for Joomla