Among the infinite diversity of various trading systems and indicators on the foreign exchange market, the ordinary trader is easy to get lost. Methods of estimation of price movements have become popular and play major roles in making trading decisions. The use of indicators has its pros and cons. But in this article, we talk about how to trade, which do not involve the use of any additional analytical tools.

Forex strategy without indicators can be based both on visual graphic signals, and be completely fastened only on money management. Such strategies are popular among different types of traders. Fans of forex strategy without indicators prefer to rely directly on the dynamics of prices, not the late data from the oscillators and togas on.

The most common methods - intraday strategy, the Martingale system, Elliott waves, waves Wolf, scalping, trading breakouts volatility. Intraday strategy can be a set of defined rules (levels of open positions, protective stop loss orders) that are based on the current market price. The Martingale system is generally involves work with support and resistance levels on the mantle and a fairly aggressive tactics position sizing.

Elliot wave, perhaps the most complex visual method of trading. It's based on the postulates of behavioral tendencies of the crowds. Author Elliot Wave theory states that any market cycle - includes a number of steps that are repeated over and over again, regardless of the time frame. Thus, the strategy of forex without indicators - is a worthy alternative to modern approaches based on mathematical tools, and partial or full automation. Below we consider the example of a simple strategy - a breakthrough volatility.

Description of the strategy based on the break volatility.

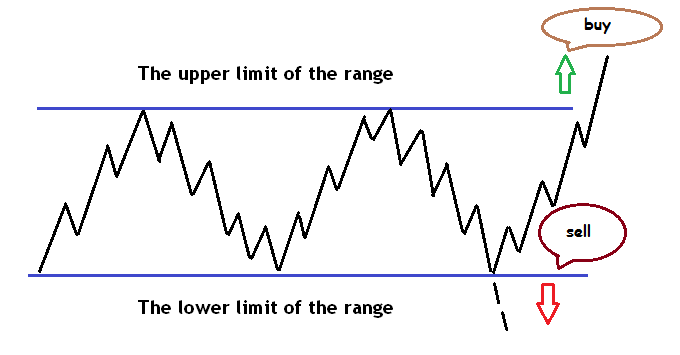

Trading on the given method is very simple. To do this, we need to find the graphs of traded instruments are certain situations in which the price is consolidating within a certain range with clearly defined boundaries. Statistically markets most of the time are in the range of about 80 %. And only 20 % of the time staying in the (trending) mode. Therefore, we need to wait for the start of the trend movement and enter in his direction. Signal to go long break is the upper limit of the price range, confirmed by volume. The signal to engage the short position, respectively, will break through the bottom of the price range.

Like other forex strategy without indicators, volatility breakout method has strict rules exit positions. Appropriate protective stop orders placed within range, approximately at mid- because, if true breakthrough, the price is almost never returned to this level. The risk/profitability of such transactions on the average can be 1 to 3. Of course, like any other trading approach in volatility breakout strategy has its drawbacks. First of all, it's of course the false breakout of the range. This leads to a series of losing trades.

Some traders use several approaches simultaneously. For example, using the system of oscillators or momentum indicator for filtering spurious signals. This integrated campaign can significantly increase the profitability of forex strategy without indicators. When choosing a method of trader needs to be based on a logical and intuitive model. This is the key to a stable psychological state and trade efficiency. Source: Dewinforex