Almost every trader at heart dreams to do nothing and get paid a lot for doing nothing, so today we will not raise the issue of "trading as a job" and see what is a Lazy Trader Strategy.

This technique is ideal for "lazy ones", because it implies the conclusion of a single transaction in a week, it does not even require constant monitoring of the situation to find the promised signal and is completely built on pending orders, which are installed on the four-hour timeframe.

Before considering the conditions for transactions, we would recall the main causes of loss in Forex. Firstly, it is a complete lack of knowledge and opening of transactions at random, i.e. like in casinos; secondly, it is the high expectations of the market and as a consequence – increase in the volume of the lot; thirdly, banal fatigue from constant presence in the market leads to errors, and the last reason is the lack by a trader of at least approximate statistics on the system to be used.

Lazy Trader strategy will solve all problems

Why will it? Because when you use this system, gambling is treated automatically, as any instruction by definition involves trading under strict rules. Furthermore, the expectation of a system is positive and ensures profits of about 5-9% per month at reasonable risks, i.e. in this case it is inappropriate to talk about inflated expectations. If you can’t wait and want to take the risk, it may be easier not to torture yourself with trading and visit a respectable place where you at least get a free good whiskey right away.

The problem of fatigue is eliminated automatically, since the Lazy Trader strategy requires the involvement of trader only on Monday and on Friday evening. Rest of the time you can never come to the monitor and do you main job or personal business. By the way, even though the name of the system is so challenging, you can even say reproachful, it perfectly suits people who value professional job or business, and Forex is something of a hobby or part-time work.

One last caveat may also not disturb the readers, as numerous experiments of the developers and their followers proved the viability of the algorithm. It means literally that if you strictly abide by the rules, i.e. open orders every week, then any drawdown resulting from unfavorable period will be eventually covered by profit.

Lazy Trader strategy in practice: the rules of opening orders

The authors of the system recommend to trade only on the Yen pairs, namely: GBP/JPY, EUR/JPY, AUD/JPY, CAD/JPY and CHF/JPY. This choice has been made due to two reasons: firstly, in the beginning of the week, the maximum activity is observed in Asian currencies which include Yen, and secondly, long trends are frequently formed on those pairs – at least the price much more often takes more than 200 points over a week than stays within a narrow range, for example:

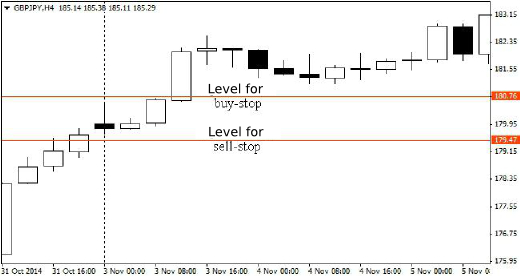

After selecting a particular pair (trading all of them is not recommended, as they are correlated), you must configure the pending orders. To do this, we wait for the first four-hour candle of the week to close, and then at a distance of 20 points from the high and low of the candle we set two orders – buy-stop and sell-stop, respectively.

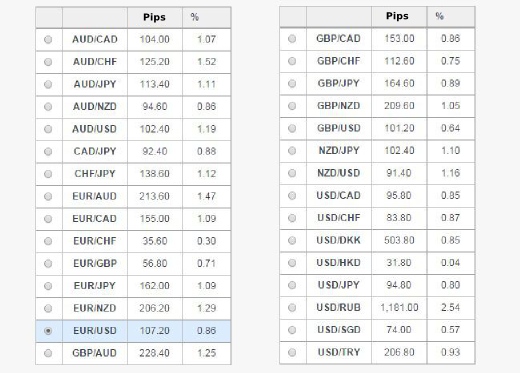

Of course, 20 points is a universal value of the offset, but if you have time, you can experiment with values, since it is obvious that the average volatility of the pair with the pound will be significantly higher than, for example, with the Canadian dollar. If you are really too lazy to calculate something on your own, you can use any service to calculate volatility, for example:

After obtaining the data, you need to correct the offset by a factor equal to the ratio of the average volatility of reference pairs (GBP/JPY and EUR/JPY) to the volatility of the required tool. Let’s consider the situation with an example: the table above shows that the variability of GBP/JPY and EUR/JPY in points was 164.6 and 162, therefore, the average volatility of the "reference" will be equal to 163 points. We remind you that the Lazy Trader strategy for these pairs provides offset of 20 points for pending orders.

Now we define a correction factor by dividing the obtained value by the volatility of the required pair: for example, for CAD/JPY we will get 163/92.4 = 1.76. Thus, if trading is expected to be on the pair with the Canadian, the offset from the high and low of the first candle will be 20/1.76 = 11.4 points, where we pay attention that the value is always rounded to the next higher, i.e. in this case it will be equal to 12 points.

Accompanying the positions

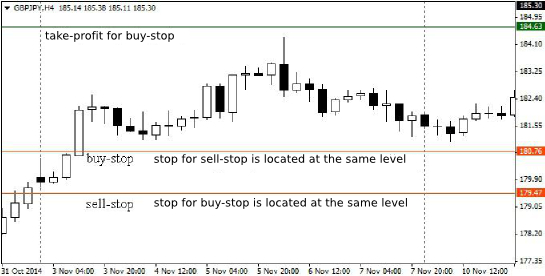

After the pending orders have been placed, it is necessary to set a stop-loss. In this case, exactly the same principle is used as in the Inception strategy – namely, the stop for buy-stop is set at the same level as the pending order for the sell, and for the stop by sell-stop the procedure will respectively be the opposite. The figure below shows an example with explanations:

Take-profit is always set at the rate of three-time stop, while after the price passed the distance equal to the stop towards the profits, the latter is moved to breakeven, i.e. to the level of opening of the order plus a few points to make up for the commission or spread.

Once one of the orders has triggered, the second cannot be deleted, because it is possible that the trend may reverse and the second pending order will also work out its scenario. If the first transaction triggered a stop-loss, the situation is even more simple, since the opposite order is automatically opened. Nevertheless, all the markup (if there was any, since the Lazy Trader strategy is elementary) and extra pending orders should be removed strictly on Friday, so that the gap on to Monday brought no surprises.

Pros and cons of the Lazy Trader strategy

The first part of the review has already discussed in detail all the problems which are easily solved by the algorithm discussed today, so we will not repeat ourselves but note that the trading robot can be easily written for the system, with even a novice MT4 user being able to cope with this task, as they will only need the constructor of the expert advisors.

What does it do? It allows to assess the profitability of the strategy on the history with minimal time, in addition, an automated Lazy Trader strategy will appeal to all traders who live in Europe and for objective reasons cannot adjust the orders in the middle of the night.

On the negative side, the cons can be listed for a long time, but only when the system is compared to fundamentally different approaches. If there are parallels between the Lazy Trader and similar techniques, the disadvantages cannot be found here, as even the ratio of profit/stop will not turn fault. Source: Dewinforex

Social button for Joomla