Basically, a majority of foreign exchange traders use short-term methods of work in the market, and sometimes medium-time methods. Constantly making transactions and being in the center of financial world activity, every day they control the trading process. And the use of an approach based on the long term, is quite rare. Despite of this, long-term forex strategies can certainly become interesting and alternative ways of earning money.

Basically, a majority of foreign exchange traders use short-term methods of work in the market, and sometimes medium-time methods. Constantly making transactions and being in the center of financial world activity, every day they control the trading process. And the use of an approach based on the long term, is quite rare. Despite of this, long-term forex strategies can certainly become interesting and alternative ways of earning money.

If trading is not the only source of income for a person, and he is not able to constantly follow the monitor, one can come to the aid of automated trading systems. However, not all people trust the system which was not developed by them. A long-term approach to trading can become the solution here.

Long-term Forex strategies are such trading strategies, in which transactions are made infrequently, and positions may be held for days, weeks and months. It is worth noting that this kind of work is not suitable for all traders. A human temperament plays a key role here. People who use a long-term approach are often quiet, self-confident and prudent.

To predict long-term trends in the foreign exchange market one is required to understand well the fundamental analysis and have the skills to determine trends. In literature one can find recommendations for beginners regarding timeframes in the early stages of their trading career.

The majority of the authors of publications on stock trading just recommend starting with long-term deals. Then, more one gain experience and hones the skill of transactions conduction; more one can switch to a short format. But it's probably works more with stock market and commodity futures. But one must have a substantial starting fund which could withstand various sharp market fluctuations to stand for the long-term strategy on the FOREX market. Let's look at pros and cons of long-term forex strategy.

Advantages and disadvantages of the long-term trading

The truth could be found in comparison. In order to illustrate pros and cons of long-term strategies for the beginner we will use the comparative analysis.

Thus, the advantages are:

1.Very low time spending: traders should occasionally follow the status of open positions and make adjustments if they are needed. Thus, all market-based solutions are weighted and the probability of error is extremely low.

2.No risks connected with the closing of positions on protective orders as a result of fluctuations in prices: long-term forex strategy involves the use of very distant protective stop orders. This fact negates the risk of accidental operation as a result of sharp volatility triggered by unexpected news release or market manipulation of different kind.

3.The high profit: trading on long-term strategy, a trader can capture motion of hundreds or thousands points in length.

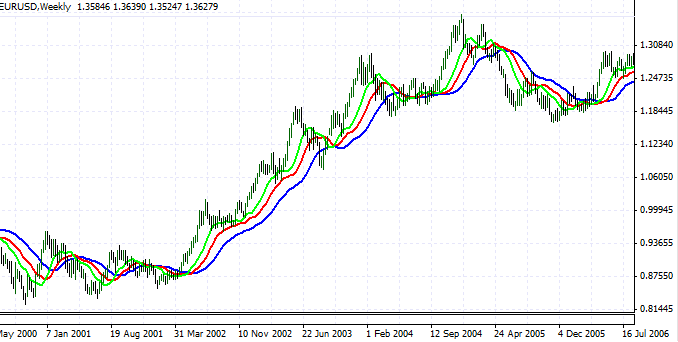

4.Accuracy in identifying of trends: the trader uses daily and weekly charts of currency pairs. This ensures high accuracy of the trend determination, as long-term impulses are more inert so the predictive benefit of this analysis is much higher, in contrast to short-term time frames. The picture shows an example of a long-term trend for the euro. Look carefully to the timeline.

Now let's move to disadvantages:

1. Requirements for capital: to trade on such a distance the trader must have a significant sum in the account to avoid the risk of margin call during periods of increased volatility.

2. Commission costs: despite of the fact that there is no commission on active operations, the swap tax is a considerable expenditure. A situation where the position is open in one direction with the swap is an exception.

3. Potential loss: the risk of loss on long-term trading is significantly lower, but it still has a place to be. And the volume of this loss is quite large, since the defensive orders are quite far from the entry price.

4. Time: position must be held for a long time, and it blocks a significant amount of capital on an account of the trader. It may happen that the deal would be unprofitable for a long time. During such periods, the long-term strategy efficiency in terms of capital investment is reduced.

Long-term Forex strategies - are a good solution for people who have deep knowledge in the field of economy and finance, and have relatively large amounts of trading capital. Source: Dewinforex

Social button for Joomla