Classic Martingale implies the increase of each subsequent transaction. In this way, even after a series of losing trades, once the TP is triggered, the trader will instantly not only compensate for all losses, but also get some profit.

Theoretically, this should ensure sustained success and rapid growth of the deposit, but the reality is not that good. There are a number of features that often are the cause of zeroing the deposit:

- the value of start-up capital. The requirements are quite high, because the deposit must withstand large drawdowns, there are bursts of volatility in the market from time to time, these areas in the chart are the most dangerous;

- Martingale strategy is unprofitable in any case, it relies on the hope that the trader will have time to withdraw good returns before siphon-off. But there is always a risk that a streak of bad luck occurs immediately after the start of work.

Nevertheless, Martingale is quite popular in trading; it is quite often used as a supplement to the existing trading system, in which case it is a kind of method for managing capital. Modern traders retain only the general concept of the method, but the details (distance between orders, magnification factor of the lot, etc.) vary according to the trading system.

Classic Martingale strategy

Classic assumes the constant doubling of the lot in each subsequent transaction while moving in a losing side. At first glance, it does not make sense, but in fact the average price of entry into the market is reduced.

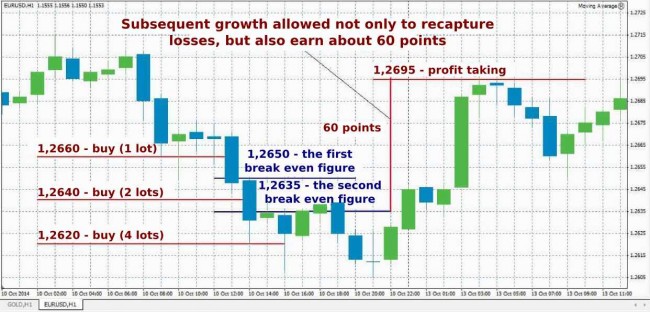

Let's assume that the step between orders is 20 points, and the initial deposit is $10,000. Buy EUR/USD (starting transaction in 1 lot) was made at the level of 1.2660, then the price continued downward movement. At around 1.2640, the deal was already opened for 2 lots, and the loss amounted to $200 at that time.

After the conclusion of the second deal, it’s enough for the price to rise to the level of 1.2650 to reach breakeven point. Now if the fall continues, the next purchase of 4 lots will happen at 1.2620, a loss at that point would be $600, and the price will need to correct to 1.2635 in order cover the losses.

Grid of orders is limited only by the size of the deposit – if its size allows, then sooner or later the losses will be reset. A main reason for the failure of traders using such a strategy is insufficient strength of the deposit.

Using Martingale in trading strategies

Martingale strategy is rarely used in its pure form as a basis for the trading system. Most often, it is supplemented by certain rules to enter the market. As a rule, the Martingale is used in automated trading strategies (grid expert advisors), because the approach of trading counts on the opening of a large number of orders, which is difficult to do manually.

Among the abundance of mediocre trading systems, there are quite interesting ways to use Martingale. For example, the Crazy Lock strategy implements an interesting way out of the lock with moderate Martingale in order to build profits.

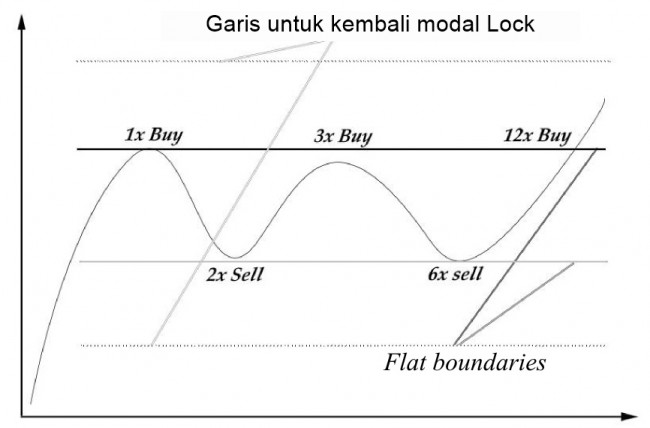

The essence of this strategy is that sooner or later, the price goes beyond the boundaries of the horizontal channel (flat ends) and the trader may try to capitalize on this. Locking and Martingale are applied in this case to receive profit even if the channel boundary breakthrough appeared false.

The work is as follows: after, for example, the order to buy has triggered, it gets a small TP (within 10 points) and at the same time the locking order is set (in this example, to sell), but with the volume of 2 lots.

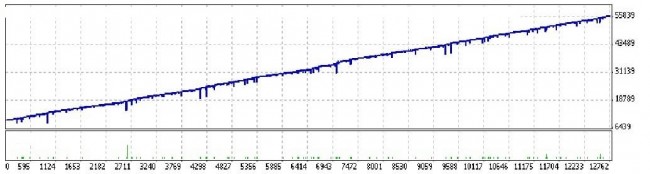

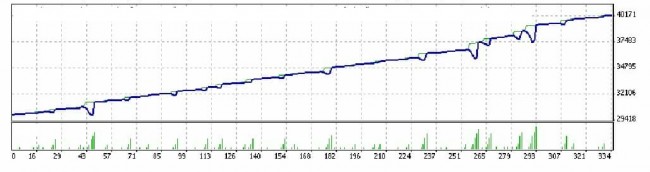

If the price has hooked both orders and continues to fluctuate within a channel, then the third order to buy is set (3 lots). Sooner or later, the channel will be broken through, and the profit will be taken due to increasing the working lot. The results of testing the expert based on this algorithm deserve respect.

How to tame the Martingale?

Despite the abundance of trading techniques, we can formulate some general rules due to which the Martingale strategy can consistently make profit:

- it is desirable to break the existing deposit into several parts and experiment with Martingale on only one part of it. Siphon-off will not be so painful;

- Martingale is better to use in automated trading. Of course, you can trade manually, but firstly, it will be difficult to control the placing of a large number of orders, and secondly, it will be psychologically hard to increase a working lot at a deep drawdown;

- Martingale strategy can be used in real trading only after testing on the time interval of a few years;

- don’t trade during the release of the world's major statistics;

- regularly withdraw profit.

Working strategies using the Martingale exist, for example, in a 10-point strategy, where trading is conducted on a breakthrough of the extremes of the previous day. Profit in points is small, but the addition of Martingale to the algorithm allowed to turn it into a tool for stable earnings.

Summing-up

Martingale strategy owes its existence to gambling. It was in the casino that the players have tried to cheat the system in this way the first time. However, Martingale fully proved itself only in the currency market.

The popularity of this method of trading is explained by the fact that the price chart cannot always fall or rise. Even the strongest trends sooner or later give way to at least the protracted correction, which may well turn into a change in trend. The task of the trader is to provide a sufficient amount of the deposit.

Another proof of the viability of Martingale in the currency market can be considered that the price chart will never be zeroed (theoretically, it is possible, but it will require the whole countries to disappear from the world). Therefore, sooner or later, all losses will be reset – you just need to have enough money in the account. Source: Dewinforex

Social button for Joomla