Medium-term Forex strategies are recognized as the most reliable not without a reason. The matter is that they combine many advantages of short-term and long-term methods of work, while leveling the specific inherent disadvantages. In order to better understand the rules of the medium-term trading, we will consider some practical examples.

First of all, we shall remind you that most problems for speculators are created by the bursts of news and general news background. Scalpers and intradayers in periods of high volatility are ripped off of stop-losses, one after another, and long-termers find themselves even in more difficult situation, because their position is often not speculative, but a kind of investment. Therefore, in the absence of stop-loss, incoming information and statistics day after day can slowly but surely make a deal deep down.

In contrast to these styles, the “medium-term” relies heavily on technical analysis, always having an acceptable margin for maneuver on the deals, and the magnitude of the potential profit exceeds the stop-loss several times and allows to live through a sequence of losing orders. In addition, the search for entry points is carried out on the timeframes older than “hourly”, which frees up time of the speculator for private life.

Medium-term Forex strategies on daily charts: example from Linda Raschke

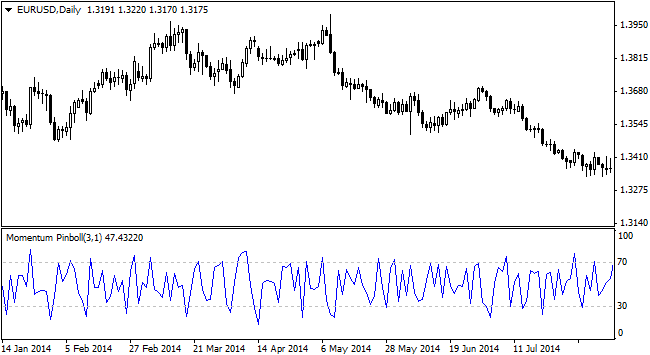

As noted above, the main advantage of this approach is that it saves time and lowers the degree of dependence of the result from random events (both individual and their sequence). In addition, a few decades ago, intraday trading wasn’t developed due to lack of infrastructure, this is why the medium-term Forex strategies absorbed the experience of many generations of traders. One of these techniques is “Momentum Pinball”, proposed by Linda Raschke.

A few key features should be mentioned for the said algorithm. Firstly, the signals to buy and sell are formed not on the level breakthrough, as is customary in most popular strategies, but rather on the corrections from the main trend. Secondly, the moment of completion of the correction is identified using a special indicator, whose name is assigned to the trading strategy.

Momentum Pinball differs from the standard oscillators by being the ratio of Rate of Change, abbreviated ROC (which is not included in the standard package of MT, but can be found in exchange terminals) to RSI. In this case, Linda recommends that you set the period of ROC equal to 1 and RSI equal to 3, accordingly, while the eponymous indicator can be downloaded online for free. Several actions must be performed for long trades in Forex.

To get started, we are waiting for the moment when the indicator goes to the overbought or oversold area (70 and 30 by default), and the daily bar must close in this case. If this situation emerged during the day, it is prohibited to set the orders, due to the possible redrawing in the near future.

Next, you need to markup the corridor formed before the start of the main session and place a sell-stop order (or buy-stop, depending on the situation) 5-20 points (four-digit prices) from the corresponding boundary of the range. This rule is not an original recommendation from the author of the strategy, because it is specifically modified for Forex. The original version provides guidance for the stock market, so the corridor is not marked up, but only the minimum (maximum) of the first hour bar after the opening of the marketplace is taken into account.

The last move is risk management and support of the deal. To limit losses, a stop-loss should be set behind the opposite end of the range. For the fixing of profit, a number of scenarios are allowed, the simplest of which is to close a lucrative deal at the end of the current or the next day. The more elaborate tactics is to leave the market when the indicator has reached the overbought area again – this is the procedure recommended for work.

Synthesis of the algorithms as a way to improve the overall efficiency of trading

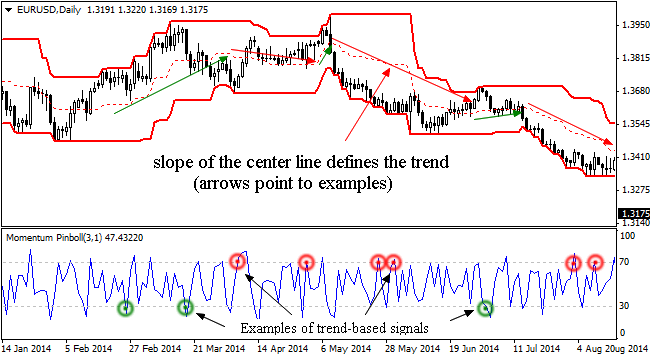

As you can see, the above-mentioned system is vulnerable under prolonged trends, as the oscillator gives a lot of false signals due to the short period of calculation. To solve this problem, it is rational to combine Linda’s technique either with individual modules or with full-fledged trading strategies, such as Donchian channel.

Like other well-known medium Forex strategy, this algorithm has been “taken over” from the stock market in the days when there were no computers, so traders had to draw and calculate everything manually. It is for this reason that the Donchian’s “invention” works fine today, because it is designed for the daily charts, without regard to the optimization of junior timeframes. The eponymous channel is added to the Raschke’s system on the chart below.

Given the fact that the said indicator reflects only the maximum and minimum price for the period, it becomes one of the most effective tools for analysis, because the trend is nothing more than a sequence of extremes. Therefore, it is perfectly suited for the solution of the problem, for which you must set the period of calculation equal to 21 days.

Richard himself recommended to work on the breakthrough of the boundaries of the channel, but for trend identification it is enough to consider only the direction of the middle dotted line. Thus, from the signals generated by Momentum Pinball, only those that match the main trend (direction of the center of the Donchian channel) will be taken into account. The figure below shows an example of system signals:

Indicatorless medium-term Forex strategies

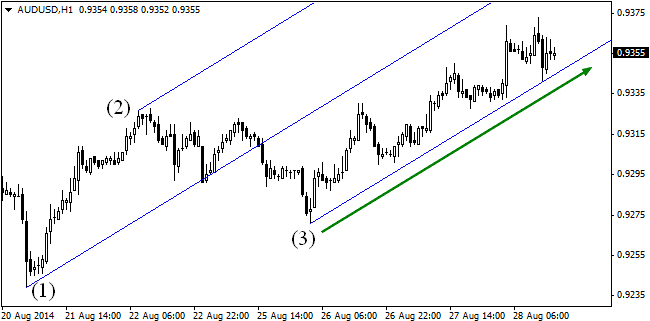

Today’s article covered only indicator trading, but the picture would not be complete without mentioning another important group of trading systems, whose algorithms do not use formula. Of course, we won’t manage to cover the whole set of methods, but in the continuation of the theme of the trading channels we will examine a tool known as Andrews’ Pitchfork. To construct the “pitchfork” in MT terminal, you need to select the appropriate item on the toolbar, and then connect the three points on the chart as follows:

We should note some important points: firstly, the markup is applied against the latest trend. Here the second nuance appears: there must be three extremes confirming the reversal. The figure above shows a classic bullish formation after a bearish trend; for the reverse situation, the rules are opposite.

As it can already be seen on the chart, the strategy under Andrews’ Pitchfork does not give the signal to within a point, but allows unambiguously and without the notorious “delay” to interpret the situation on the market. To do this, remember the following basic rules:

- if the price fluctuations don’t go beyond the boundaries of the channel, we can speak of a strong trend;

- breakthrough of the boundaries towards the trend is likely a false one, and a rollback should be expected;

- breakthrough of the boundaries in the direction opposite to the current trend indicates a reversal of the market or the beginning of the sideways.

Thus, the medium-term Forex strategies without indicators are not inferior in accuracy to their mathematical counterparts, but by definition require experience to find the entry points, because to recognize the direction is only half the story. Source: Dewinforex

Social button for Joomla