The New Zealand dollar is one of the "tech" currencies, but due to the small weight in world trade it is often forgotten in the training courses. As a result, many new Forex strategies for this pair are undeservedly put aside, as they are simply aren’t tested. In order to correct this injustice, we will take a look at three systems for "kiwi", which appeared relatively recently.

Before proceeding to the study of indicators and rules of transactions, we should recall a few facts about the New Zealander. Firstly, it is the commodity currency, so long-lasting positive stable trends often form on it following the commodities, and secondly, the kiwi is actively used in carry-trade operations, which also creates additional preconditions for powerful trends, and, thirdly, the news background across New Zealand is the most transparent and clear. All these factors provide invaluable help when using technical systems.

New Forex strategies on the basis of "Yesterday" system

So, the first method is a basic algorithm, which is based on the RSI indicator. We should note that if it were not for the developers assurances that the maximum drawdown of the account as a result of losing trades is less than 70 points, this strategy, like most counterparts, could complete his inglorious way, without taking the first steps.

As is clear from the title, one of the central parts of the model will be yesterday prices, and RSI with period of 10 (the hour timeframe is used) is required as confirmation. To make deals, the levels are marked through the extremes of the past days, after which the development can get two scenarios:

-

Hour candle touched the high boundary of the range, RSI also touched the overbought area (level 70), and then turned around and returned to the normal range – a signal to sell. At that, in a number of cases, the price can go above the key level, and if this happens, you must wait until it is back within the range (similar to the strength index);

-

The opposite situation is when the price on the chart and the RSI touched their lower boundaries – a signal to buy. The false breakouts filtering rules are similar to when opening short positions.

To limit the risks, almost all new Forex strategies use stop-loss, and the technique under review is no exception. The authors recommend to set a stop behind the previous extreme plus 15 points, while its value should be in the range between 30 and 50 points. If the stop order is less, it may be disrupted by a false move; if it is above, the expectation of the system becomes unsatisfactory. The following figure shows a more detailed example of the transaction:

Special attention should be paid to the method to install the take-profit, and you need to remember an important point – the profit is fixed at the maximum price of the candle body, which formed the opposite extreme, but in no case on the High (Low). At that, the high of the body can be both an opening and closing price, depending on the type of formation that formed next to the level.

In addition, the strategy provides additional constraints for the false alarms filter. In particular, when taken one signal in practicing, the opposite is not recommended to use. If the stop-loss is triggered, it is best to re-enter the market at reappearance of the original signal.

We should also note that according to our own observations, the New Zealander can often be traded consistently above the yesterday extremes. The authors of the original version didn’t include this moment, so it is recommended to combine the signals of "Yesterday" system with the price action, and in the case of a reliable trend continuation pattern above the high (under the low) of yesterday's session, the relevant transaction should be opened.

"Magical Stream" Strategy: classic in combination with new indicators

Another fairly simple strategy that is perfect for a five-minute chart of the NZD/USD is "Magical Stream". Perhaps, it received this name due to its brightness, because it uses a number of indicators, and does not represent anything supernatural. So, in order not to go into theoretical considerations, let us list the indicators and the rules for transactions (on the example of buy, while conditions to sell are the opposite):

-

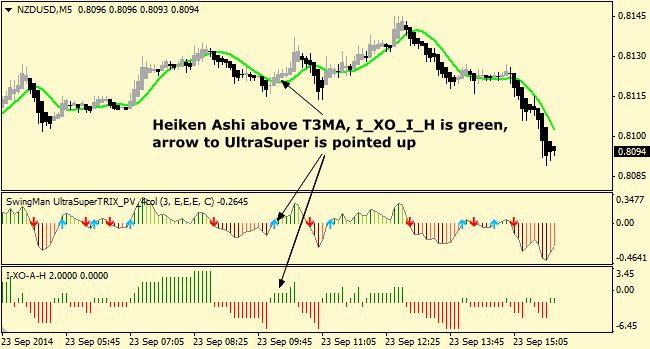

T3MA is a trend indicator built on moving averages. It is always used in combination with the standard Heiken Ashi – in particular, if the latter is gray and above T3MA, then the trend is upward;

-

I_XO_A_H is a lower oscillator designed to confirm the trend. Respectively, in this case, the color should change from red to green;

-

UltraSuper TRIX is an upper oscillator, acting as a signal module. For convenience, the algorithm has arrows indicating the direction, so a signal to buy would be complete only when the up arrow appears at the confirmed bullish trend on UltraSuper.

We should note that the current version is slightly modernized – in particular, the Momentum indicator is excluded, which was useless and has not been used correctly, but in the rest, the system is still working. To exit the position, the authors recommend to wait for take profit to work out, which is set twice a stop-loss and is equal to 30 points. Nevertheless, almost all the new Forex strategies have additional rules for closing orders, as the modern market is very unstable. In this case, this signal is the Heiken Ashi color change.

Other new Forex strategies that deserve attention

Since the financial crisis "broke" a lot of the usual high-yield methods of work, different methods on correlation have emerged relatively recently, one of which is as follows: the dynamics of world prices for dairy products is analyzed, and on the basis of identified dynamics, the decision to buy or sell New Zealand dollar is taken.

The fact is that, as was noted at the beginning of the article, "kiwi" is a commodity currency, and dairy products account for considerable weight in the structure of New Zealand’s exports, directly influencing the dynamics of the trade balance. Of course, this pattern has been known for a long time, but only the large funds and banks were using it.

Currently, more and more people are starting trading in the financial markets. In addition, the commodity markets do not seem such inaccessible for the majority of "home" speculators: this, in combination with improvements in infrastructure data, results in traders replenishing their arsenal with new programs, terminals and tools, and the previously little-known techniques literally turn into new Forex strategies.

China had an additional impact on the growth of popularity of this strategy, as its economy starts to slow down, and every alarm could provoke sharp movements in commodity markets (The Celestial Empire is the second largest buyer of New Zealand dairy products after the United States), and then in foreign currency market as well, which is what a speculator needs. In conclusion, we should note that these algorithms work best in long-term range. Source: Dewinforex

Social button for Joomla