Before looking for profitable Forex strategies, you need to clearly understand that the price chart alone is not enough in practice. Some traders argue they are trading exclusively on pure charts, but as practice shows, it is the result of years of experience and a good knowledge of the instrument, which the beginners lack by definition. So today we will review a reliable indicator system, as well as a methodology for analyzing reports of the Chicago Mercantile Exchange.

So, what is the difference between profitable Forex strategies on indicators and obviously unprofitable options? First of all, it is about mathematics, statistics, and understanding of the principles laid down in the formula, because the indicator is a simple calculator, not a random number generator.

How basic but profitable Forex strategies are created

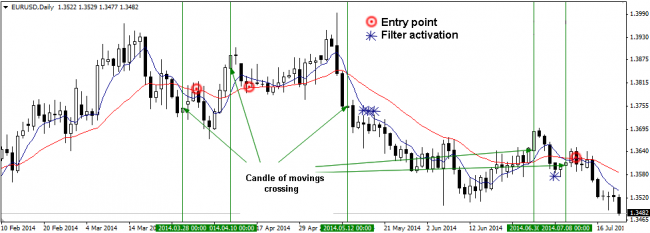

We’ll review a common medium-term strategy at the crossing of the moving averages. Since the orders will be opened on a large timeframe, both movings were assigned an exponential method of building. For the same reason, and to eliminate the redrawing on the last candle, opening prices were taken into account.

Periods for calculating of the moving averages are respectively equal to: 5 for the fast (corresponding to the number of days in a week) and 21 for the slow (average number of working days per month). The figure below shows an example of the working window on the EUR/USD pair:

Profitable Forex strategies never “fit” the parameters for the current situation, the periods should always be based on certain fundamental principles. Since many "critics" didn’t comply with this rule, some myths began to spread.

Talking about mathematics and statistics, it has become evident that these disciplines are useful for calculating the optimal ratio of profit/stop. To do this, you need to create a table with the results of backtesting, since the setting on opening prices allows doing so.

The output will represent several data arrays, each of which will require the mean and variance calculation. Then you just need to choose the most profitable and stable option. And that’s it – in fact, the system is ready. Daily newsletters with CME can significantly increase the effectiveness of trending strategies.

Profitable Forex strategies based on option levels

Before you deal with the practice, let us remind you that the option is the right to buy or sell the basic asset at a predetermined price. As such, there are two types of options – Put (sell) and Call (buy), which together reflect the behavior of the bulls and the bears.

It should be noted that the CME is directly related to Forex trading, as it is one of the largest exchanges where futures on currencies are traded. There are opinions that the interbank market determines the behavior of speculators and investors in the futures market, but the practice did not find confirmation of this, and things are exactly the opposite, so you can use not only exchange volumes, but also the option levels in trading. So first of all, you need to download the report from the official website:

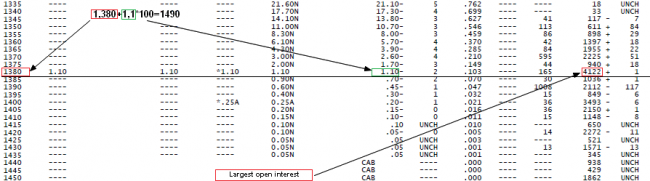

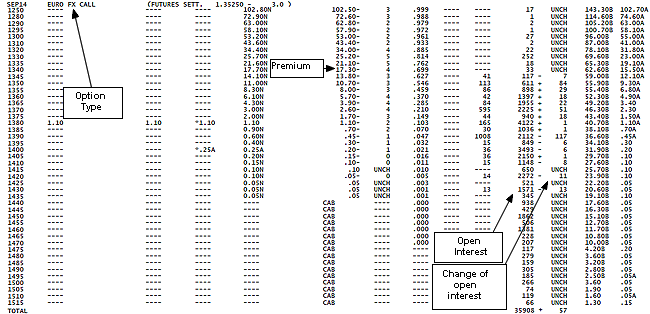

The last working day will be enough for an initial layout, but in the future you will have to regularly update the information, especially after the important milestones. If you delve into the theory, the description of the strategy would take a whole book, so we’ll just mention it briefly: the cluster of the open interest on Put options will identify levels of support, on Call options – the resistance. Below you can see the elements of a report that will be required for analysis:

If we calculate absolutely all levels manually, the detailed approach will take too much time, so it is reasonable to set a limit on Open Interest (OI) – for example, take into account only the levels where the OI is more than 5% of the Total (the last line in the list of the contract). In our case, on the Call the Total = 35908, therefore, everything that is less than 1795 (35908*0.05) would not participate in the markup.

The final touch is calculation of the specific levels for projecting on a chart: to do so, you need to add the value of 100*premium to every level with high OI. If you go back to the example, the strongest resistance level will be the price at 1490. The details of the calculations are presented in the figure below. For Put options, the calculation will be similar, with the only difference – the premium must be deducted:

Of course, the markup is required for other lines as well. To summarize, we can note that the option levels have knowingly been mentioned in the context of profitable strategies, as they are an excellent alternative to all the other options of defining the objectives and potential losses, because they allow to read the market like an open book. Source: Dewinforex