Puppet Master strategy is a relatively simple algorithm designed specifically for trading with a basket of currency pairs. This method uses only one indicator in its operation and is intended for trading exclusively on large timeframes.

Despite the fact that the said system has gained wide popularity in 2014, i.e. is considered to be new, it is based on the long-known principles and techniques that have repeatedly been reviewed on our website under “Trading Strategies” and “Indicators” sections. But in order not to confuse the reader, we’ll recall some important theoretical aspects when reviewing the Puppet Master.

As is well known, the most common cause of losses in the foreign exchange market lies not even in the discipline, but in many flats and false movements that prevent from correctly determining the trend on the currency pair. It does not matter which currency is quoted and which is basic, you can look through all of it, but the result will not change.

Some old-timers of the market have long noticed this fact and began to use the currency indexes, while the other "camp" of the speculators began to develop the idea of hedging positions using a basket of currencies. The meaning of this math is to find the true trend in a particular currency in order to eliminate the effect of random and regional factors.

Puppet Master strategy and the peculiarities of trading via MT4

Don’t forget that trading in the foreign exchange market via the dealing centers (hereafter DC) is a special case, and not really the most common, because much of what the “home” traders are now using was created decades ago. This technique was no exception. Therefore, let’s pay attention to some important nuances that should be considered before starting to work.

Let's start with the most important: as mentioned above, the Puppet Master strategy uses one indicator of the same name, the algorithm of which is elementary and is as follows: the dynamics of several pairs including key currency is analyzed, after which a special factor is calculated that reflects the strength of a major currency.

Thus, the logic of the system is somewhat different from the construction of indices, where special weighted coefficients are used, but it is not a disadvantage, on the contrary – a kind of an advantage, since the algorithm becomes even easier, and such formula will surely work without failures in MQL4.

The second nuance is that not all DC offer the required pairs in the mix of instruments. Of course, it is an absurd situation in our time, but nevertheless it happens, so if one of the components in the working window is represented as a straight line with the extreme values, it means that the program can not get a quote for this pair. Unfortunately, the code has no built-in automatic notification of such errors.

Rules to make and support deals provided by Puppet Master strategy

So, the indicator consists of three files, one for each basket. Puppet Master USD is basket for a dollar, at the calculation of which the rates of the following pairs are taken into account: GBP/USD, EUR/USD, NZD/USD, AUD/USD, USD/CAD, USD/JPY, USD/CHF. Accordingly, if the dollar strengthens for objective reasons, the value of the basket will grow. By the way, here is an example that proves that the index and the basket cannot be equal:

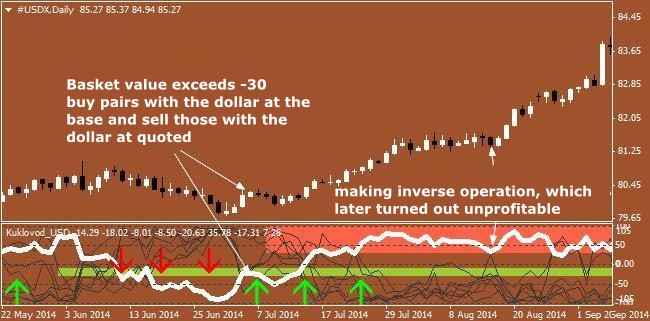

Thus, the Puppet Master strategy is built on the oscillator, and any oscillator is capable of generating both trend and countertrend signals, and this rule is also valid for the Master, so the following set of alternative deals is provided for a dollar basket:

- 10 <Puppet Master USD <30 – buy USD/CHF, USD/CAD, USD/JPY and simultaneously sell GBP/USD, EUR/USD, NZD/USD, AUD/USD – trend method;

- -30 <Puppet Master USD <-10 - buy EUR/USD, GBP/USD, AUD/USD, NZD/USD, sell USD/CHF, USD/CAD, USD/JPY - trend method;

- Puppet Master USD was above the level of 30 for some time, but then returned to the range from 0 to 30 – buy EUR/USD, GBP/USD, AUD/USD, NZD/USD, sell USD/CHF, USD/CAD, USD/JPY – countertrend method;

- Puppet Master USD was below -30 for some time, but then returned to the range from -30 to 0 – buy USD/CHF, USD/CAD, USD/JPY and simultaneously sell GBP/USD, EUR/USD, NZD/USD, AUD/USD – countertrend method.

The figure below shows examples of buying the dollar on the trend – i.e. when the indicator began to gain momentum – and of one losing selling against the prevailing trend at the moment when the value of a basket exited the local overbought area:

There are quite a lot of those false signals, so we do not recommend trying to get ahead of the market, it is much safer to work in the same direction as the major buyers. In addition, the active window can show the signal arrows that are created for the ease of perception of the trend signal and carry no semantic meaning. Therefore, they can be discolored to avoid cluttering of the chart.

Algorithm of the strategy affects support of the positions as well, because you can no longer set a fixed take-profit and stop-loss. As recommended by the authors, the indicator levels of 70 and -70 should be taken as a virtual stop-loss (to buy and sell, respectively), and the stop-loss at the opening of the long positions on the trend may be the level of -10 (10 for short).

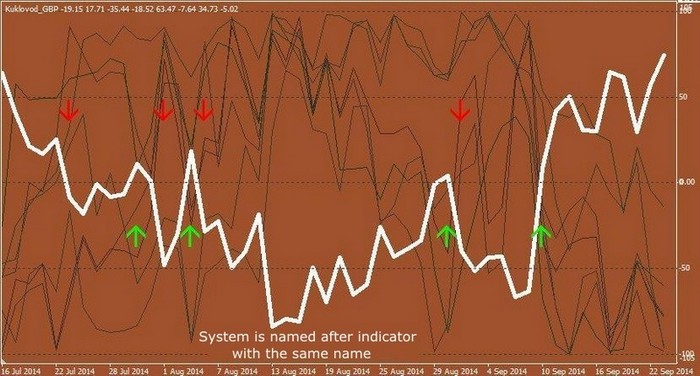

All of the abovementioned conditions of opening orders and supporting deals are identical for the baskets of the Japanese yen and the British pound – of course, with the exception of set of trading instruments, which include the following pairs:

- For yen trading, this set is needed: CAD/JPY, AUD/JPY, EUR/JPY, CHF/JPY, NZD/JPY, GBP/JPY, USD/JPY;

- For pound trading, as well as for dollar, you will need two blocks, the first of which consists of one pair (EUR/GBP), and the second includes GBP/CAD, GBP/AUD, GBP/JPY, GBP/CHF, GBP/USD, GBP/NZD.

Disadvantages of the Puppet Master strategy

Shortly summarizing the above said, we can note that the main principle on which the entire algorithm is built is not unique and is a special case of the analysis of overbought and oversold areas. Consequently, this system will exhibit all the shortcomings of any oscillator. They are:

- “sticking” of the indicator values at the extreme boundaries, making it of little use for trading against the trend. Of course, it's not a catastrophe, perhaps even opposite – a positive thing, as the speculators mostly do not know how to catch reversals, but for “griders” this disadvantage can cause difficulties;

- despite the fact that the Puppet Master strategy works best on the daily charts and higher (and respectively requires less time than intraday strategies), the position control can bring a lot of trouble, especially if you trade with all three sets at the same time;

- the aggregate amount of the swap paid increases many times, so it is best to trade on the swap-free accounts, for which many DC also list special conditions in their offer.