Recently – over three years ago – a new trading system dubbed "Revenge" emerged online. Lots of online traders immediately started using it. Its name speaks for itself, at the first place. Of course, many experienced traders would show little interest, because the market doesn’t allow anything beyond incredible. However, interest prevails, and we believe that it is worth taking a look. Anyway, no trader will suffer from simply reading about it.

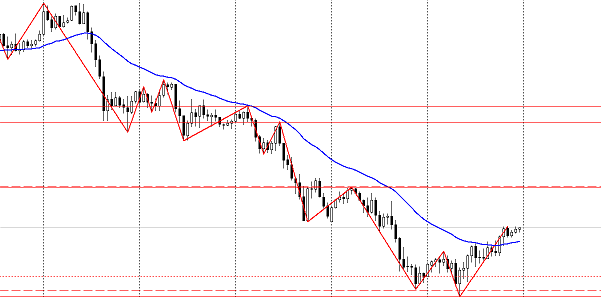

So, what kind of strategy is Revenge? If we start from the beginning, the first advantage is worth noting right away: the analysis starts at time interval which is quite long. It is a daily interval. The indicators include ZigZag with settings of 5,5,3 and MA with parameter of 33. By putting these indicators on the daily chart, we define the extremes of yesterday. That is, the maxima and minima of yesterday's candle are determined. Besides, we mark the opening price of the current period, and have a following picture in result.

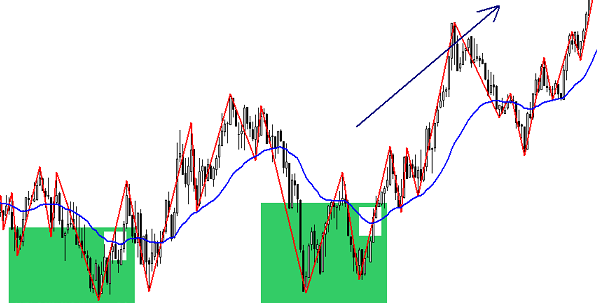

Then, the system implies a switch to 1-hour time interval. Here the vertices of ZigZag should be marked as important levels playing a role in defining the goals. Then it becomes even more interesting: we switch to 15-minutes chart and determine the intersection of MA and price. And we open orders in the proper direction defined by M15 on a minute chart. Then the orders are opened and closed based on MA. Now we can make a conclusion: of course, the Revenge strategy has a right to exist, but only for one simple reason: if trading is carried out on minute chart, it makes no sense to go further or above the M15 chart. This is the only and the most important reason.

The fact that the author of the system takes a day as its basis shows that the main trend within the daily movement is analyzed. But! If, based on M15 chart, trading in both directions is planned, the "day" becomes no longer important. And if the daily direction had excluded opening orders in a particular direction, the situation would have been different.

So, how many minutes are there in one day, or in one day candle? The answer is 1440. And how many candles do you need to determine the largest pattern, which is known to traders? Probably, it won’t even take a hundred. The conclusion is the following: if a daily interval is taken as the basic direction, then you should tie the process of trading to it, assuming following after the daily trend, at no less than 1-hour time interval. Why? The answer again is simple. Because H1 and H4 will not show you the real signal in the opposite direction at the confident movement of daily direction. Thus, the probability of false discovery basically halves. And vice versa: when trading in the M15 chart or below, the number of patterns can be great during the day even in the opposite direction to daily movement, which denies the use of daily interval. Revenge strategy is just an improvisation with the addition.

Of course, levels in the daily chart will play an important role, no one can deny that. But! The very trading process on the M1 chart occurs using ZigZag and MA, rather than using the daily levels.

In order to trade on the M1, it’s enough to determine the trend movement on M15 chart and that’s it. This will be enough to determine the order opening. Thus, browsing online how Revenge strategy works, you should identify the basic laws at first: not the price chart movement rules, but rather the laws of simple logical analysis, ignoring which can lead you to the "jungle" of reflections and conclusions.

Of course, if we discard all unnecessary and "inflated" features of Revenge strategy, we’ll have a clearer picture. M15 chart defines temporary movement, while M1 chart is the trading scene. Or a day can be a basic definition, with H1 being a trading scene. Otherwise, you can easily fall into a trap of a large time gap. Source: Dewinforex

Social button for Joomla