None of the experienced traders would dispute the fact that the key to success in Forex trading is to create a reliable trading strategy capable to determine the optimal moments for the transaction with high precision and without subsequent repainting.

Unfortunately, the professionals rarely share knowledge, and new traders are forced to obtain information mainly from forums that sometimes contain such misinformation that one can only wonder. Therefore, first of all, we shall understand what the Forex strategies without repainting are.

In general, repainting is peculiar not to the systems, but rather to indicators in their base, and describes situations in which the indicator value calculated in the recent past has been recalculated after some time. As a result, the trader receives false signals and suffers losses.

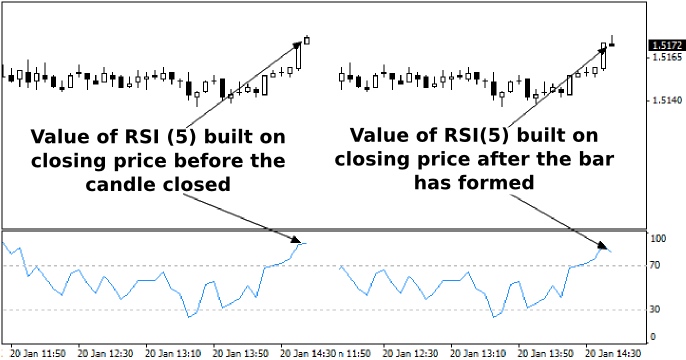

Very often you can hear that all the indicators, even the standard ones, repaint their values. In fact, this is misleading, since repainting is only formula recalculation after the close of the last candle, and if the result of the calculation at the current time is changed regularly until the close of the bar, it is a normal phenomenon associated with the use of the algorithm of the closing prices. As an example, the following situation can be observed on RSI:

In this case, to avoid premature signals it was enough to wait for the closing of the candle or set Open value in the field "apply to" in the drop-down list in the expert settings, and then only the first price at which the bar opened will be used for calculation.

How to recognize Forex strategies without repainting

It is very easy, and your chief assistant at filtering the unsuitable methods is “by contradiction method”. It means the following: instead of long-term testing of strategies in real time, each of them is quickly backtested, and if there is at least one of the following signs, the system clearly changes the layout after a few minutes after the signal.

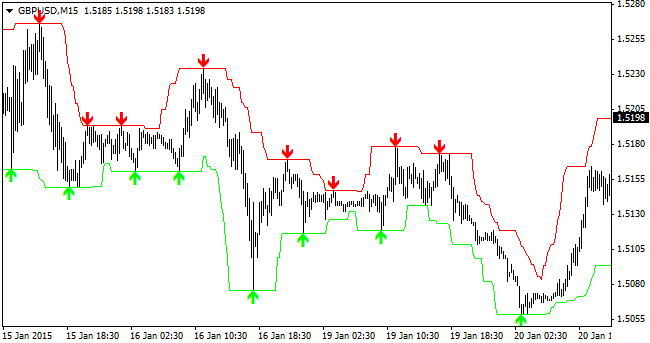

The first sign is that the signals are processed perfectly, i.e. no losing trades occur. This is due to the fact that the algorithm simply removes false signals and leaves only profitable ones. As an example, look at the Super Signals Channel indicator:

The second sign is that signal arrows (or similar symbols) are marked right at the intersection of moving averages (or other indicators) without delay. As noted above, Forex strategies without repainting often base on indicators built on the closing prices, so the signal can appear only after one bar.

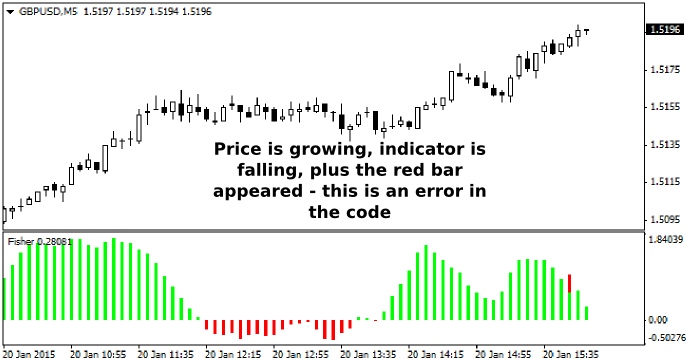

And the last sign is that the oscillators at the current time are displayed incorrectly or their value is always close to zero. In most cases it is not even a bug in the code, but rather a purposeful distortion of the formula to fit the signal on the history in such a way that they satisfy the signs No.1 and No.2. A brilliant representative of such algorithms is the Fisher indicator in its first versions:

Studying Forex strategies without repainting. Example No.1: trading on deviations

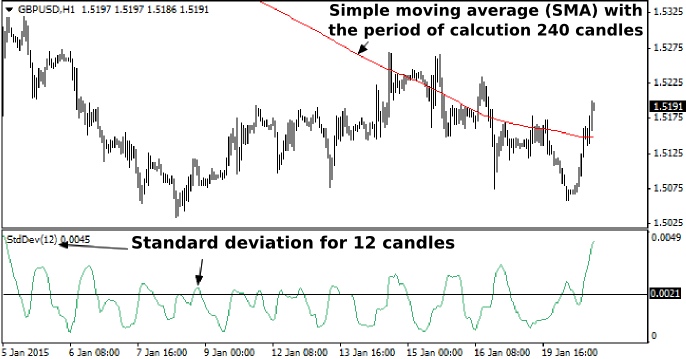

No special and unique name for the following technique has been invented, and this is not actually required, since it is based on only one moving average and standard deviation. The author recommended to trade on the GBP/USD pair, as it has high volatility, and the best working timeframe is 1H. The following figure shows the operation window and the parameters of the indicators:

Like all other Forex strategies without repainting, the algorithm cannot be called elementary despite its simplicity, as you will have to track signals on your own, and no arrows can longer prompt the optimal direction. Trading rules are reduced to the following instructions:

- To open an order to buy, the SMA should be directed upwards, and the value of the standard deviation has reached the level of 0,002 at decreasing price;

- To open an order to sell, wait for the SMA to reverse downwards and Standard Deviation reaches 0,002 on the increasing price, for example:

Profits can be taken in two ways: the first is on the formation of the reserve figure on the standard deviation (new touch of the signal level but at the market movement toward the open position), and the second is to optimize the ratio of stop/profit. Speaking of stop-loss, the protection order is easier (and effective) to place behind the latest extreme, and you can deploy a smaller timeframe for more precise marking.

Example No.2: Simple system on non-standard indicator SnakeForce_b

The abovementioned indicator is the rare case when one algorithm can be a full trading system without additional tools. The user only has to specify a period of calculation, and all other parameters and formulas are already configured by the programmers and do not require adjustment, although if desired it can be upgraded, as the expert code is available online. It looks as follows:

Wide green indicator bars indicate a bullish trend and a buy signal, and wide red, on the contrary, become signal to sell. Thin bars can never be taken into account, because if they are used as a flat filter and make transactions only after the appearance of "pure" bullish or bearish pattern, there is a high probability to buy at the top and sell at the bottom.

Forex strategies without repainting on SnakeForce_b indicators are suitable for many commercial instruments, with the only exception being the contracts, which often see strong gaps. As a rule, they are CFD on stocks and some commodities, and in this case the estimation of the trend will be greatly delayed from the real trend, and when the market passes the desired number of bars for the correct calculation of the SnakeForce_b, the trading sites will shut down.

Let’s summarize what you need to consider when choosing Forex strategies without repainting

The main conclusion of today's discussion, which should be remembered, is the fact that not all indicators repaint their values – moreover, the bulk of them work correctly. Traders create their own problems without waiting for the closing of the candles and trying to catch the movement even before it began.

In addition, Forex strategies without repainting are not always complex and time-consuming. Of course, there are more complex techniques – for example, Price Action, VSA, etc., but their profit potential is much higher than that of the indicator analysis.

And the last thing I would like to remind is that unfinished system with accidental or intentional errors are easily recognized on historical data – in particular, if the signals are perfect and come without the slightest delay, the system is likely not suitable for one simple reason – the formula is not able to predict the future but can only process the present. Source: Dewinforex

Social button for Joomla