In recent years, the popularity of Forex market among traders is rapidly growing, but unfortunately, not everyone manages to allocate enough time to learn complicated techniques, so the simplest Forex trading strategies remain an excellent alternative.

As a rule, all simple systems are characterized by common features: firstly, they are designed for timeframes from H1 and higher; secondly, they use a minimum of patterns or indicators; thirdly, they disregard methods of mathematics and statistics; and their last feature is that regardless of the signal quality, they are based on a conservative money management.

Thus, if you create a "passport" of the algorithms taking these features into account, you will find that the simplest Forex strategies are designed for a quick search for signals on the chart (a cursory examination of the situation) and further long-term retention of the open position with minimal risk.

And before we proceed to a description of some typical techniques, we would like to note that the Price Action method, which some traders call "simple", cannot be attributed to those for one reason – it requires knowledge of a large number of patterns. All other strategies do not cause ambiguity in the classification process.

The simplest Forex strategies on moving averages

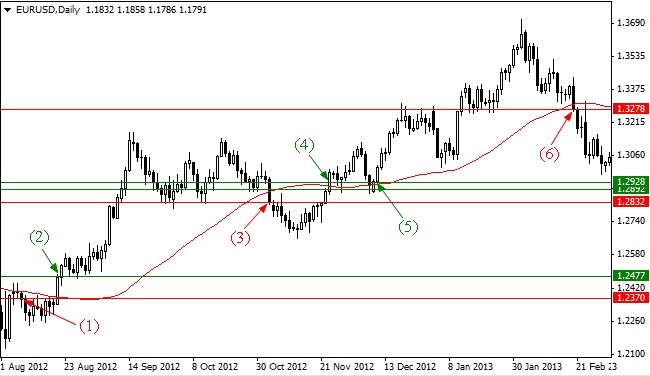

The most basic strategy is, of course, trading on the breakthrough and a rebound from the moving average. Some people believe that it is impossible to make money in such a way, but this is misleading, since all losses are the result of greed and unwillingness to limit losses. The following figure shows the daily chart of EUR/USD and a simple moving average with a period of 50 (the SMA (50)):

Even a novice speculator will notice that the price always tends to its average, it cannot be the other way, since SMA is a dynamic value. As Alexander Elder said, the average for the period is the balance level between the interests of buyers and sellers.

In fact, all the simplest Forex strategies in one form or another are based on the search for the moving strength. Accordingly, if the price is below the “moving”, the sellers rule the market, if above – the buyers have gained strength. The moment of crossing the SMA by the price is the point of changing the balance on the market.

The rebound of the current price from the average for the period is treated similarly, but in this situation some speculators fix the positions and wait for more favorable terms for "re-entry", while the balance itself is not changed. In this example, the points mark the following situations:

(1) – sell on rebound;

(2), (4) – buys on breakthrough;

(3), (6) – sells on breakthrough;

(5) – buy on rebound.

As mentioned at the very beginning of the publication, the conservative money management will help sustain a series of losing trades, and the professionals recommend to place the stop-loss behind the last extreme, if the value of the stop in points is too high, it may be placed for the weekly extreme, for example:

After the low of one of the following days has closed above the opening of the transaction, the stop loss is moved to breakeven and is further trailed along the price movement. In addition, this strategy can be partially automated by creating a special expert advisor to open the deals at the crossing of the SMA by the price. The standard criteria will be a confirmation of the breakthrough: Open and Close prices of the candle should close above (below) the moving.

Indicatorless simplest Forex strategies

Just like methods on the moving averages, almost all indicatorless methods are built on search for the predominant direction of movement, because regardless of the skeptics’ arguments, the trend still remains the only friend of the trader.

It is therefore not surprising that one of the most reliable and simplest tactics is trading in the equidistant channel. This tool is easy to build on the chart and "read", it allows you to accompany a deal with minimal risk, and is also available at any terminal immediately after installing the basic package.

The simplest Forex strategies suggest selling (buying) from the top (or bottom) of the downward (upward) channel. Initial stop-loss here is set behind the "signal border" with the offset of a few points.

We would like to discuss this nuance in more detail, because the offset raises some questions. On the one hand, it can be used for calculating the fixed value, which should be calculated in advance for each pair, and on the other hand, it is much easier to divide the "diagonal" of the channel by a fixed ratio – for example, 5.

Take-profit is set at the opposite border – by the way, this is the main advantage of this strategy: at the minimal time spent on analysis and markup, you can obtain not only the entry points, but also guidelines for the near future.

Unfortunately, this case is also not without the drawbacks, because if you take a look at the channel, it becomes apparent that it consists of two oblique parallel lines, which the price may or may not reach, reversing in the middle of the range.

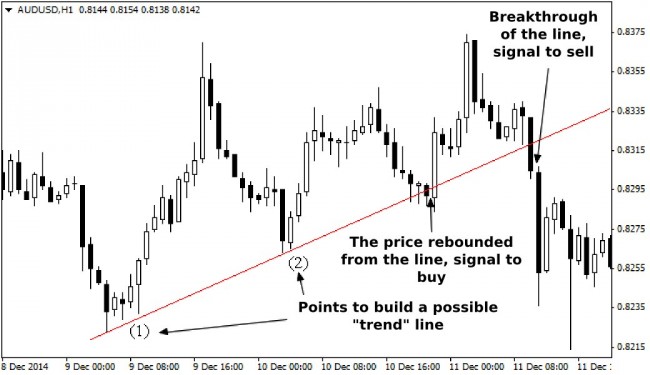

Therefore, many traders prefer to trade on tangents (trend lines), which are built by at least two consecutive extreme points. Thus, the simplest Forex strategies based on the "trend" lines become more flexible and versatile in comparison with the channel techniques.

It is not hard to guess that the transactions in this case will be opened similarly to the strategy based on the moving average, i.e. either on the rebound from the "trend" line, or on its breakthrough (stop-loss and take-profit are also placed in a similar way). By the way, the price much more often breaks through the inclined levels than rebounds from them – this is due to the fact that before all market participants manage to find an obvious trend line formed, major strong players have already gained positions in the opposite direction. As you know, the "crowd" always loses.

Conclusions and recommendations

In conclusion, we’ll sum up the results of this review according to tradition and perhaps begin with the advantages of the simplest Forex strategies. First and foremost their advantage is universality, because the average prices, channels and trend lines can be calculated and built on the chart of any trading instrument – moreover, these methods have been moved to Forex from the stock and commodity markets, which is the experience of thousands of professional traders.

Secondly, no special knowledge is required to develop simple strategies, all you need is to remember a few simple rules. And thirdly, low risks and trading on large timeframes would not let you lose the capital overnight – if something goes wrong, you will always be able to freeze trading and carry out the analysis.

The other side of the elementary strategies is a small number of signals and their relatively low quality (compared with more complex algorithms, which may be a long list). In part, this is why many traders no longer use them when they gain some experience. Source: Dewinforex

Social button for Joomla