Using the outcome of the battle of Waterloo is considered the largest financial speculation and an example of a successful trading using the strategy on the news. Speculative trading in periods of bursts of information is very beneficial and is available for any trader, regardless of the tools, experience, and the amount of the deposit.

Thanks to the personal courier service (high-speed channels), Nathan Rothschild was considered the most informed person on the London Stock Exchange in the early XIX century, and its trading behavior had a huge impact on other players. The “disinformation” he floated about the victory of Napoleon (trading on rumors) caused panic and depreciation of British, Austrian and German securities. Rothschild himself, as well as his brother Jacob in Paris, also ostentatiously sold his stocks of concern (to his own agents – the first brokers). When the real information arrived (actual news), the competitors went bankrupt, securities rate went up (price rolled back) and strategy on the news brought more than 40 million pounds to young traders.

Basic idea of the strategy

The implementation is based on the impact of news on the supply/demand balance and depends on macroeconomic indicators. Information is always characterized by three values – for the previous period, the forecast and actual. The strength of the price reaction to the news depends on the difference between the actual and forecast values and the trend towards the past. The greater the deviation, the stronger the surge and the higher the possibility of earnings. The most traded pairs are EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD, USD/CHF and S&P.

Important: processing speed is crucial for news trading – you need time to get information and have time to properly react to it.

Before the start of the trading week, we analyze the economic calendar and determine the points of possible trading. Information background is large, but different by strength of the impact of the news or event on a specific (or associated) instrument – the importance is usually indicated by 2-3 markers next to the announcement. The correct setting for the current time zone is necessary, because information sources usually specify GMT time. At the time of the news release, reaction can be both anticipatory and retarded, so if you are going to trade on it, you must first try it on a demo account and perform technical analysis of the current situation. After that, you can start selecting a suitable trading strategy.

Tactics 1. Bundle of pending orders or StraddleTrade.

Objective: to catch the movement regardless of the direction.

Some time before the news release, a pair of pending orders BuyStop+SellStop is places at a certain distance from the current price. Placement of StopLoss+TakeProfit at the time of placing the order is required. Subsequent adjustments (moving along with the price) until the price surge is possible. At the reaction to the news, one of the orders is triggered in plus, and the opposite is removed.

Strategy on the news requires distance to price in accordance with the volatility of the instrument and the history of reactions to specific news – from 10 to 40 points in both directions. If you place it too close, there can be a “false” trigger and double stop, if too far – there may be not enough movement. Stops and profits are on a normal level. Trailing with the average increment is set for both orders. Period is 5 minutes or more.

Release of data and work of the orders is controlled visually. You can use expert advisors with manual control to place and track orders.

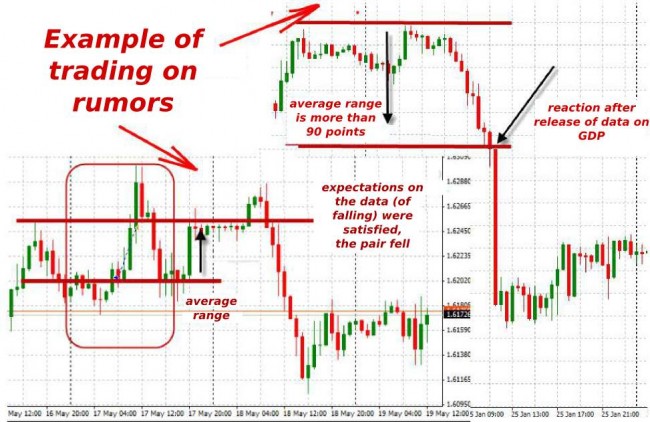

Tactics 2. Trading on market rumors

Objective: to predict the direction and strength of the reaction to the news in result of the analysis, place pending orders only towards the expected price movement.

If the calculation was correct, the order will trigger and close by profit. If not, you just don’t make a profit. The distance to the current price is not less than average daily volatility.

Important: immediately after the news release, a false price surge in the opposite direction most often occurs. Your order may trigger, but then reverse and go into minus without reaching a profit, so the stops are required.

Tactics 3. Hedging positions before news release

Objective: to catch the best possible reaction to the news by opening the two opposite orders on the market, one of which goes into profit, and the second is closed fast with a loss.

This strategy on the news opens orders as close to the current price as possible. Profits for the orders are not placed, only the stops, but the bravest ones may refuse to use those either, which saves the first minutes of swing, while the market is still uncertain. You can enable trailing after the unprofitable order has closed. You immediately lose a double spread, but the profit from the positive transaction should compensate it.

Important: during the news release, the broker will not allow you to quickly close the position manually, so work without stops just drives you to "locking" and the entire transaction becomes meaningless. To prevent this situation, you may use automated expert advisors instead of stop-loss.

Tactics 4. “Post-release” deals or deals on the price rebound

Objective: to wait out the first reaction and then open along with the market in the direction of a trend or rollback.

This strategy on the news implements the second part of the principle of buying on rumors (before the news) and selling by the fact (after release). Prior to the news, the orders are not opened, and you do not enter immediately after the news. You need to let the market survive the first surge, and the harder it was, the greater the subsequent pullback. We wait and enter the market with the usual parameters first in the direction of rollback, and then along the main trend together with those who “were late” for the first reaction.

Important: not all news indicators are able to "surprise" the market. You need the current analysis of the obtained reaction to calculate further action.

Tactics 5. Special software or "autoclickers"

This software for strategies on the news allows to work out the news reaction without trader's participation after presetting. You set the time, the currency pair and the key parameters, and the actual news data goes directly to the program, where the built-in algorithm performs analysis and sends a request to buy or sell to the terminal.

The systems cannot tolerate violation of the terms of the news release and do not track the possible rollback. Work is conducted only on digital data, so the program is not responding to such news as bank statements of banks or speeches of influential persons.

Important: there are special requirements to the broker (ESN or STP) and communication systems to open orders at the first affordable price.

Typically, it is a paid service (from $200 per month), but with a good broker and fine tuning, it quickly pays for its use.

And as a conclusion...

Strategy on the news makes serious demands to the broker, and main of them are the lack of...

- slippage (or stable minimum level);

- requotes at opening/closing during high volatility;

- bans for pending orders before the news release (in time and distance from the current price);

- expansion of the spread at the time of publication;

- intentional failure of stops and orders triggering;

- further abolishing of the gains from trading during news;

- restrictions on working with orders in the contract offer.

This affordable but very risky strategy also depends on the trader's psychophysical characteristics, quality of communication, proper risk assessment for each tactic – this is a topic for another article. By the way, Nathan and Jacob Rothschild never carried out such speculations after their first StraddleTrade deal, but rather invested only in long-term stock and industrial projects.

Today, the strategy on the news is a recognized technique, very profitable and backed by the best technologies of the market makers. All the arbitrage transactions work under it, because it is during the news release that the gaps appear in quotations between trading platforms due to the speed of processing orders, as so does information panic – a constant source of income for traders who have mastered the technique of news trading. Source: Dewinforex

Social button for Joomla