As you can see, traders are mostly creative people, so do not be surprised at the appearance of strategies with very unusual names, the classic example of which is the Surfing strategy. The main purpose of this technique on the idea of the authors is to find and try to catch the intraday price wave.

Anticipating the major question, we would like to briefly mention why this strategy has attracted our attention. The matter is that it is radically different from the rest of the wave theories, it is appropriate to even say that it has nothing to do with them, as it is based on the standard indicators included in the package of any terminal.

In our opinion, this feature is an advantage, since it eliminates the ambiguity in the interpretation of the pulse, as it happens, for example, in the study of Elliott waves – furthermore, the system provides unambiguous rules to set stop-loss, which is an important consideration when trading in the Forex market.

Surfing strategy and a set of required indicators

So, for the correct work of the basic version of the strategy, you won’t have to download anything from the web, you only need to properly configure two blocks of standard indicators – in particular, the first group is a few moving averages that must be installed in the main chart window:

-

Red EMA with a period of 20, based on Low prices (EMA (20, L));

-

Green EMA with a period of 20, based on High prices (EMA (20, H));

-

Dashed red EMA with a period of 10, based on Low (EMA (10, L));

-

Dashed green EMA with a period of 10, based on High (EMA (10, H));

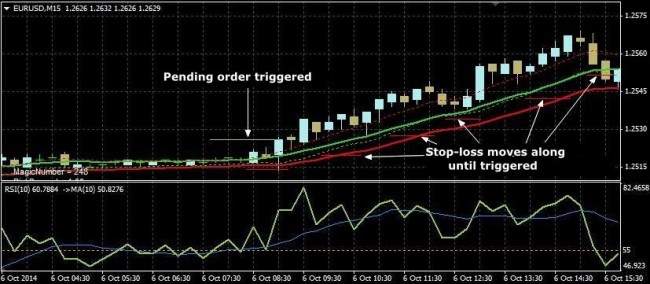

The second block is the RSI in combination with the moving average, for the settings of which you need to firstly add the usual basement window with the strength index, and then choose a simple moving with a period of 10 (hereinafter the SMA (10, RSI)) and using the "apply to" command, select Previous Indicator's Data from the list. As a result, the program will display a moving built not on the values of the price, but on the RSI readings. The figure below shows the operating window used by the Surfing strategy:

As you can see, the RSI also uses two horizontal levels – 45 and 55, which are nothing more than an element of a signal to buy. As for organizational issues, no restrictions on the use of the algorithm were mentioned by the authors, the only thing that should be noted is the fact that the strategy works best on a 15-minute timeframe.

Surfing strategy in practice

As mentioned above, the purpose of the application of this strategy is to search for intraday wave, whose origin is easily recognized by the strong price impulse. Therefore, the entire algorithm is summarized in two simple steps: identification of breakthrough and transaction support. Why simple? Because it is enough to perform the following set of rules without hesitation (on the example of buying) to open an order:

-

candle closed above EMA(20,H). Pay attention that this rule is subject to the usual methods of breakdowns identification, i.e. Close price is to be located above the moving average, and a false puncture, on the contrary, does not count;

-

RSI crossed the horizontal level with a value of 55 upwards. This rule can be easily remembered, but from a logical point of view, this behavior of the indicator literally means that the market exited the consolidation area, as the bulls have gained strength;

-

RSI is above SMA(10,RSI), confirming the validity of short-term impulse.

-

After the formation of these patterns, you should mark the pending order as follows: take 5-15 points from the high of the impulse candle (value depends on the volatility of the pair – for example, 6-7 points will be enough for the euro) and set the buy-stop order. Stop-loss must be placed 10-20 points below the EMA(20,L).

Original Surfing strategy does not provide fixed take-profit: instead, the author has listed several options for manual tracking and closing positions. Firstly, after the order triggered and the price started moving in the desired direction, it is reasonable to start a position trailing. The previously untapped EMA(10,H) will be useful for this purpose:

Secondly, the profit can be fixed at a time when short-term impulse ended, as evidenced by the intersection of the RSI line by SMA(10,RSI) downwards. The alternative course of action is to close the order at the feedback signal, and then “roll over”. Thus, in the first case, we obtain the usual scalping model, while in the second there is a classic medium-term strategy, which in combination makes Surfing a universal method.

Rules to sell are diametrically opposed, so it is not appropriate to list them all – we can only note that in the basement window the horizontal level equal to 45, not 55 should be taken into account, and not the green dashed line, but EMA(10,L) should be considered at trailing position.

Addition to the reviewed strategy

You can often find this system complete with the Trade Manager expert advisor in the vastness of the worldwide web, which makes it easier to work with orders. But as new MT4 builds already have integrated module for “one-click trading”, the need for this robot has disappeared. Therefore, it is not recommended to complicate your life by installing this expert, as it also requires to import libraries.

The second thing we would like to pay attention to is the possibility of using this algorithm on Renko charts. We should remind that in some terminals, this type of chart is built by default as an option of the price representation, but to work in MT4, you need to install a special advisor called RenkoLiveChart. As a result, after setting up a stand-alone graphics and loading of the template, we’ll get the following result:

At that, the rules for opening orders in terms of the breakthrough of the key moving average remain the same, despite the fixed value of the Renko bricks. This is due to the fact that this type of chart more accurately reflects the dynamics of prices, smoothing the “noise” in the process of building, which are the primary cause of most false breakthroughs and as a result – incorrect transactions.

Also, thanks to Renko charts, the Surfing strategy becomes much easier in terms of trailing positions, because indicators considering the readings of the ordinary candles are largely delayed and subject to the time factor, i.e. primarily focus on the timeline, and not on the actual points. The use of the “bricks”, in contrast, allows to solve this problem, as each new bar has the same weight.

In conclusion, we’ll note an important observation: this technique is able to generate a steady income only in strict compliance with these rules, which for many novice speculators is physically impossible, so it's best to write the robot for it. Source: Dewinforex

Social button for Joomla