A very important and necessary step in the online trading is to test Forex strategies. Any trader understands that without preparation, without a proven trading strategy it is meaningless to start trading, it is the same as if you move trough a minefield without a sapper. But here, I want mention some differences. Do not confuse the testing of indicators and testing of strategies. And because it's important we will not consider trading system based on a single indicator. So, let’s put it in order. To test strategy primarily means to test all of its components. This is the main indicator, oscillator and if provided the support and resistance line at the same time. In order to test the trading strategy, you should to do it manually, visually following the history or trading on a demo account. Another option is to test the main indicator, which lies in the basement of the entire trading strategy, with the help of the program advisor. In this case, you can begin to test all trading strategies when the options you want to have are chosen and the results you need have gotten. Let us describe the way of testing Forex strategies in details.

A very important and necessary step in the online trading is to test Forex strategies. Any trader understands that without preparation, without a proven trading strategy it is meaningless to start trading, it is the same as if you move trough a minefield without a sapper. But here, I want mention some differences. Do not confuse the testing of indicators and testing of strategies. And because it's important we will not consider trading system based on a single indicator. So, let’s put it in order. To test strategy primarily means to test all of its components. This is the main indicator, oscillator and if provided the support and resistance line at the same time. In order to test the trading strategy, you should to do it manually, visually following the history or trading on a demo account. Another option is to test the main indicator, which lies in the basement of the entire trading strategy, with the help of the program advisor. In this case, you can begin to test all trading strategies when the options you want to have are chosen and the results you need have gotten. Let us describe the way of testing Forex strategies in details.

Suppose that our trading strategy includes two indicators. These are MACD and ADX indicators. And we need to test our trading strategy for successful online trading. And as the strategy bases on the MACD indicator we have the opportunity to test it with the help of advisor in MT4.

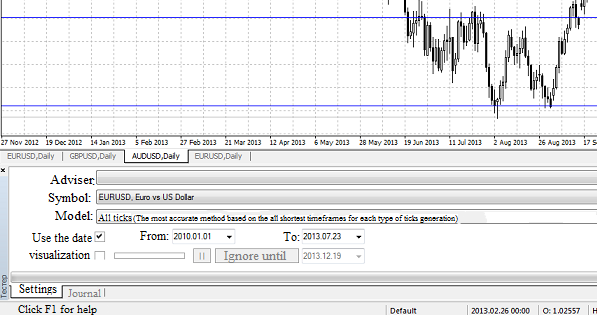

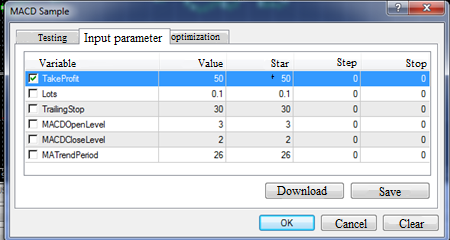

When we click the "Strategy Tester", the panel will occur before us. Then we chose the "Advisor” and select MACD indicator. In the "Symbol" we choose a pair, for example, EUR/USD. In the function "Model" we chose "Every tick". Then we define a date range and open "Expert properties". In the opened window we set data, under which we will conduct our trading. Then we set a temporary period, and leave the current spread. Then click "Start”. We can insure you that there is nothing complicated here, and you can understand it by yourself soon. Testing Forex strategies is very often carried out with the help of advisors.

If you need to control the process visually, you can put use feature called "visualization".

Thus, by varying the parameters of the main indicator you find the essential the most optimal MACD settings.

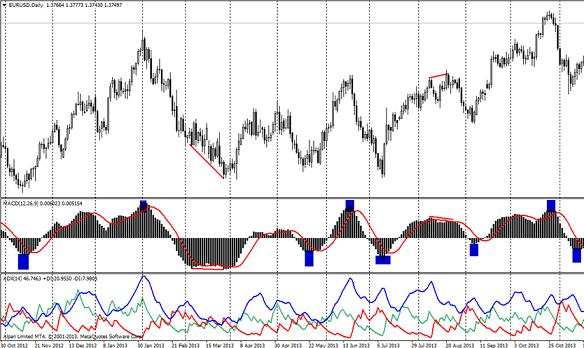

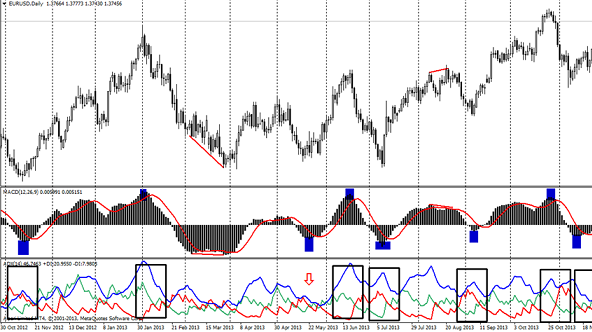

You can then move to the second phase of testing. This includes manual data matching principle and fitting the second ADX indicator, under the MACD. Thus, we improve and adopt to the trade the signals which are given by MACD.

We have chosen the most probable and actual signals of the main indicator for the picture. Now you need to consider precisely the behavior of the ADX indicator. Or rather its behavior when there are MACD signals.

If you look closely, you can reveal a great trend. MACD gives signals and ADX shows these signals strengthen.

Thus, when + DI meets -DI, it confirms the MACD signal. A blue ADX indicator line shows is the movement is strong or not. The higher the line is, the stronger the trend is. And if the main ADX line starts to fall along with the + DI, then the signal of the main indicator on the market fall may occur. If the blue line falls along with the -DI, the recovery is possible. Thus, the ADX indicator controls the movement between the MACD signals. As the image of 8 signals (divergence is not counted) shows 7 of them work clearly. If you need to test strategy more precisely with all the important criteria stop-losses as well as lot size are worked out.

So the Forex trading strategies testing can not be fitted by that universal method. Of course, you can test strategies manually only, but if you use the strategy tester the manual method is not required. The main thing is to understand that the best option is to test both trading strategies and Forex indicators in complex. This is the only way to achieve good results. Source: Dewinforex

Social button for Joomla