Selection of the time period is crucial for the trading strategy. The effectiveness of the trading process depends on how the timeframe is consistent with the style of trading and the most important the trader’s character. The traditional classification of time frames is as follows. Long-term time frames are the strongest, followed by medium-term and then short-term timeframes. Trading in each of these periods has its pros and cons.

Selection of the time period is crucial for the trading strategy. The effectiveness of the trading process depends on how the timeframe is consistent with the style of trading and the most important the trader’s character. The traditional classification of time frames is as follows. Long-term time frames are the strongest, followed by medium-term and then short-term timeframes. Trading in each of these periods has its pros and cons.

The long-term strategies include a rare number of transactions and long-term position. Medium-term methods are more speculative and are based on a number of factors which are mainly of technical character. Short-term speculation implies very frequent transactions. Minute strategies are trading strategy, which has short working time intervals that is minutes.

The interval can last for 1min, 2min, 5min, etc. The idea is that in this case the trader investigates quite short time periods, finds opportunities for profit and enters the market. To work in this mode the trader should always stay in front of the monitor and follow the situation. There is an exception for this rule as you can use a short-term trading advisor. But due to the fact that the minute strategies are highly risky methods of earning, one should not trust entirely automatic trading system.

Usually work with minute charts requires substantial leverage. A high yield of such operations is achieved through the leverage. Thus, the trader must be much disciplined and fully aware of the risks he or she takes on.

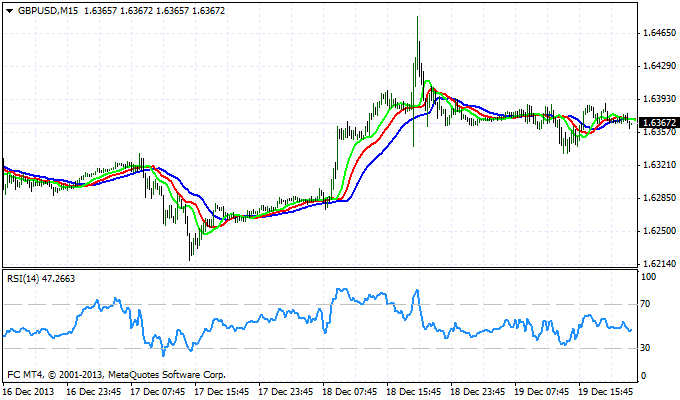

If we look at any minute chart of any currency pair, firstly removed timeframe symbols and the current price, then it would be difficult to guess the period. The picture below shows the 15-minute GBP/USD chart, where moving averages and RSI oscillator are marked. Despite of the seemingly narrow trading type, minute strategy are also ranked according to the method of work.

The types of minute strategies

According to the logic of the method, the following categories of minute strategies can be found:

1. Trading on the micro imbalances

Here you can use a minimum set of technical instruments. Often, they include the standard oscillators, which are adapted for work in such conditions. The trading principle is quite simple: you should indicate the local overbought or local oversold and to conduct the transaction in the direction of the current imbalance compensation.

2. Trading on the trend

It is just funny and enjoyable to trade on the trend. Trends on minute charts are shorter, but this fact does not prevent speculators minute to ride on any micro wave at 10-minute chart.

3. Contra trend trading

Trading against the trend is much more risky. But, nevertheless, there are speculators who prefer this method. Minute strategies are based on this principle, carry higher risks.

4. Temporary trading

Positions are held not to reach profit or loss value, but only for a certain time.

Minute strategies are best suited for traders with strong nerves. For successful work on minute strategies the trader should be able to stand the stress and be able to make decisions quickly, not to be egoistic and think flexible. Source: Dewinforex

Social button for Joomla