The Internet trading pays much attention to an instrument called XAU/USD, in other words, gold. At the first sight the gold trading does not differ from any currency pair trading. But it is not right. This strategy has a number of distinctive factors which should be considered, as they play a role in the gold trading strategy itself. Even if you look at the price chart for this precious metal, you will notice that it there are much less volatile fluctuations on it. Gold is moving more directly and has less "noisy" movements in large time frames. Of course there is an explanation, but we will reach it further.

The Internet trading pays much attention to an instrument called XAU/USD, in other words, gold. At the first sight the gold trading does not differ from any currency pair trading. But it is not right. This strategy has a number of distinctive factors which should be considered, as they play a role in the gold trading strategy itself. Even if you look at the price chart for this precious metal, you will notice that it there are much less volatile fluctuations on it. Gold is moving more directly and has less "noisy" movements in large time frames. Of course there is an explanation, but we will reach it further.

In order to apply the gold trading strategy effectively, one should understand and know the factors that may affect on the strategy itself.

1. The most important thing here – is the fact that gold is tightly linked to the economic situation in states. If there is a destabilization of the markets, which develops into a crisis, or at least into a recession, investors immediately begin investing in gold. Consequently, precious metal usually increases in price during the crisis.

2. It should be noted here that the presence of a relatively large spread and typical long-term of this instrument requires a considerable deposit, and this requirement makes it impossible for many traders to work with this instrument.

3. This spot-quotation is typically used with the aim of currency pairs such as EUR/USD and USD/JPY. These instruments precisely reflect the moving trend of gold.

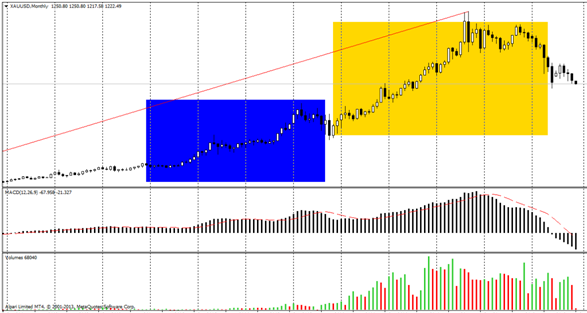

The square shows the gold prices movements during the beginning of the U.S. mortgage crisis and the crisis in 2008.

Thus, if we compare this financial instrument with any of the major currency pairs, the difference between them will be obvious. Mostly more "serious" traders work with gold and ordinary traders there are less common. Central banks of countries are largest participants of the gold market. Therefore, this factor must be taken into account as well when one constructs gold trading strategies.

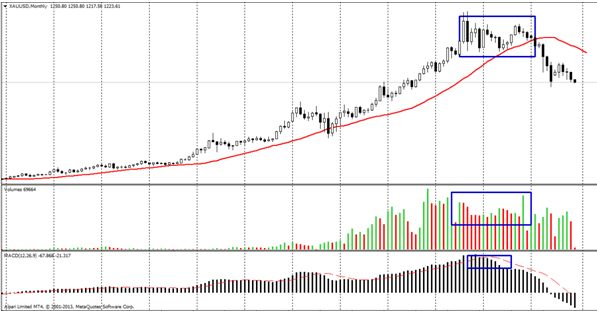

Below a simple trading system is presented for the following reasons: as only traders or investors, so to speak, of a larger "caliber", work with this pair, thus in comparison with other instruments, gold more truthfully reflects the ratio of the price movement towards volume. Everyone knows that the volume indicator shows the ticks not money. Consequently, the amount of not significant ticks will be considerably less, and it will give us a clearer reflection of the information about the gold market.

The picture clearly illustrates what the volume indicator shows. When it moves laterally the downward trend of the volume becomes clearer. Even the little amount of candles in a yellow square, and the index of the volume indicator shoes that it is better to prepared for a change of direction. Please note that the MACD in that case also sends a beginning of bearish movement signal. However, despite of this, one should wait for more obvious downward trend signs. And only when the price crosses the moving average downwards, one can search for the signals for opening sell orders at shorter intervals of time.

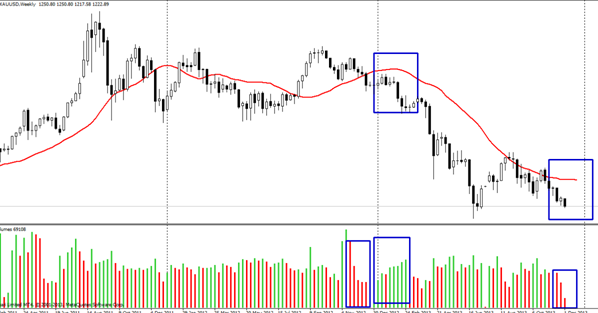

Having examined week or even day interval it is possible to seek moments to open orders in the direction of the downward movement. The volume index also shows grouping green or red lines and this fact indicates a possible change in the direction of price movement. But, despite of this, there is an opportunity to open sell orders when the price crosses the moving average. Basically, you can use pending order. Stops should be placed outside of the local levels of support/resistance.

Thus, the strategy of gold trading has no difference with any other strategy. All indicators and time intervals are the same. The only outstanding feature of this pair is that it requires more capital from the trader. High spread, high volatility and as a result, a greater amount of the deposit, make the trader work precisely with the gold trading strategy in a more rigid framework. And if a mistake on one of the currency pair’s transactions can lead to considerable losses, in the gold trading, the same error may become the last. Source: Dewinforex

Social button for Joomla