For minimal human factor influence on working data on financial markets, the mechanisms of objective reality identification are included in trading strategies. Most frequently forex market indicators are these mechanisms, that trace impartially market situation development and give structured information to the trader for trading decisions.

Despite the difficulty of previous wording, the essence of indicators is easy: to trace determined activities and to produce them in a processed form for a trader on specified algorithm. As in any area indicators may tell the trader and its trading system when to do what and warn about a critical situation.

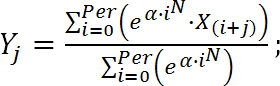

Forex indicators have statistical mathematical algorithm that transforms quotations into necessary activities for a decision making. Thus the most important factor in indicator usage is comprehension (or creation, if we are talking about a proper unique indicator) of this mathematical algorithm. The knowledge of algorithm of indicator computation is essential for understanding the finite data shown by the indicator. The correct interpretation of the data displayed by indicator is also very important. Since same results may be interpreted differently which is inadmissible for systematic profitable trading.

That is why the best forex indicators for traders are those indicators, the mechanisms of which they fully understand and can confidently interpret given indicator in any situation.

That is why one should begin his search of forex indicators materializing “money” button with learning the foundations of receiving the data by those indicators. Just like in mathematics in order to solve a logarithmic equation one must know multiplicative and division rules. Never try to find a super popular and surely profitable indicator, since you can’t guarantee that your dreams about regular high profits will come true.

the data by those indicators. Just like in mathematics in order to solve a logarithmic equation one must know multiplicative and division rules. Never try to find a super popular and surely profitable indicator, since you can’t guarantee that your dreams about regular high profits will come true.

This does not mean that you should not look for means of improving current indicators, create new or search for new ideas. Of course not, if you are using indicators in your strategy, you ought to revise the methodology of indicator usage from time to time. But the revision of methodology must proceed from profound analysis (preferably a long-term one) of data obtained by indicator and real market development. Only by constantly comparing real market and data obtained through indicators, one may make decisions on methodology of usage of different indicators.

In spite of difficulty of analysis of indicators functioning, a trader needs to rely on something in his reflections, and more importantly that something should not be questioned and must be absolutely objective. That is why the indicator may be used very widely.

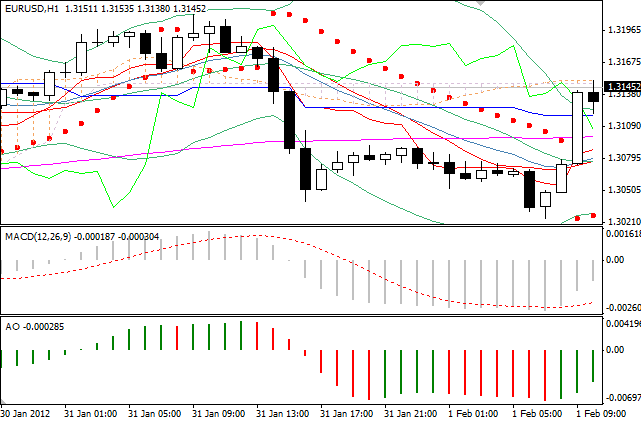

Nevertheless, considering the problems described above one must be very careful when using indicators with detailed study of work principles of every used indicator. That is why we recommend beginning the study from classical indicators that have been in use by traders for decades. These forex indicators do not need to be downloaded from anywhere or searched for- they are realized in trading terminals (for example in MetaTrader 4).

These indicators are time-proved, and it is possible to build profitable trading strategies on their basis by selecting necessary parameters.

All indicators are divided in two groups:

1) Trend indicators, showing continuation of trend.

2) Oscillators, determining the market speed and possible crucial points in current tendencies.

A good trading strategy, that employs indicators, usually includes at least 1 trend indicator and 1 oscillator. A course and market entry are determined by trend indicator. And the most profitable entry and exit points of market are determined by oscillator.

Some traders utilize different indicators of every kind in their work for filtration of false signals (which are inevitable for any indicator) of the basic indicator. Thus, a trader reduces the number of detrimental deals, increasing the effectiveness of the system. But one should not keep increasing the number of indicators employed simultaneously for trading, because different indicators can give different results of the market situation at the same time. And there will be a high risk of contradictions among results of indicators which may lead to loss of potentially profitable deals and entry to the market at a dubious period, when none of the indicators will display anything specific. In case one ignores the complexity of tracing many indicators and their interpretation for a trader, a large quantity of indicators is inappropriate because a trader does not have a goal of minimizing the risks. His aim is to maximize the profits with a rational risk, while a large quantity of indicators do not allow getting good mathematical expectation from the strategy.

If you are not satisfied with standard indicators, that are in terminal you can always find new indicators with free access and to start developing your own indicators.

One may see traders’ latest developments and download forex indicators even 2012 ones absolutely for free on the official website of the developers for MetaTrader 4 — mql4.com/ru/, where there are only safe forex indicators, that are uploaded by experienced and inexperienced traders.

One may see traders’ latest developments and download forex indicators even 2012 ones absolutely for free on the official website of the developers for MetaTrader 4 — mql4.com/ru/, where there are only safe forex indicators, that are uploaded by experienced and inexperienced traders.

However, as it was mentioned the usage of indicators starts with the study of algorithm. Source: Dewinforex

Social button for Joomla