Many novice traders want to trade every day in order to faster understand the market and to gain experience, but majority of them in the end still face the most common problem – lack of time for trading. Of course, you shouldn’t give up on trading because of busyness at the main job, not least because d1 Forex strategy allows you to benefit from speculation, while spending minimum of time.

Before proceeding to the description of a particular system, we should note that in some communities the following stereotype dominates: “Famous traders become successful because they worked exclusively on large timeframes, while intraday and scalping don’t bring any results». In fact, it is an absolute fallacy, and the converse statement will be better – “stars” of trading are working by position, because they are the professionals, they have equity, funds, real businesses – they simply have no time to scalp.

Therefore, d1 Forex strategy is not a panacea or a "sacred cow" – it is the common style like any other, which requires an understanding of the current situation on the market. On that note, let us discuss a non-indicator system for catching pulses.

How “Trend Reversal” d1 Forex Strategy works

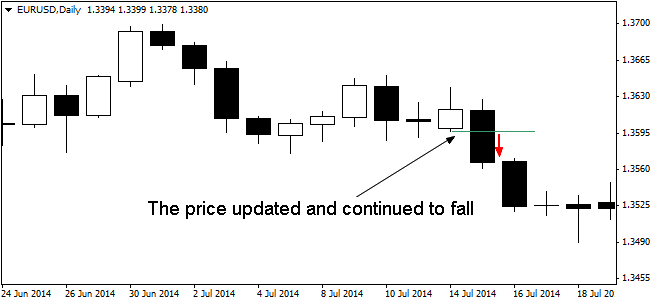

This method is based on a simple principle, which is as follows: an unambiguous conclusion about the change of bullish situation to the bearish or about the readiness of the market to start consolidation can be made only when the price has rapidly broken the minimum of the previous day. To better understand the meaning of what has been said, let us turn to the figure below:

The emphasis in the description was made on the mood of the market rather than the general trend, because in the example you can see the pulse in the direction of the previously formed bearish trend, after a brief correction. Therefore, you can’t say that this model is a classic counter-trend trade, despite its name invented by the author. D1 “Trend Reversal” Forex strategy suggests the following procedure for operations to sell:

-

“yesterday” candle should be bullish (price close>open);

-

range of variation in the last day, i.e. the distance between the High and Low, for the EUR/USD pair should be greater than or equal to 40 points;

-

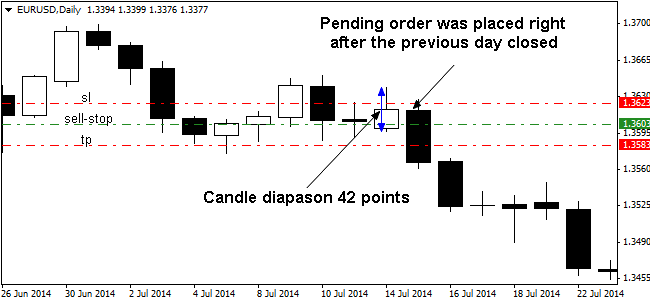

then a pending order of sell-stop type is placed at a level equal to the Low of the last day plus five points, stop and profit levels for which are set equal to 20 points;

-

if during the day the order wasn’t triggered, the entire marking is deleted. If the deal was open, but the price didn’t reach take-profit and stop-loss, the position is lied over to the next day. The figure below shows the markings on the old example:

To buy, the rules are inverse, so it is inadvisable to repeat – instead, we would bring your attention to the important points. First of all, the author recommends to put a pending order within the boundaries of the previous day, i.e. before reaching the extreme, which, in our opinion, reduces the stability of the system to random fluctuations. The optimal way is to arrange the orders behind the levels of the previous day, at the same time doubling or tripling the profit targets.

D1 Forex strategy, as you can see, has a number of advantages and disadvantages. The former ones are lower time costs and minimization of the negative consequences of technical failures and frauds of the dealing centers, which significantly affect the operation of scalpers.

There are no specific deficiencies in this approach, except for the considered nuance regarding levels of the order placing, but you mustn’t forget about the common cons that are characteristic of many long-term strategies built on the logic of range breakthrough.

First of all, it is a small profit (1-5%) per month from the initial deposit. Secondly, the signals are rare, some of which will be further closed by stops. And, thirdly, such an approach is not conducive to the speculator’s professional development, since without analysis of the situation within the day it is impossible to understand the logic of market participants’ behavior. Source: Dewinforex

Social button for Joomla