Among the many forex strategies those which are based on the moving average lines are probably the most common. Usually they are referred to as Moving Averages. This instrument is the easiest one for analyzing the current market situation, and therefore the most common one. Everyone knows about the simplicity of genius.... But let's focus on our specific issue and see, what is the moving averages Forex strategy.

Among the many forex strategies those which are based on the moving average lines are probably the most common. Usually they are referred to as Moving Averages. This instrument is the easiest one for analyzing the current market situation, and therefore the most common one. Everyone knows about the simplicity of genius.... But let's focus on our specific issue and see, what is the moving averages Forex strategy.

Assume that, as all economists say, all the requirements are met. That the interval of time is chosen, the pair is defined and lot sizes, stop-losses limit and even mental approach are there. The most interesting and the equally important here is the core of the trading strategy which is based on moving averages. We will try to describe two common online trading strategies which use moving averages .

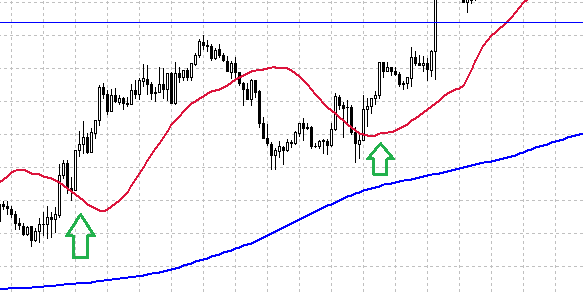

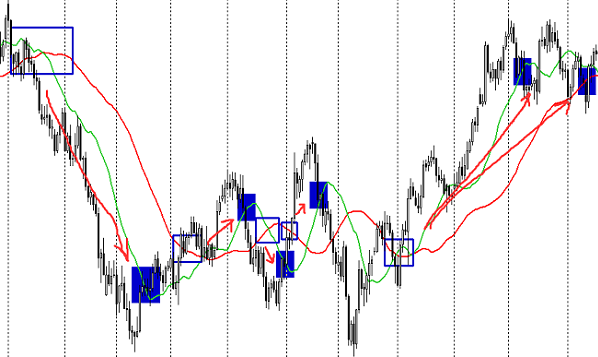

The first strategy. The Moving Averages Forex Strategy that has parameters as follows: MA 200 and MA 21 with the shift in MA200-21 and AI 21-8.

We chose one-hour interval to show you the noise movements on the chart.

As you can see the principle is simple. When the long-term MA200 is below the price - the trend is upward. In this case, when the price graph crosses the MA 21 upwards, it is a signal to buy. At the same time MA200 is below the MA 21 and the price graph. Stop-losses can be tightening up, in accordance with the price graph movement.

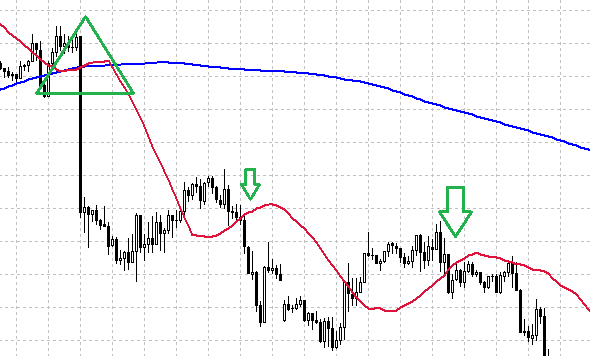

The following picture shows the same signals, but for the sale. Orders are opened when the price graph crosses MA21 downward. In this case MA200 should be above MA21 and the price graph.

A very strong and long-term signal, should be outlined, when the price, breaking MA21, breaks MA200 immediately and MA21 itself crosses MA200 also. This is a long-term signal in both the upward and downward movements. The following picture shows a triangle which is formed as a result.

The Moving Average Forex Strategy has a disadvantage as well.

This strategy is very difficult to apply if the lateral movements occur. Since the price graph is uncertain in the direction towards the trend. This is understandable, since the moving averages themselves are trend indicators indeed. In such cases one can wait only or use other instruments.

The second approach. Moving Averages Forex Strategy can be realized in a following way as well.

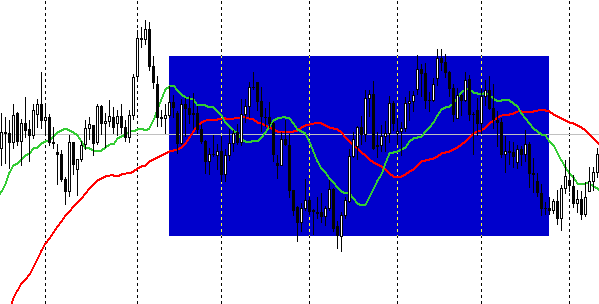

The image shows a slightly different moving averages using tactic. The parameters are changed here. There are MA 34 (a red line) with the shift 13 and MA 13 (a green line) with the shift 5. In this situation the order is opened when MA 13 crosses MA 34. It is opened for sale, if it crosses downwardly. And it is opened for purchase if the trend is upward. It should be reminded that this method is acceptable even for the sideways movements, but only if there is a movement with sufficiently large maxima and minima, i.e. high amplitude motion. But if, after, let’s say, a bear market there was a real turning point of the trend, you should think about a long position. And no matter, is it an order to sell or an order to buy. The most important here is to sustain MA 13 and MA 34 intersection.

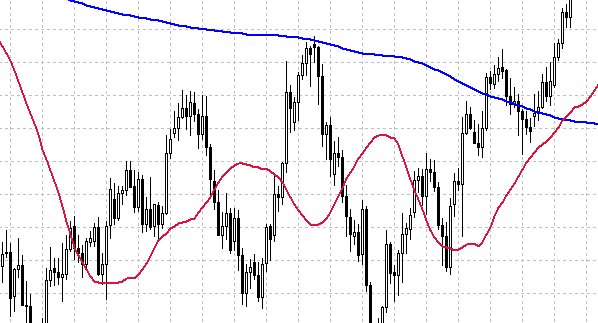

But this strategy also has a disadvantage. The lateral movement should not be too weak. Otherwise the moving averages will cross each other to much, and it will give too narrow difference in price, whereby the strategy will be ineffective.

The image shows the track of the price where the trading conducted under this strategy is difficult.

Thus, the Moving Averages Forex Strategy is, first of all is a trend strategy, as it is hardly possible to trade when the movements are lateral. The only solution here can be a temporary change of the interval. What is impossible to be done on a daily interval can be executed on the hourly one. Anyway the Moving Averages Forex Strategy is used by many traders regardless to the financial instrument which they analyze. Source: Dewinforex

Social button for Joomla