It is widely thought that there are very few profitable strategies for the currency market, they are incredibly difficult to find, and trading is actually just a game. In fact, working Forex strategies are literally on the surface, but all genius doesn’t attract the attention of the beginners, because it is too simple.

The reason for this paradox lies in the stereotype, which is firmly entrenched in the minds and makes us treat the market like something super complex; it is also promoted by popular training courses on the waves, candlestick patterns and the psychology of the market crowd. It would seem that all of the above is really present in the market, but the problem is that the novice Forex trader often lacks objective information to work on the above methods.

Therefore, it is recommended to start trading with technical (in particular indicator) analysis, supported by mathematics and statistics. Exact sciences were mentioned not in vain, because all the problems emerge as a direct result of neglecting the analysis of the aggregate sample signals.

Some theory about the working Forex strategies on the indicators

From time to time you can meet some aggressive characters on trading forums and communities, who flatly assert the impossibility to earn money with indicators. The beginners who read and listen to these opinions from the “old-timers” start to believe in such statements and tread on the path of regular losses, then start looking for the “grail”, pay these “professionals” money for education, and as a result most of them just give up trading.

But initially you would have to consider one fact – all the representatives of the old school of trading who actually reached the heights in trading and earned capital, such as Elder, Andrews, Donchian, Lambert etc, relied on technical analysis and indicators.

The matter is that all working Forex strategies generate signals unambiguous in interpretation, the systematic execution of which provides a positive expectation on the history. Can many modern techniques offer strict rules? No, even particularly popular volume strategies today involve a subjective interpretation of the situation, because different people will interpret the same level in their own way.

The only exception is an analysis of option levels, because the clusters of open interest are quite ambiguous and are interpreted according to strict rules. But let’s get back to the indicators. Typically, standard algorithms are fairly sufficient to create a profitable system, because it is very difficult to come up with something fundamentally new for the market. For example, let’s consider an intraday strategy based on moving averages and CCI.

Example of the working intraday system

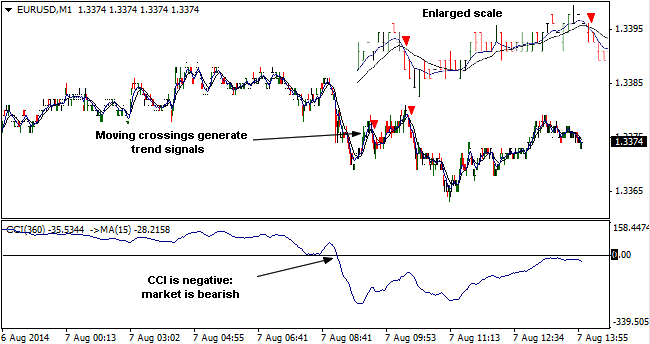

Before proceeding to describe the first technique, we should make an important qualification: the strategy is appropriate to apply either on futures or in the dealing centers that offer spread for the EUR/USD pair of no more than 1 point. Thus, the logic of decision-making is build on the classic principle of following the trend, which is defined using the Commodity Channel Index (CCI), averaged over the last 15 bars. Signals for transactions are given by the intersection of two moving averages:

-

fast (blue) exponential with a period of calculation for 5 bars;

-

slow (black) weighted average with a period of calculation for 14 bars.

Accordingly, if the trend in the market is downward, only sell is allowed; if a bullish trend has formed, only buy is allowed. Then comes the most interesting part, because it is at the next stage, in the process of developing the scenarios for fixing damages, where the greatest number of myths and stereotypes are born. To avoid going deep into the theory, let’s just mention alternative scenarios for closing a false signal under the above system.

Option No.1: a professional approach which implies a set of array data. You should specify several values for the stop-loss (for example, 5 points, 7, 10, etc.) and impartially collect statistics on the history for each option and summarize the calculation of mathematical expectation. The result is a table from which you will choose the most profitable option.

This approach is called professional, as it completely eliminates subjectivity and uncertainty in the result. By the way, all working Forex strategies contain not just a set of rules, but also a psychological component. For example, a trader feels much more comfortable if they know that according to statistics, after two losing entries, there is a high probability of a series of profits. Such knowledge can be gleaned only from that very table resulted from the test.

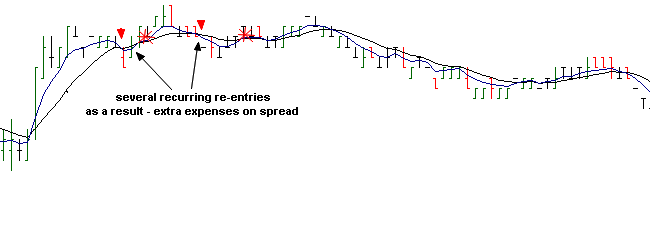

Option No.2: a reverse signal, i.e. a decision on the loss fixing is taken at the moment when the counter signal appears. In fact, this approach is a failure, because there is often market noise. The figure below shows an example of such a situation:

Working Forex strategies at large timeframes

Many beginners have probably heard about the system of the “three screens”, which was developed and presented to the public by Alexander Elder. The main point of this strategy is a comprehensive analysis of the current situation on several timeframes. The model presented below works on a similar basis, but uses the simplest combination of indicators as a signal.

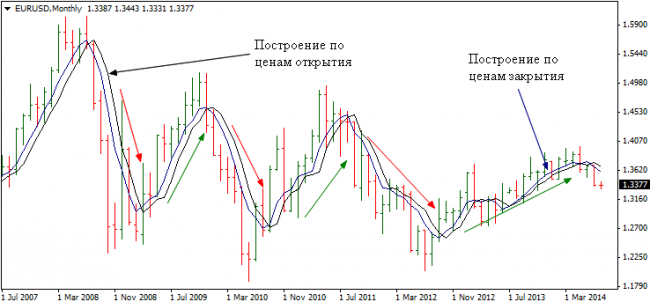

Algorithm to search for signals under this method consists of several steps. First of all, the global trend is analyzed with the help of two moving averages on the monthly chart. The key difference from most of similar tactics is that the calculation periods for months are set the same (equal to 5 bars), but one of them is based on the closing prices, and the second is on the opening prices. A graphic example is presented below:

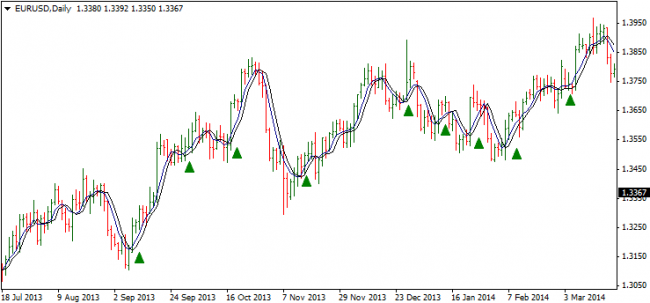

If the average closing prices stably remain above the opening prices for the same period, it is appropriate to speak of the bullish trend; the converse is also true. Next, you need to come down on the daily timeframe to search for signals, the interpretation of which will be completely identical to the rules of the trend search. The figure below shows all the points to buy in the direction of the trend:

Working Forex strategies are not a “holy Grail”, so you can notice the presence of false alarms in this case as well. But this is easily remedied – you just need to apply the above recommendation on the calculation of stop-loss and to determine the optimal risk.

In conclusion, we should note that almost any strategy can be made unprofitable if you fail to collect statistics of signals at least on backtesting. In practice, this mistake is made by the majority of traders – they blame indicators without realizing that if you do not change the approach to risk assessment, other strategies will lead to precisely the same disastrous results. Source: Dewinforex

Social button for Joomla