At the end of last week, all the major currencies except the yen fell against the U.S. dollar. Reduction of the euro and the Australian dollar was the most ambitious, EUR/USD for the week decreased from the level of 1.3380 to reach 1.3220 (-1.22 %), AUD/USD closed at 0.8897 (-1.37 %). The British pound also closed in the red zone, but with fewer losses, GBP/USD fell from 1.5570 to 1.5491, thus losing 0.47 % for the week.

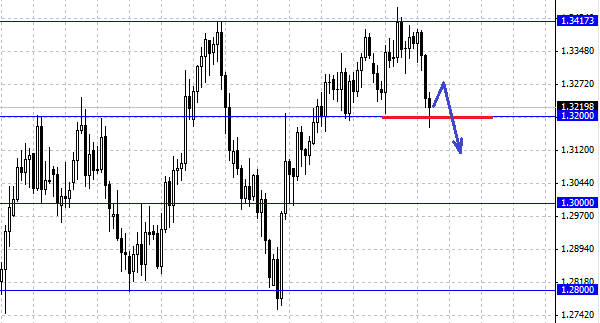

The EUR/USD on Friday tested support at 1.3200 after failing to gain a foothold below, a pair of slightly recovered. Dollar contributed to the growth of the business activity index, which rose to 53, the value was worse than analysts' expectations, but, nevertheless, a value above 50 indicates an increased rate of development of the economy. End of August also contributed to reducing the European currency, investors liquidated positions open last month, when the euro was growing strongly and gaining momentum . The fact that the EUR/USD failed to break the level of 1.32 can be alarming bell that a further reduction can not be. We observed a significant increase in pairs in July and August was the month of respite for the euro, rollback, and now the fate of EUR/USD pair in question. Movement in August - correction before the beginning of the long-term growth or decline? We suggest you take a look at our point of view on the short term the euro and the U.S. dollar.

"And only a dollar for ever turns green."

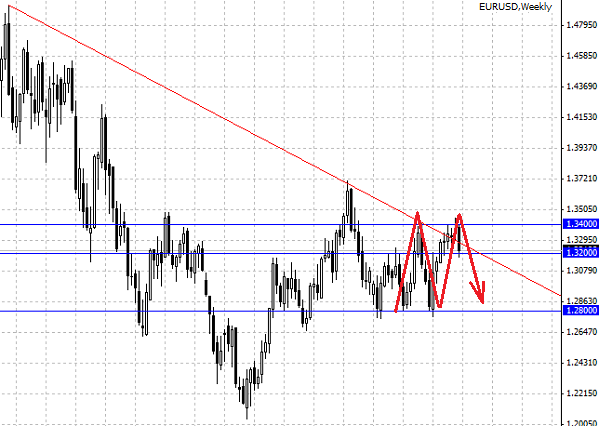

Let's start with the technical analysis, as can be seen in the graph growth that began on the support of 1.28 for the last time reached the level of 1.34, there was formed the resistance. The recent wave of growth also started from the level of 1.28 and 1.34 before reaching the resistance, the pair EUR/USD began to decline. So if history repeats itself, as it has already been partially began to repeat (the beginning of the decline from 1.34), there is a high likelihood of re- reduction to a level of 1.28 . The only thing that makes us hesitate is that the single currency has stopped on the support of 1.32, the last time the level of 1.32 was broken.

From a fundamental point of view, the economic situation in the U.S. is clearly better than in the euro area. Economic statistics from the U.S. dollar gives strength, and the data from Germany and the other peripheral countries point to the weakness of the economy and the strength of the Euro. The war in Syria could become a catalyst for a new wave of growth in the dollar. The weak point of the dollar remains the program of quantitative easing, or rather the question of its decommissioning soon, but this is the future, and the result will be clear in the near future at the September meeting of the FOMC.

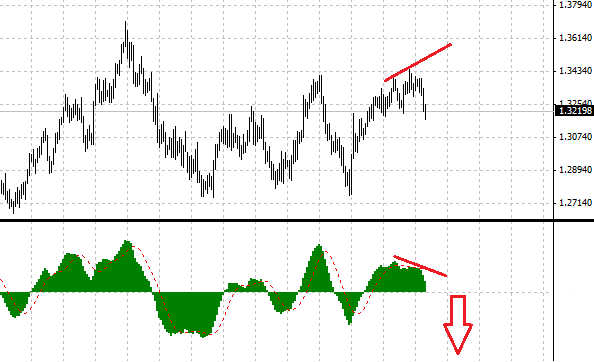

For adherents of the computer analysis offers insights into the value of the MACD indicator and the price chart, we can see a classic divergence - the discrepancy between the indices of volume and price movements. The indicator points to a further decline in EUR/USD.