Despite the strong pressure that was the U.S. dollar on Thursday, the U.S. currency still managed to hold and recover some of the losses. In many ways, the appreciation of the dollar contributed to positive economic data on the U.S. economy.

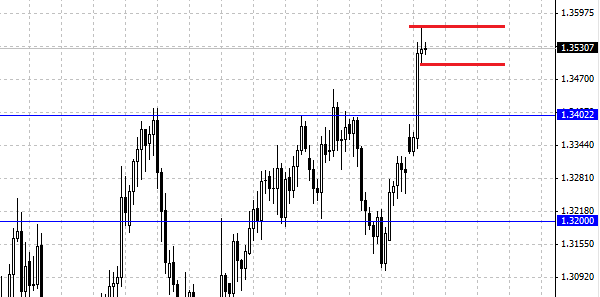

The EUR/USD has shown mixed results, the growth of the European currency was stopped better than analysts expected data from the U.S.. The pair reached the 1.3570 mark, then decreased to the level of the opening. From a technical point of view we can say that the euro will consolidate after strong growth, so we have to be a small decrease in pair EUR/USD. Local levels of support and resistance levels are 1.3570 and 1.3500, respectively.

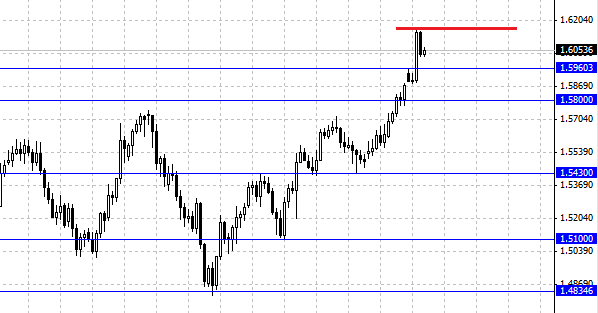

British pound dropped significantly, by more than 100 points. GBP/USD has declined due to weak data on the UK news. Measures the volume of retail sales fell sharply, the data were far worse than analysts' forecasts, thereby causing a serious blow by the pound. Finished off a pair GBP/USD is good news from the U.S., which gave the force downward movement, plus the role played by the technical factor. At the moment, the pound is trading slightly higher. Resistance for the pair is at 1.6150 .

After the publication of minutes of the FED meeting, many banks have made projections with new applications.

Bank Credit Suisse. Bank analysts believe that the previously present constraints to growth pound and the euro is no more. For the British pound target level will be the level of 1.6200, to reach this mark pound by early next year. Analysts at Credit Suisse also advised to put on the depreciation of the U.S. dollar against the Brazilian real and the Malaysian ringgit.

Bank UBS. Following statements by the FED, the growth of the dollar in the long run is put in jeopardy. The results of the FED's meeting will have a lasting effect on the dollar, and not at its best. Pair EUR/USD and GBP/USD supported and in the opinion of the Bank's strategy to test their highs at the levels of 1.37 and 1.64, respectively.

Bank Goldman Sachs. Their forecasts for rolling program of asset purchases by the FED Bank classifies December. Completion of the same program, analysts expect by September next year. As for interest rates, then the change, according to Goldman Sachs, will occur in 2016.