The EUR/USD opened slightly higher at 1.3080, but immediately began to lose ground, falling progressively. This week, the pressure on the European currency should be maintained, and we expect the EUR /USD pair is trading below 1.3000 in the near term. The upward movement of the currency pair is limited to resistance at 1.31 and 1.32 . Trading on Monday may be very volatile due to low trading volumes, so it's sensitive to the opening of positions. EUR/USD can also show the trading range for the week, but the move below 1.3000 will indicate the resumption of the downtrend for the pair and will give a sell signal of the European currency.

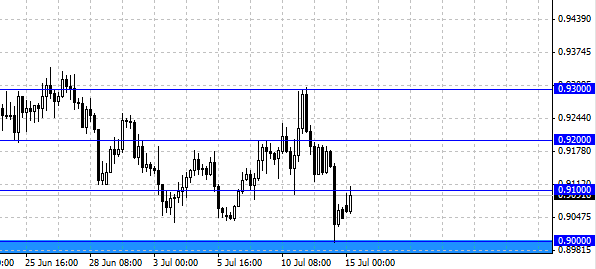

The Australian dollar opened higher and continued to rise, reaching 0.91 at the same level. Now the pair AUD/USD is trading near the resistance level and is showing signs of decline, so the level of 0.91 may contain the growth, and then we will see the movement of the currency to the support level located at around 0.90 . Australian dollar looks very vulnerable, we remain bearish outlook for this currency pair, but there is a small disclaimer. Last week the pair AUD/USD managed to achieve a level of 0.90, which was followed by the quick buying the Australian dollar and the couple has grown, thus forming the rebound. Perhaps the market will take time to re-test your level of support for this pair may correct to gain more sales at higher levels. In the short term AUD/USD remains attractive to trade a couple in connection with the dynamics of movements and high potential.

With the start of trading, many investors expected economic performance of China, which were issued during the Asian session, more data on GDP. Unfortunately, data from China brought negative mood on the markets, as the GDP has slowed down and is now equal to 7.5 %, analysts expected 7.7 %. Being the world's second economy, weakness and slowing Chinese economy signals the general economic downturn. Usually in such cases, investors are trying to find safer assets and currencies, which include gold, the U.S. dollar and the Japanese yen.

Social button for Joomla