On Thursday, the dollar rose significantly against the euro. One of the main factors contributing to the growth of the U.S. currency was a report published by the Institute for Supply Management (ISM). The PMI for the manufacturing sector in the United States July rose to 55.4, a value above 50 indicates expansion of industrial activity. The volatility of the pair also provoked statements of the ECB's Draghi. He said that the base rate of the European Central Bank at 0.5 % would not go up, at least until 2014.

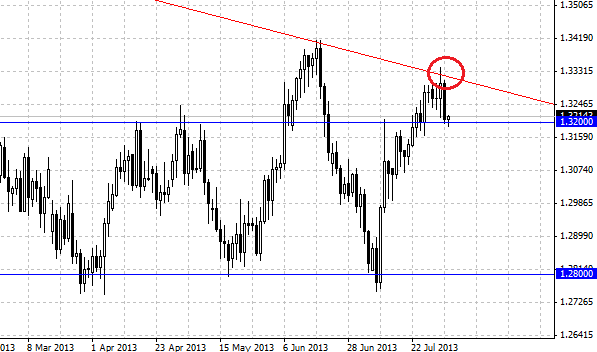

In the end day for the euro ended the strong decline from the level of 1.33 to 1.32 . Such behavior of the pair EUR/USD once again confirms the dominance of the downward trend, from a technical point of view, a couple strayed from the trend line and now we expect purposeful movement to the level of 1.30, with the ultimate goal of 1.28 . At the moment, the level of 1.32 is supporting the euro, we recommend selling the pair EUR/USD on a break of this level.

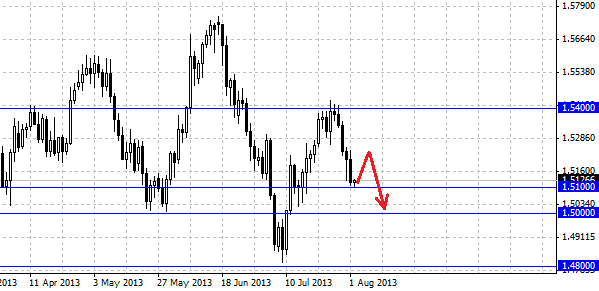

GBP/USD rate has continued to fall, losing the position of all previously earned. Note that initially helped by strong growth in the pound data on the manufacturing PMI and the decision of the Bank of England. The pair rose to 1.5240, and then began to decline. It's learned that manufacturing activity in the UK in July showed the highest growth in over two years - Purchasing Managers Index (PMI) for the manufacturing sector rose to 54.6 against 52.9 in June. The Bank of England decided to leave at current levels, as the rate and the size of its asset purchase program. Unlike last month, this time MPC refrained from accompanying statement. The pressure on the pound had U.S. data and Draghi comments. Due to the pair GBP/USD finished the day in 1.51, this level has a deterrent, and perhaps we can expect a small recovery up to the level of 1.52 . In general, we expect the pair deteriorating situation, we believe that the pound will continue to fall in the long term with targets at 1.50 - 1.48 .

It's worth noting that support for the dollar have expectations publication of employment data. Since the Federal Reserve announced that employment data will help determine actions on monetary policy, traders will wait for the release of the data, for that would determine the prospects for the dollar.

Social button for Joomla