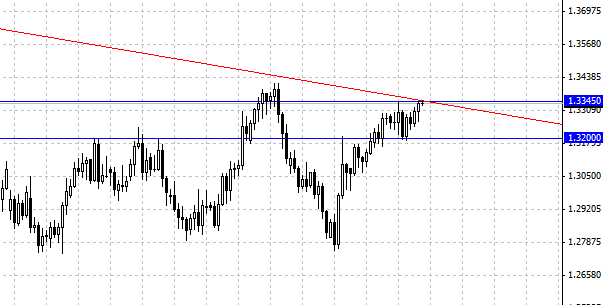

Bidding on Wednesday ended with the fall of the dollar strong. Since EUR/USD pair showed a strong upward movement. To do this, there were many factors, primarily the support of the European currency was positive data in Germany. The Federal Ministry of Economics and Technology reported that as a result of June's industrial production in Germany increased substantially, thereby exceeded the forecasts of most economists. The second factor of growth of pair EUR/USD was the announcement that the agency Fitch Affirms Germany at 'AAA' with a stable outlook. Fitch said that the German government has exceeded the plan by some key financial goals. "Germany has all the ingredients to reduce the national debt - said in a statement. - The economy is growing, the state budget is relatively favorable, nominal interest rates at low levels." On such a positive pair managed to break through resistance at 1.33 and consolidate above. Now the pair is constrained by resistance, which passes through a maximum on July 31 - the level of 1.3350 . The Euro is trading near the downlink long-term trend. We believe that the EUR/USD pair has the potential to grow to a level of 1.35, but downside risks still remain.

The British pound rose significantly against major currencies, which was associated with the application of the Bank of England, which revealed the plans for the future monetary policy of the central bank, noting that the key interest rate will remain at a record low of 0.5 % until while the unemployment rate in the UK has fallen to 7 %. Add that strengthen the pair GBP/USD also helped the comments of the Bank of England, Mark Carney, who said that gross domestic product will not reach its pre-crisis level in the coming year. He also added that the Monetary Policy Committee will continue to pursue a policy change to secure economic growth. The pair rose to the level of 1.55, breaking the strong support at 1.54. To continue the growth of the British pound to gain a foothold above the 1.55 level, the next goal will be the level of 1.56 . The strong growth that we saw yesterday, posing a risk of the formation of the correction, the limit of which is likely to be the level of 1.54 .

Social button for Joomla